Analysts Say Bitcoin Bottom Has Not Yet Formed

According to CryptoQuant analysts, Bitcoin investors who think the market has already hit rock bottom may need to be more patient. The company says that real bear market floors have historically needed long periods of consolidation before recoveries that last begin.

The most recent weekly report says that Bitcoin’s “ultimate bear market bottom” is now close to the $55K level. Researchers stress that price structures usually stabilize slowly instead of quickly going back to where they were before a big drop.

Realized Price Becomes an Important Indicator of Support

CryptoQuant says that realized price is an important number to look at when trying to figure out long-term market support during downturns. This indicator shows the average purchase price for all investors, not just short-term traders.

In the past, Bitcoin’s price touched the realized price at the bottom of the last 2 major bear markets before bouncing back. Analysts say that the metric often serves as a psychological and technical anchor for people in the market.

Historical Patterns Point to a Longer Period of Consolidation

Researchers say that when Bitcoin gets close to its realized price, it usually stays in that range for 4 to 6 months. This kind of sideways movement lets too much leverage unwind while slowly rebuilding trust among investors.

This long period of stability often comes before the first signs of a new bullish cycle. Analysts, on the other hand, warn that traders often misjudge market timing when they are impatient during this time.

Recommended Article: Bitcoin Holds Near $67K as Analysts Warn of $52K Risk

Cycle Indicators Show That the Market Is Still in a Bear Phase

Right now, CryptoQuant’s own bull-bear cycle indicator only shows a normal bear market. It hasn’t yet reached the “extreme bear” level that has historically been linked to clear bottom formations.

The difference is important because extreme readings often happen at the same time as capitulation events and a lot of people being negative. Analysts think that there is still a chance of more downside risk until that stage arrives.

Institutional Forecasts Reinforce Downside Possibilities

Other research teams share the same worries about Bitcoin’s short-term path because of its structural weaknesses and lack of catalysts. The head of research at Galaxy said that the 200-week moving average near $58K could be a possible destination.

Standard Chartered, on the other hand, updated its forecasts to say that Bitcoin could drop to $50,000 before making a big comeback. These kinds of predictions make people think that volatility will stay high in the crypto markets.

Prediction Markets Point to More Price Weakness

Sentiment data from the Myriad prediction platform shows that traders are getting ready for even bigger drops. Market participants now want the price to drop to $55K before any big upward move happens.

Probabilities suggest that there is about a 54% chance of that bearish scenario happening, which shows that investors are being careful. Prediction markets often show what people think will happen when the economy and crypto are both uncertain.

Recent Price Action Shows Mixed Signals For Investors

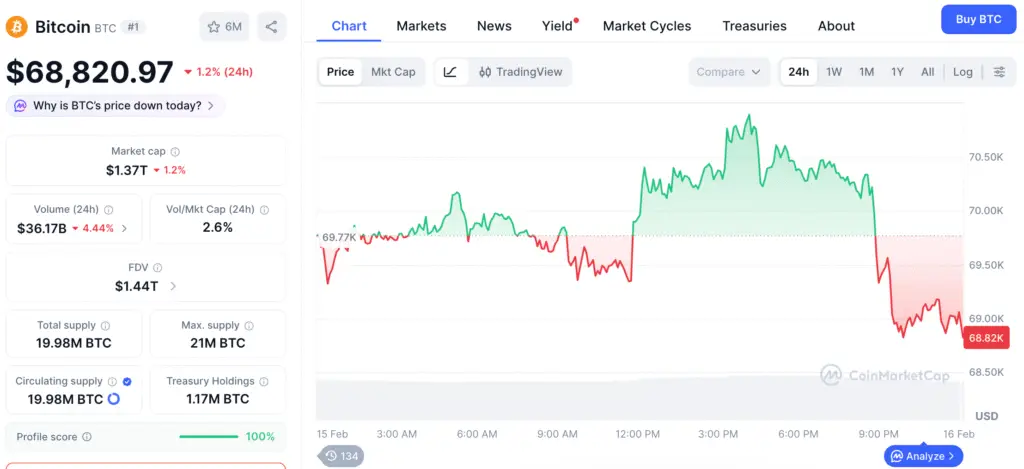

Bitcoin has gone up about 1.6% in the last 24 hours, even though people are predicting it will go down. It is now trading at about $69,724. Even during larger correction phases, technical buying can cause short-term rebounds.

The asset is still down about 27% over the last month, though, and almost 45% below its peak in October. As the market looks for a stable bottom, analysts tell investors to keep a close eye on support zones.