MetaMask Expansion Brings New Opportunities

MetaMask plans to introduce Hyperliquid perpetuals, potentially enhancing its liquidity. This partnership will allow Hyperliquid to access MetaMask’s large user base, potentially increasing its usage and demand. Analysts believe this move will boost HYPE’s position as more trading volume leads to stronger network effects and token growth.

The integration also makes it easier for users to trade perpetuals directly through MetaMask, putting Hyperliquid on par with big wallets like Phantom and Rabby, making it more competitive. Hyperliquid is increasingly popular in decentralized trading ecosystems due to its increased liquidity and exposure.

Hyperliquid Growth Already Showing Momentum

Hyperliquid, a decentralized perpetual market protocol, has gained significant traction since its launch, competing with centralized exchanges and chains like Binance and Solana. Its decentralized perpetual markets attract platforms seeking liquidity, demonstrating its strength and appeal.

In the second half of 2025, daily users increased by an average of 3,000, reaching nearly 700,000 users. This rapid growth demonstrates Hyperliquid’s potential to compete with the biggest players and attract more users.

Strong Outlook Supported by Capital Flows

In less than two years, Hyperliquid has brought in about $6 billion in new money. These inflows give the platform enough liquidity for trading and make it a serious competitor among decentralized platforms. Investors see this momentum as a clear sign that the business will be around for a long time and will be popular.

The buyback model means that HYPE token holders get the most out of these capital flows. More than 90% of the fees for the platform go toward buying HYPE, which lowers the supply and raises the value. This deflationary mechanism makes sure that people who hold tokens directly benefit from the ecosystem’s success.

Recommended Article: Hyperliquid Price Hits Record as Network Fees Surpass Ethereum

Boost for the Buyback Model and Stablecoin

The revenue-sharing model of Hyperliquid has worked well to get people to want HYPE. By buying back tokens and lowering the number of tokens in circulation, the project puts upward pressure on prices that goes along with the growth of the platform. This one-of-a-kind structure encourages holders to stay invested, which builds trust and loyalty.

The introduction of USDH, Hyperliquid’s own stablecoin, makes this cycle even stronger. The yield from USDH stays in the ecosystem and goes directly to funding ongoing buybacks. As more people use it, this system should help keep prices stable while steadily raising HYPE’s value.

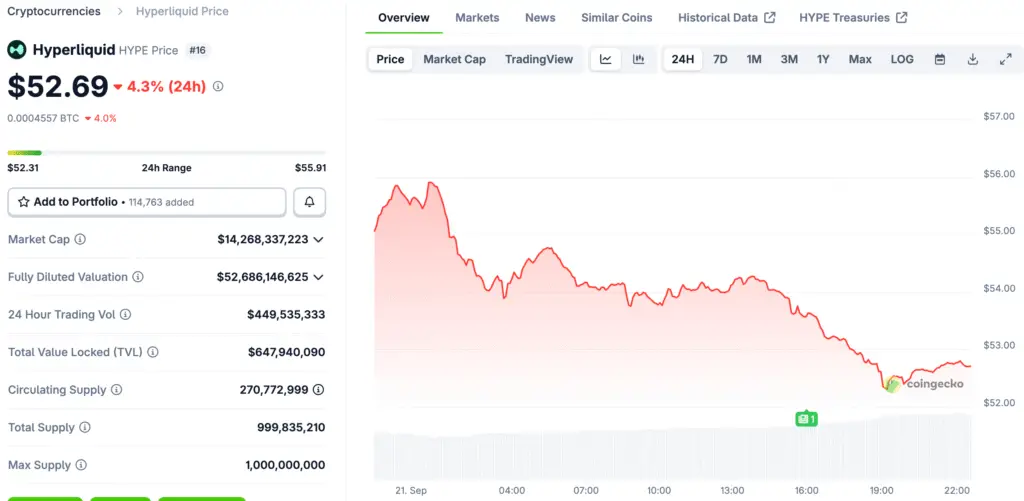

How the Market Feels About HYPE Price Action

HYPE has shown strength by holding on to the important $50 support zone, even though it briefly fell back. Holding above this level shows that buyers are very interested and sets the stage for more bullish momentum. Technical analysts say that a strong defense here could open the door to a retest of the $60 resistance level.

Traders are keeping a close eye on whether momentum can clearly shift toward higher targets. If HYPE breaks above $60, it could enter price discovery, where bullish speculation grows stronger. If it doesn’t hold $50, though, it could bring back bearish pressure and short-term uncertainty.

Short-Term Caution in the Options Market

The derivatives market indicates cautious optimism about HYPE’s short-term future, with a drop in the 25-delta skew for the one-week tenor, indicating increased demand for protective puts. Traders remain cautious of short-term volatility, despite a positive mood.

However, the one-month tenor remains neutral in the medium term, indicating faith in Hyperliquid’s fundamentals over long periods. Traders are protecting themselves from short-term risks while acknowledging the potential for long-term growth.

Hyperliquid Eyes $60 Breakout as MetaMask Integration Drives Demand

Hyperliquid’s growth in adoption, integration with MetaMask, and strong tokenomics all point to a bullish future. If demand stays strong, analysts think HYPE has a good chance of testing $60 again in the next few weeks. This important breakout could happen because MetaMask is involved.

The $50 level is still the must-hold support for long-term investors who want to stay bullish. If it goes over $60, it could open the door for higher targets and start a new phase of price discovery. With more money coming in and the company’s fundamentals getting stronger, HYPE seems ready to move into new areas.