ONDO Struggles Near Resistance but Holds Strong Fundamentals

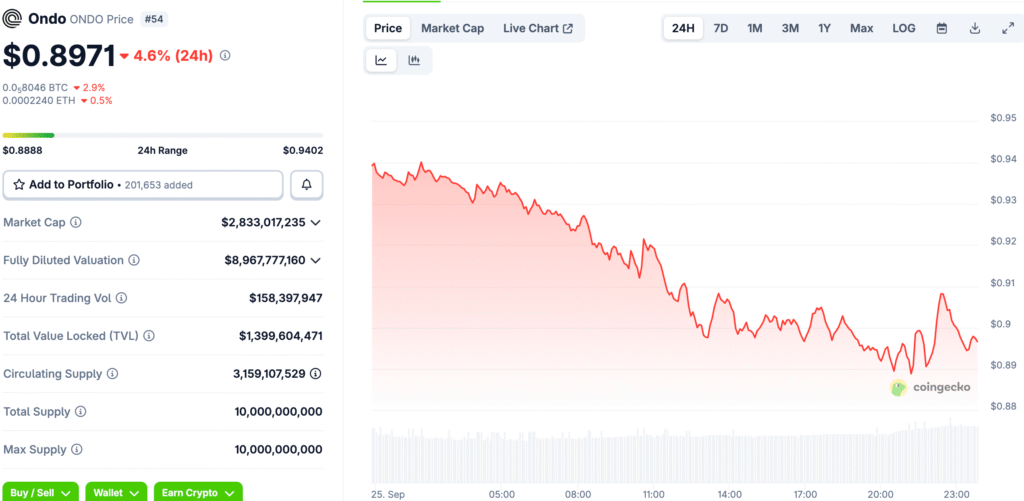

ONDO, trading near $0.93, is facing resistance as investors contemplate reaching all-time highs above $2.14. Despite short-term volatility, the token’s strong fundamentals and its leadership in tokenizing real-world assets make it a valuable asset.

Maintaining current levels is crucial, as momentum above $1.08 could lead to upside targets. Market watchers suggest $0.90 as a crucial support level, and if bearish sentiment increases, the price could drop to $0.80. ONDO’s growing use sets it apart from speculative tokens, making its long-term path more appealing to institutional investors.

Real-World Asset Tokenization Drives Investor Confidence

Ondo Finance is a company that converts real-world assets like U.S. Treasuries into tokens, providing access to financial markets that are often difficult to access. Their products, such as OUSG and USDY, combine yield opportunities with openness, attracting attention from institutions and individuals.

Ondo’s partnerships with companies like BlackRock, J.P. Morgan, and PayPal demonstrate their expertise in tokenized assets and their potential to transform traditional finance. By working with these well-known organizations, ONDO demonstrates its trustworthiness in the transformation of decentralized finance.

Current Price Action Highlights Near-Term Challenges

ONDO has dropped 13% in the last week and 10% in the last month, which shows that the market as a whole is weak, even though adoption trends are still strong. Traders are looking at $1.08 as a short-term resistance level, but they need bullish confirmation to start the upward trend again. Until then, prices may stay stable as traders wait for stronger reasons to act.

If $0.93 isn’t defended, selling pressure could rise, pushing ONDO toward deeper retracement zones closer to $0.80. However, whales that are building up in this range suggest that there is strong support, which lowers the risks of going down and strengthens stability. This buildup gives hope for a possible change if technical resistance finally gives way.

Recommended Article: xStocks vs Ondo Battle for Tokenized Asset Exchange Listings

Institutional Adoption Shapes ONDO’s Long-Term Potential

ONDO, unlike meme coins, is credible due to its use of institutional-grade finance, connecting decentralized and traditional markets effectively. Institutional flows demonstrate increasing confidence in tokenized finance, making ONDO a valuable tool for promoting blockchain adoption.

These inflows strengthen the tokenomics of ONDO, boosting investor confidence. In unstable markets, institutional adoption is crucial for ONDO’s legitimacy. With strong partnerships and adoption pipelines, ONDO is changing DeFi and could become a leader in this new type of money.

Technical Breakout Could Propel Toward $2.50 Target

The highest price ever for ONDO is $2.14. If resistance levels are broken, there is a lot of room for growth. If prices break out above $1.08, they could gain momentum and move toward $1.50 at first, then test higher resistance near $2.14. Analysts think that ONDO could reach $2.50 as more people start using it.

This kind of move would mean gains of almost 170% from where we are now, which is why traders are still paying attention to ONDO’s technical structure. Volume will be very important because attempts to break out need strong buying pressure to show that they will last. If it happens, $2.50 could be a big deal for ONDO in the growing RWA sector.

Risks Could Stop Price Growth in the Short Term

ONDO’s reliance on institutional adoption is risky, as it could damage credibility and slow progress. The volatility of cryptocurrencies, particularly Bitcoin’s dominance, can overshadow smaller tokens, making investments uncertain.

If ONDO drops below $0.90, downside targets near $0.80 may return, putting off bullish plans. Market volatility can worsen when macroeconomic events change investors’ focus, making it harder for ONDO to secure sufficient cash flow during challenging times.

The Possible Rally of ONDO and Its Wider Effects

If ONDO rises to $2.50, it could demonstrate the strength of real-world projects over speculation-based ones, potentially boosting retail interest in DeFi and boosting DeFi revenue.

This could also accelerate institutional flows, strengthening ONDO’s position as a leader in tokenized finance. A breakout rally could also demonstrate RWA integration’s potential to compete with top cryptocurrencies like Bitcoin and Ethereum, solidifying ONDO’s position as a leader in blockchain-based financial infrastructure.

ONDO’s Outlook Balances Opportunity and Caution

ONDO needs to address technical issues and maintain momentum for adoption from retail and institutional investors to reach $2.50. Investors are optimistic, but the risk of price swings and resistance issues makes them less optimistic.

To maintain recovery, it’s crucial to protect current support and increase volume. If resistance at $1.08 breaks, ONDO could reach new highs and reach $2.50, but problems could slow rallies until more confidence in crypto markets is restored.