Ethereum Maintains Crucial Support

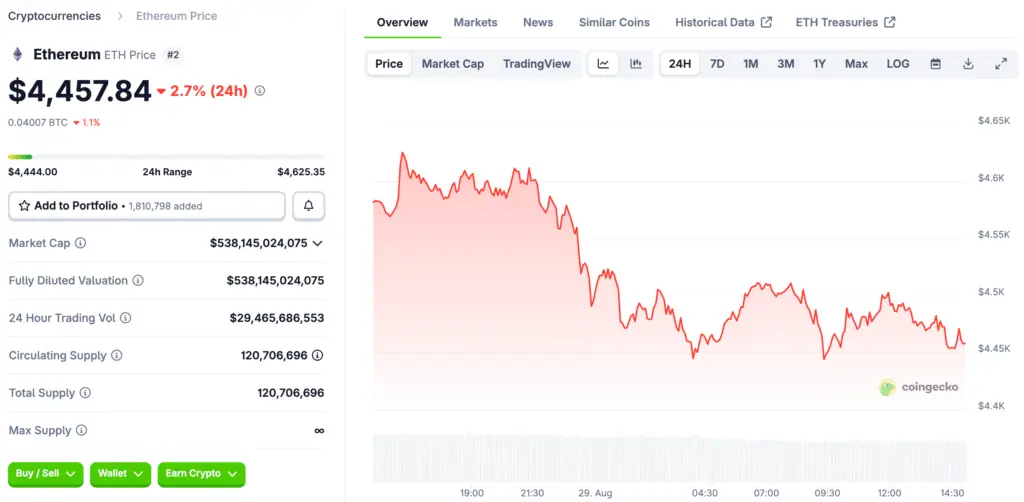

Ethereum recently reached a high of $4,960. It then experienced a swift price reversal. Despite this, ETH has held a key support level. That crucial support is located near the $4,500 mark. Analysts see this level as a very strong foundation.

This important support could power the next upward leg. The price retested a $4,270 level cleanly. This retest is a strong bullish sign. It shows that the initial breakout is now validated.

Understanding the Megaphone Breakout

Chart analysts have spotted a megaphone pattern. Ethereum has now broken out of this pattern. This is a four-year bullish megaphone structure. Technical indicators are reinforcing this potential.

A weekly MACD crossover suggests more momentum. Strong volume was seen during the breakout. This shows that buyers are in control. The pattern’s extensions point to a $7,000 price target.

Institutional Demand Drives Confidence

Institutional interest in Ethereum is growing. Spot Ethereum ETFs are attracting large inflows. This strengthens confidence in ETH as an investable asset. Many companies are accumulating large holdings.

One analyst sees Ethereum as a major macro trade. He believes the price could reach very high targets. The price could possibly hit $12,000 by year-end. This is a very bold prediction.

Recommended Article: BlackRock Ethereum Buy Sparks Major Whale Activity

The Role of Ethereum ETFs

Ethereum ETFs are playing a significant role. These products provide an easy investment path. They allow traditional investors to gain exposure. This is without directly buying cryptocurrency. This makes the asset more accessible.

ETFs have brought a lot of capital into the market. This capital helps to support the price. It also provides a level of legitimacy. This is very important for market growth.

Layer 2 Solutions and Ecosystem Growth

Ethereum’s Layer 2 ecosystem is expanding rapidly. Platforms like Arbitrum and Optimism are seeing more volume. This helps to reduce high transaction fees. It also improves the overall network scalability. This is a very important development.

On-chain data shows validators are gaining momentum. Staking services are also getting popular. Institutions now view ETH as a yield-bearing play. It is more than just a speculative asset.

Historical Patterns and Future Outlook

Historical data often supports the bullish thesis. In 2017 and 2020, ETH had big gains. These gains followed strong closes in August. Traders are watching this pattern closely.

The market has been volatile in the short term. However, analysts believe pullbacks are normal. They are part of a broader uptrend. The overall technical outlook remains bullish.

Can Ethereum Reach the $7,000 Target?

A combination of factors could help. There are strong technical signals. ETF inflows and accumulation are also factors. This creates a very supportive backdrop.

If Ethereum holds above $4,500, the path is clear. It also needs to reclaim the $4,800 resistance. This would make the path to $7,000 very likely. The market is watching for a sustained rally.