Buterin Warns Prediction Markets Are Losing Strategic Purpose

Vitalik Buterin, one of the co-founders of Ethereum, has said that he is worried about how prediction markets are changing in the cryptocurrency ecosystem. He thinks that too much focus on speculative trading could undermine the main purpose these platforms were made for.

Buterin recently wrote on X that prediction markets have grown enough to support professional traders. But he did say that platforms are putting more and more emphasis on bets that get a lot of attention over bets that create useful information.

Short-Term Speculation Drives Engagement But Weakens Value

Buterin says that a lot of platforms are “over-converging” on crypto price speculation, sports betting, and other high-frequency trades. These activities often make people feel good right away, but they don’t help society in the long run.

He said that the need for money during bear markets might be what led to this shift toward dopamine-driven products. Teams that are losing business might focus on profitable areas even if they aren’t the best strategic choice.

Revenue Pressures Push Companies to Offer Risky Product Incentives

Buterin said that the increasing reliance on uninformed traders is a sign of unhealthy product dynamics. When platforms depend a lot on people who don’t know what they’re doing, the incentives may not be to give accurate information.

These kinds of structures can change the results of the market by putting more weight on the number of transactions than on how likely they are to happen. This imbalance could hurt credibility and make institutions less interested over time.

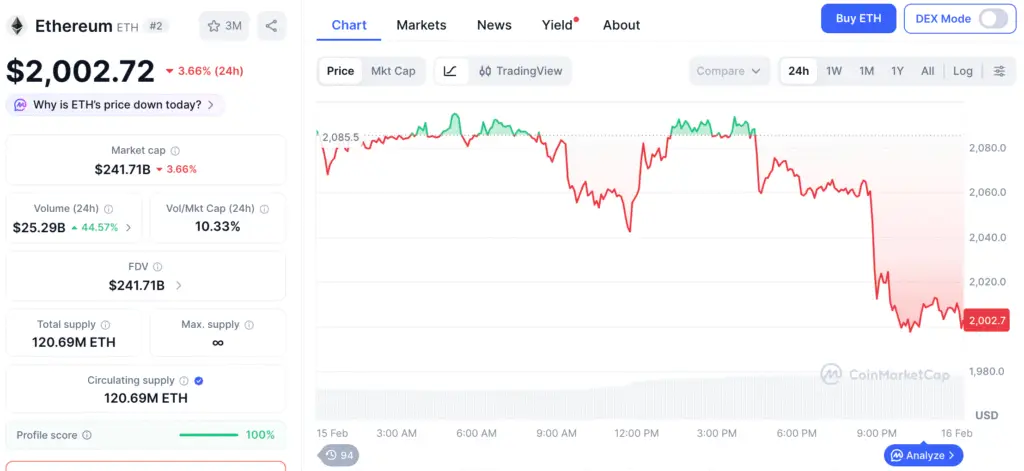

Recommended Article: Ethereum Eyes V-Shaped Recovery as Analysts Signal Bottom

Getting to Know the 3 Main Market Players

Buterin put prediction market users into 3 groups: smart traders, naive traders, and hedgers, each with their own reasons for being there. Smart traders give useful information, but naive traders often lose money because they expect things to go wrong.

Hedgers, on the other hand, are willing to take on losses in order to lower the overall financial risks in their diversified portfolios. Buterin said that current platforms rely too much on speculative users and not enough on risk-management users.

Ethical Concerns Around Financially Vulnerable Traders

The debate heated up when an X user said that financial desperation has made gambling normal for people who work in retail. Buterin said that pushing people who are already in a bad financial situation to gamble makes things worse for them.

His comments bring up more ethical questions about crypto-based betting systems and protecting retail investors. More and more people are looking closely at whether the design of the platform protects new users well enough.

The Hedging Framework Might Open Up Real Economic Benefits

Buterin suggested moving prediction markets away from being just places to criticize and toward being useful hedging tools. He showed how a biotech investor might bet against an election result that wasn’t good for them.

These kinds of trades could make return ranges smaller and volatility lower, which would be useful for making money even if the expected value stays negative. This way of thinking about prediction markets changes them into tools for managing risk.

Stablecoins And Decentralization Concerns Enter Debate

Buterin also asked if users really want to use fiat currency or just want prices to stay stable in digital economies. He warned that relying too much on stablecoins backed by the U.S. dollar could make decentralization harder.

He suggested making price indices linked to important goods and services and prediction markets that go along with them as an alternative. He concluded that builders should put long-term financial stability ahead of short-term speculative volume.