XRP Price Has Problems in September

XRP has been trading steadily between $2.78 and $2.86. Experts say that the token could drop to $2.75 if there isn’t more buying pressure. If it goes above $3.10, it could make people even more hopeful.

Investor sentiment is still cautious because there isn’t much upward momentum. Traders are still paying close attention to support and resistance levels. Investors are unsure right now because XRP’s price is moving sideways.

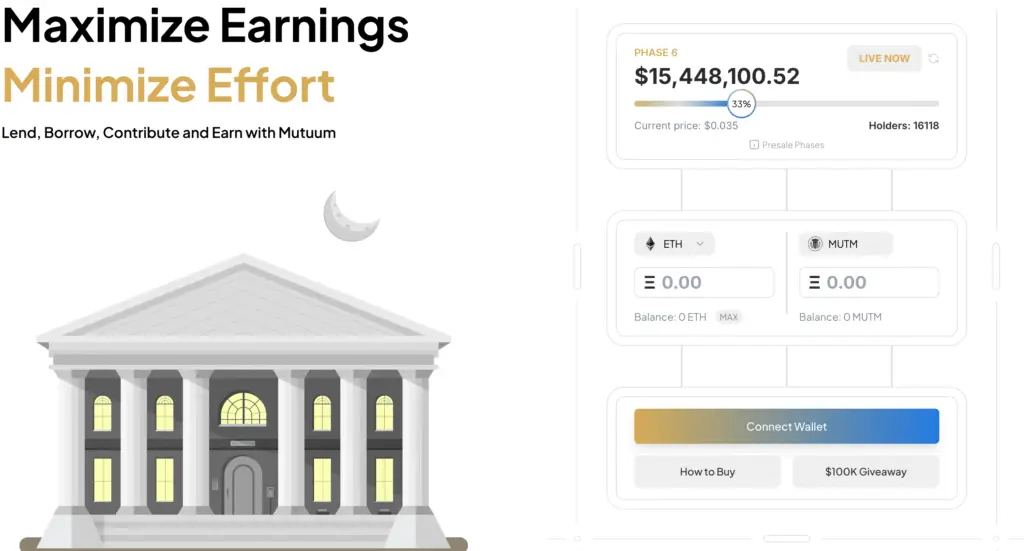

Mutuum Finance Presale Shows Strong Growth

The presale for Mutuum Finance is now in stage six, and each token costs $0.035. More than 16,000 investors have already given more than $15.45 million. Prices will go up by 14.29% in the next stage.

A lot of people are getting involved, which shows that interest in utility-driven DeFi projects is growing. Investors are confident in the plan and how it will be used in the future. This presale has quickly gained a lot of interest.

Stablecoin Development Adds More Utility

Mutuum Finance wants to make a stablecoin on Ethereum that is linked to the US dollar. To keep it safe and stable in price, the coin will have more collateral than it needs. It will be able to be used for everyday decentralized transactions.

The stablecoin’s goal is to make things less volatile for both individuals and businesses. It also gives you a reliable asset that you can hold onto for a long time. This utility makes Mutuum’s case for being a long-term project stronger.

Recommended Article: Whales Accumulate Mutuum Finance as a Leading Q4 Crypto Pick

Dual Lending Infrastructure Opens Up More Options

The platform offers peer-to-contract and peer-to-peer lending options. Both systems work completely on open smart contracts. This method makes things safer and more efficient for both lenders and borrowers.

Dual lending makes sure that all user groups can be flexible and included. Institutional players get reliable systems, and retail investors get to keep control. The combination helps decentralized finance grow over time.

Protocol Design Helps Keep the Market Stable

To keep liquidity in check, Mutuum Finance (MUTM) uses changing interest rates. When supply is low, high rates encourage deposits, and when supply is high, low rates encourage borrowing. This system controls how loans are made.

Stable rates give borrowers a good idea of what will happen. They are especially good for assets that can be turned into cash. This balance between stability and flexibility makes the protocol appealing to a lot of people in the market.

Risk Management Strengthens Ecosystem

The project uses strong risk parameters for assets that are used as collateral. To keep the system in balance, borrowers are told to overcollateralize. To lower systemic risk, illiquid and unstable assets are limited.

Loan-to-value ratios and penalties for risky positions are two examples of controls. These rules help keep liquidity and make sure the protocol is strong. Mutuum Finance makes DeFi safer by putting these protections in place.

Mutuum Finance Challenges XRP with Breakout Potential

More and more big investors are using MUTM. Whale participation makes the presale more credible and speeds up adoption. Their participation shows that they believe the project will be successful in the long run.

This momentum is different from XRP’s price action, which has been stuck. The rapid growth of Mutuum is making people hopeful for a breakout altcoin. September could be a key turning point for how investors feel.