Analyst Highlights Critical ONDO Support Zone Before Breakout

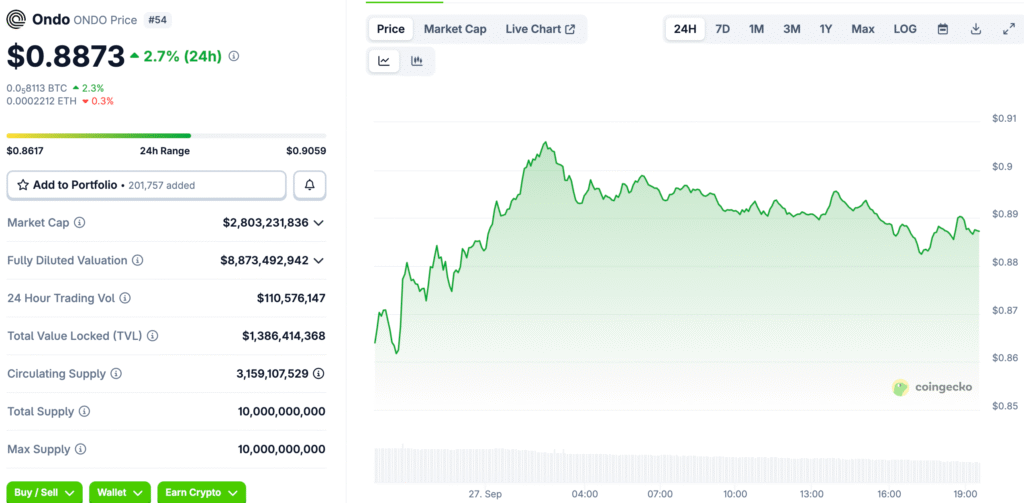

Crypto Winkle says that ONDO’s current trading range of $0.88 to $0.90 is very important for what will happen with prices in the future. This support range could be the start of a bullish trend, drawing in both technical traders and institutional investors who are closely watching what happens in the market.

The symmetrical triangle shape of ONDO puts the price at a key turning point, and if support holds, there are upside targets. People in the market expect more volatility because holding this zone could confirm a bullish structure and cause a lot of buying pressure.

Symmetrical Triangle Pattern Signals Imminent Technical Resolution

The daily chart for ONDO shows a symmetrical triangle with support rising from $0.43 and resistance falling near $1.20 over time. These kinds of patterns often come before big breakouts, giving traders chances to make money on price moves in a certain direction with good risk-reward ratios.

Right now, the price of ONDO is testing the lower boundary, where buyers have historically come back to protect important levels. A strong rebound could bring back bullish sentiment, while a breakdown could put off more attempts to go up for a while, which would have a big effect on how the market works in the short term.

RSI Levels Indicate Sellers May Be Losing Momentum

The Relative Strength Index is currently around 37, which is close to the level where selling pressure usually starts to ease off. In the past, these kinds of levels have been market turning points that drew in buyers who thought prices might go back up after long periods of going down.

This positioning suggests that sellers may be running out of steam, which gives bullish traders chances to strategically reestablish their positions. Traders pay close attention to these signals because RSI reversals often happen with important technical breakout patterns, especially when they are backed up by strong fundamental support.

Recommended Article: xStocks vs Ondo Battle for Tokenized Asset Exchange Listings

Ondo Finance Fundamentals Reinforce Bullish Technical Structure

The fundamentals of Ondo Finance keep getting stronger, which backs up bullish technical signals that show investors are becoming more confident in the platform’s direction. The total value locked has recently risen to $1.66 billion. This is because more people are using the ecosystem and putting more money on the blockchain across many networks.

Ethereum has $1.3 billion of this TVL, Solana has $242 million, and other chains add more liquidity. Increasing volumes and a wider range of networks show that Ondo is a leader in tokenized real-world asset markets. This supports bullish stories that are in line with significantly better technical conditions.

Price Targets Set at $0.96 to $1.20 for Next Breakout

If ONDO stays stable above $0.88–$0.90, the first bullish targets of $0.96 to $1.00 become more likely. If the price breaks out above those levels, it could open up higher targets toward $1.20, which would be a big upside for patient market participants looking for trend continuation opportunities.

If this support range doesn’t hold, though, bullish developments may be delayed, and corrections may happen toward $0.80 before recovery starts again. Traders are still on the lookout for possible technical breakouts and are closely watching key levels as they think about their positioning strategies.

Market Sentiment Shifts as Traders Prepare Strategically

As traders get ready for a technical breakout formation that is about to happen, the mood in the market is getting better for ONDO. Accumulation behavior near support zones shows that people are becoming more confident. During current consolidation periods, larger investors are finding good entry points.

At the same time, short-term traders are getting ready for big price swings when a breakout is confirmed. In the past, ONDO price changes after symmetrical triangle resolutions have caused quick changes in direction, giving both breakout traders and longer-term investors looking for long-term trend developments chances to make money.

ONDO Is Ready to Lead the RWA Sector

Ondo Finance’s role in turning real-world assets into digital tokens is growing, which could make ONDO a leader in the sector in the future. Its expanding ecosystem and growing interest from institutions are strong fundamental factors that could lead to a big increase in its value.

ETFs and activity in on-chain capital markets make Ondo more competitive compared to other protocols. Analysts think that ONDO’s mix of technical structure and fundamental momentum makes for a strong story that draws in investors looking for both growth potential and early positioning advantages.