XRP Prices Rise Sharply as Investor Confidence Grows

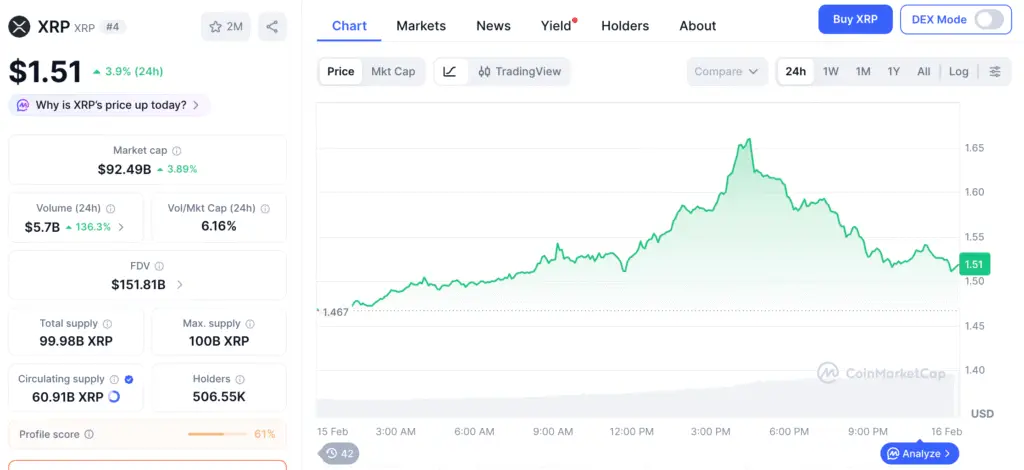

XRP saw a huge 10% rise in a single trading session, which shows a big change in short-term sentiment. Investors seemed to be getting more confident as buying activity picked up again after a time of weakness for the token.

The rally is a sign that the cryptocurrency market as a whole is stabilizing, and dip-buyers often get back into positions after corrections. This kind of behavior often happens during times of change, when fear goes down and hope slowly comes back.

Trading Volume Surge Highlights Strong Market Participation

During the price rise, trading activity picked up a lot, which suggests that both institutional investors and retail traders were more involved. Higher volume often strengthens price movements by showing that there is real market interest instead of just speculative spikes.

Analysts usually see the pattern as healthier market behavior when volume and upward momentum are in sync. Long-term participation may help keep prices stable and make sudden changes less likely.

XRP Still Trails Historic Highs Despite Recent Momentum

Even though XRP has risen sharply, it is still trading well below its all-time highs from earlier cycles. This gap shows that there is still a lot of volatility in the digital asset market.

People in the market often look at how strong the recovery is by comparing current levels to past highs. Investors are still hesitant to call a full bullish reversal until those distances get smaller.

Recommended Article: Ripple Partners With Aviva as XRP Interest Weakens

Analysts Monitor Breakout Signals And Price Structure

Technical analysts often see double-digit percentage gains as a sign that new buying pressure is coming into the market. When prices break through established resistance levels, it often boosts the confidence of traders who are focused on momentum.

But confirmation usually needs follow-up sessions with higher lows and stable consolidation ranges. Without structural support, sudden rallies could fade away just as quickly as they come up.

Broader Crypto Trends Continue Steering XRP Direction

XRP doesn’t move on its own very often; instead, it moves with the general mood of the cryptocurrency market and how investors act. Bitcoin’s performance is often a macro indicator that helps direct capital flows between different digital assets.

Changes in global risk appetite, liquidity conditions, and macroeconomic signals can make crypto rallies bigger or smaller. So, when traders look at XRP’s long-term viability, they pay close attention to outside factors.

Investor Psychology Plays Key Role In Short-Term Moves

Rapid price increases are often caused by changes in people’s minds rather than just changes in the network’s fundamentals. Confidence makes people want to participate, but if people start to feel bad about something, hesitation can quickly undo any gains.

Behavioral dynamics are still very important in cryptocurrency markets, where stories often affect how money is spent. Understanding these emotional cycles can help explain why prices stay volatile even when the market is going up.

Outlook Suggests Growing Interest But Continued Volatility

The recent rise in prices suggests that investors are slowly coming back, seeing lower price areas as good places to get in. These kinds of accumulation patterns can slowly lay the groundwork for longer-lasting upward trends.

Still, uncertainty is a big part of crypto markets, so people who want to trade must be careful with their money. While optimism is growing, it will only stay strong if demand stays high and macro conditions stay favorable.