Dogecoin Declines to $0.18 as Long-Term Holders Reduce Exposure

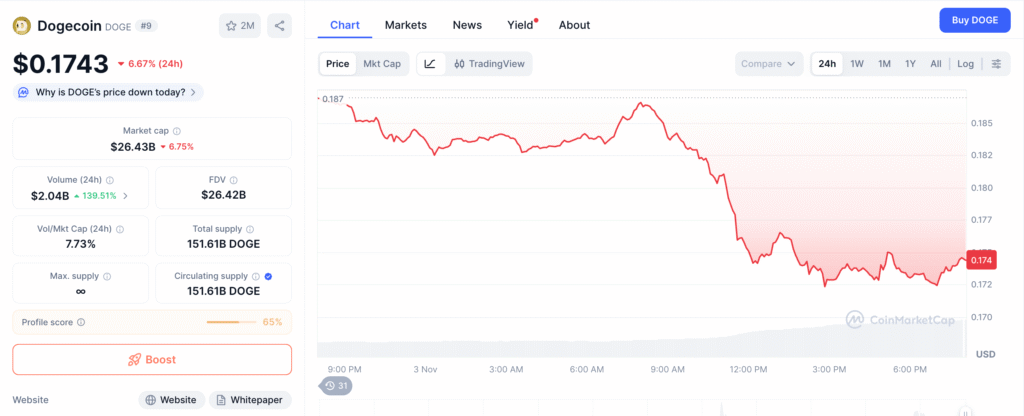

The world’s largest meme cryptocurrency Dogecoin (DOGE) has entered a critical phase as on-chain data shows long-term holders beginning to offload significant volumes. The price of DOGE fell to $0.1743, down nearly six percent in a week and 27 percent for the month, raising questions about whether its key $0.17 support level can hold.

Over the past 24 hours, DOGE declined by 1.81 percent, trading between $0.18 and $0.19, with a total market capitalization of approximately $463.7 billion. Daily trading volume dropped to $16.1 billion, signaling fading momentum and reduced retail participation.

On-Chain Data Reveals Weakening Support Zone

According to Glassnode, Dogecoin’s strongest support cluster lies between $0.177 and $0.179, where approximately 3.78 billion DOGE were last accumulated. Historically, this area has served as a stabilizing base during sell-offs. However, the latest data shows the buffer rapidly thinning as investors shift from accumulation to distribution.

The Hodler Net Position Change indicator recorded a sharp reversal on October 31, switching from an inflow of +8.2 million DOGE to an outflow of -22 million DOGE. This 367 percent behavioral shift signals that even long-term holders—traditionally the market’s strongest hands—are beginning to sell positions amid ongoing weakness.

Long-Term Whales Begin Distribution Phase

Analysts believe the current outflows mark the start of a distribution phase by major holders. On-chain data shows that wallets holding between 10 million and 100 million DOGE have collectively sold over 800 million tokens since late October.

“Whales are clearly reducing exposure,” said one market observer at Pintu Research. “As they take profits near $0.18, the broader market is losing short-term support, leaving retail traders vulnerable to deeper drawdowns.”

Recommended Article: Dogecoin Faces Critical Support As Bears Test Market Conviction

Death Cross Formation Reinforces Bearish Sentiment

Technical charts show a persistent bearish setup forming across Dogecoin’s moving averages. After the 50-day Exponential Moving Average (EMA) crossed below the 200-day EMA in late October, the price continued its downtrend. Analysts now warn of a potential second, stronger death cross, with the 100-day EMA nearing a crossover below the 200-day EMA.

Unlike short-term corrections, this pattern indicates structural weakness and may reinforce downward momentum if confirmed. “A confirmed death cross could send DOGE closer to $0.14, representing another six-percent decline from current levels,” analysts added.

Market Outlook: Key Support Levels in Focus

The next support level for DOGE lies near $0.17, with secondary support forming around $0.14. If selling pressure intensifies, this area may serve as the last defense before a potential capitulation phase. Immediate resistance levels are seen at $0.20 and $0.21, thresholds that must be reclaimed to invalidate the current bearish outlook.

Market experts emphasize that Dogecoin’s recovery potential depends on whether retail traders and long-term believers can absorb continued selling pressure. A strong rebound above $0.21 would signal renewed accumulation and could reestablish short-term confidence.

Broader Sentiment Across Meme Coins

Dogecoin’s decline contrasts with the relative stability of other meme tokens such as Shiba Inu (SHIB) and Pepe (PEPE), which have shown reduced volatility despite similar macro headwinds. Analysts suggest that profit rotation among meme coin traders may be diverting liquidity away from DOGE toward newer speculative assets.

Despite the current downturn, Dogecoin remains one of the most-traded and recognized meme cryptocurrencies, with a loyal global community and ongoing network upgrades. However, analysts caution that without renewed market catalysts, DOGE could remain under pressure through November.

About Pintu Crypto Exchange

Pintu is a leading cryptocurrency trading platform in Southeast Asia, providing secure and accessible trading for digital assets such as Bitcoin, Ethereum, XRP, and Dogecoin. The company also operates Pintu Academy, an educational initiative offering resources on blockchain, DeFi, and crypto investing.