Deal Structure and Strategic Reasoning

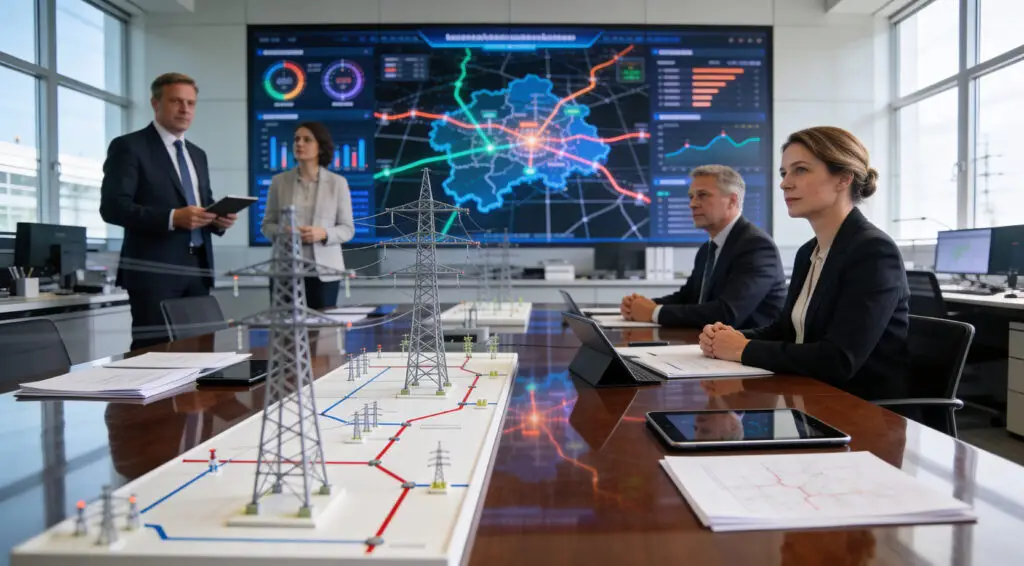

TenneT agreed to sell a quarter of its German grid unit. The deal is worth about €3.3 billion. The money will help the company grow its infrastructure by giving it more money.

The German state’s involvement is meant to make long-term planning more stable. For grid expansion to work, capital and regulatory coordination need to be predictable. When the public gets involved, it makes it less likely that big projects will have trouble getting money.

Source: Reuters/Website

German State Secures Strategic Minority Stake

Germany will own 25% of TenneT’s German operations. The minority stake gives you power without fully nationalizing. Authorities want to protect the goals of the energy transition.

Government involvement helps make sure that climate strategies are in line with each other. Updating the electricity grid is still a key part of decarbonization goals. The partnership shows how infrastructure governance works together.

Funding Accelerates Grid Expansion

Germany needs more transmission capacity right away. Stronger north-south power corridors are needed to make renewable energy work together. The growth of offshore wind makes it even harder to build new power lines.

The sale of the stake brought in money that sped up the delivery of the project. The timelines for infrastructure projects often depend on how sure they are of getting the money they need. Stable funding makes it less likely that strategic upgrades will be delayed.

Recommended Article: PUMA Creates Separate Business Unit for Training at HQ

Energy Transition Drives Infrastructure Needs

Germany’s shift to renewable energy makes it more dependent on them. For wind and solar power to work, transmission networks need to be updated. Bottlenecks in the grid threaten efficiency and the stability of supply.

Adding more high-voltage lines makes the system more stable. Better interconnections help to even out differences in production between regions. Modernizing infrastructure is a key part of bigger plans to cut carbon emissions.

TenneT Leadership Stresses Stability

Manon van Beek stressed the importance of clear long-term investments through public-private partnerships. She said that it was important to plan infrastructure in a way that worked together. Stable ownership structures make it easier to allocate capital strategically.

Leadership wants to keep operations independent while working with the government. The deal strikes a balance between private knowledge and public oversight. This mixed model makes institutions more resilient.

Market Reaction And Financial Implications

The €3.3 billion value shows that the assets are solid. Transmission networks provide regulated returns that are easy to predict. Investors see grid assets as infrastructure investments with low risk.

The money may make TenneT’s balance sheet more flexible. Less leverage makes it easier to borrow more money. Stable finances help big capital spending plans.

The Future of European Grids

European transmission systems are also under pressure to grow. Integrating renewables and electrification requires a lot of improvements. More and more, public-private partnerships are paying for big projects.

Germany’s acquisition of a stake could serve as a model for other countries in the region. Strategic state involvement could speed up the goals of the energy transition. The deal with TenneT is a big step forward in efforts to modernize the grid.