Monthly Unlock Mechanism Remains Intact

Ripple continues its structured system of unlocking one billion XRP each month as part of a long running program designed years earlier. This approach maintains predictable supply behavior rather than exposing markets to unpredictable token dumps.

Most of these tokens do not immediately enter circulating markets because Ripple typically re locks a majority portion. That predictable recycling process prevents supply shocks and stabilizes broad liquidity outlook.

Supply Rotation Shapes Distribution Outlook

Historically Ripple unlocks one billion tokens then returns seventy to eighty percent into new timelocked contracts. Only a fraction enters active ecosystem deployment which usually involves partnerships or enterprise aligned funding.

This process is trackable on chain which enhances transparency expectations. Investors value verifiable token management because on chain auditing reinforces trust regarding circulating and non circulating balances.

Traders Watch Re Lock Rates Carefully

Market analysts emphasize that the percentage of tokens re locked matters more than the unlock event itself. A lower re locking ratio could symbolize aggressive distribution which may bring additional liquidity into trading channels.

Conversely a higher re lock ratio signals long term conservative emission pacing. Market sentiment often shifts depending on how Ripple allocates each unlocking cycle for operational or ecosystem needs.

Recommended Article: Ripple Awaits OCC Verdict and ETF Greenlight as XRP Traders Brace for Breakout

Supply Debate Resurfaces In Community

X discussions reignited disputes around how circulating supply and market capitalization should be measured for XRP. Some argued that using total supply distorts forward looking liquidity metrics because locked tokens are not accessible in immediate trading.

Former leadership clarified that escrowed tokens do not count toward circulating capitalization until they become unlocked. Such clarifications help reduce confusion especially when liquid market comparisons occur between different crypto assets.

Institutional Alignment Drives Broader Momentum

Ripple aligned ventures now explore listing opportunities that could bring larger enterprise scale visibility. These corporate developments expand potential institutional access and enhance future capital integration options.

Japan based partners continue expanding collaboration and validating cross border settlement ambitions. International alliances reinforce a long term direction anchored on enterprise utility rather than speculative narrative cycles.

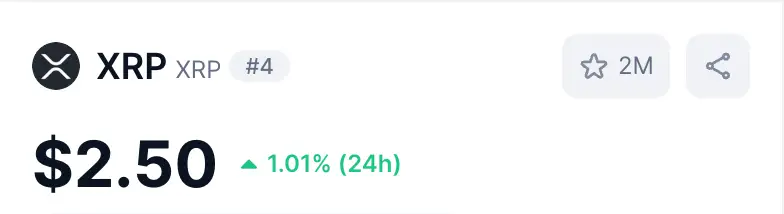

Technical Price Behavior Shows Mixed Reaction

XRP experienced recent breakout attempts but those movements softened after macro shifts created renewed volatility. Resistance breaches occurred temporarily but retracement quickly followed due to market wide pricing pressure.

Analysts believe price reactions will depend on liquidity alignment within upcoming sessions. Bulls now evaluate whether demand increases following the latest unlock or if caution persists.

Liquidity Management Determines Perception Ahead

This unlock does not represent an extraordinary event because it follows established scheduling. Yet sentiment may shift depending on how aggressively Ripple deploys unlocked allocations in the near term environment.

Market observers watch for institutional treasury signs that reflect meaningful transactional usage. If capital integration accelerates alongside enterprise related developments, investors could interpret distribution pacing as forward leaning support rather than dilution.