Ethereum Revenue Declines Sharply in August

In August, Ethereum’s revenue dropped a lot. Monthly income dropped from $25.6 million in July to $14.1 million. This was a drop of 44%.

Many investors were surprised by the drop because ETH prices went up. On August 24, Ethereum reached a record high of $4,957. Even though prices went up, fee revenue did not keep up.

Network Fees Continue to Drop Month by Month

In August, the Ethereum network charged $39.7 million in fees. This was a 20% drop from July’s $49.6 million. The cut was in line with long-term trends of lower fees.

The Dencun upgrade in 2024 made a big difference. It made transactions on layer-2 scaling networks a lot cheaper. Lower fees are good for users, but they hurt revenue streams.

Debate Over Ethereum Financial Fundamentals Grows

Critics say that the drop in revenue shows that Ethereum’s fundamentals are weak. They say that lower fees make the layer-1 ecosystem less sustainable. Some people even doubt that it will last in the long run.

People who support this view strongly disagree. They say that Ethereum is becoming the backbone of the world’s finances. They think lower fees are a good thing, not a bad thing.

Recommended Article: Ethereum Institutions Adoption Took Longer Than Bitcoin

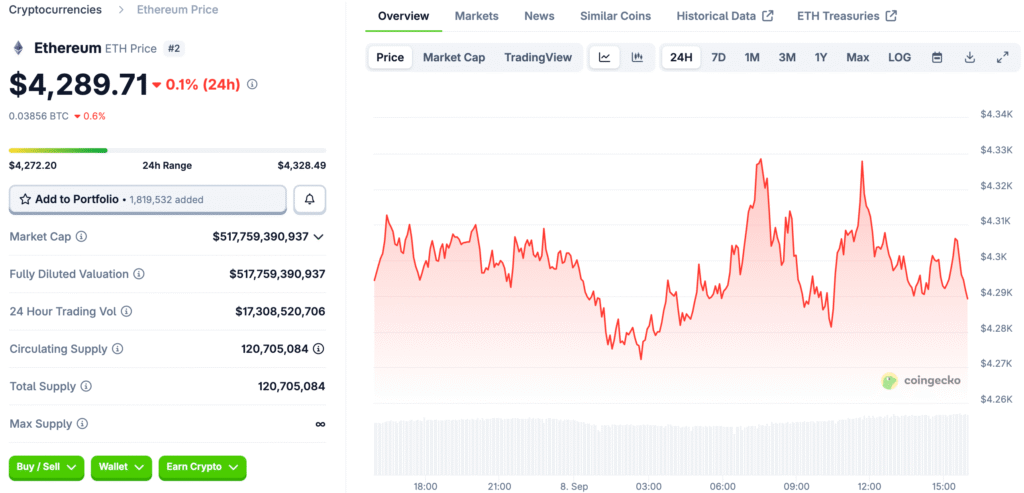

ETH Price Surges to All-Time High in August

In late August, ETH hit an all-time high of $4,957. This was a 240% rise since April. Despite falling network revenues, demand stayed high because investors were optimistic.

The rally was also helped by growing interest from institutions. ETH is still getting a lot of attention as a way to store value and make money. People in the market still disagree about long-term prices.

Institutional Interest Strengthens Ethereum Outlook

More and more Wall Street firms see ETH as a good investment. Ethereum treasuries and advocacy groups work to get businesses to use it. This outreach has helped build trust in institutions.

Etherealize, a company that helps with public relations, just got $40 million. Its goal is to get publicly traded companies to see the benefits of Ethereum. This shows that there is a planned effort to win over institutions.

Staking Remains Key for Yield Generation

Staking on Ethereum can help you make money. Investors can lock up ETH to protect the network and make money. This process makes things more stable and gives people money.

Matt Hougan from Bitwise talked about how appealing staking is. He said that institutional investors like earnings that are easy to predict. Yield generation could make ETH as appealing as stocks.

Ethereum’s Balancing Act Lower Fees vs. Long-Term Revenue

The lower fees on Ethereum show the trade-offs between adoption and revenue. Lower transaction fees make things easier to get to, but they also lower direct earnings. This duality makes it hard to know if things will last for a long time.

But institutional adoption is still on the rise. Ethereum’s position gets stronger as staking yields and corporate interest go up. The future of this will depend on how well it balances fundamentals and adoption.