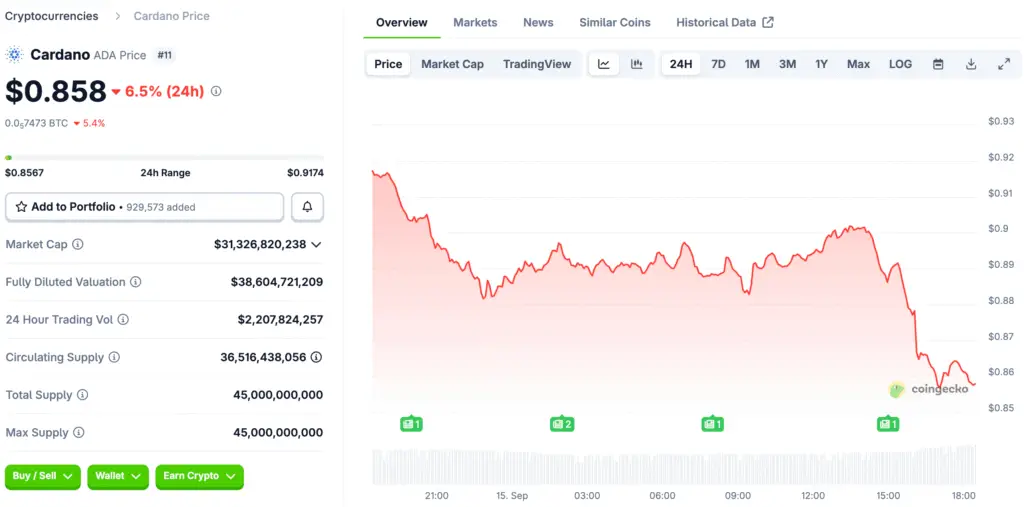

Cardano’s Crucial Test at $1.15 Resistance

Cardano has been slowly getting back up from its lows in the middle of summer, and analysts are now closely watching its progress toward the important $1.15 resistance. In the past, this level has been a major barrier that often stopped rallies, so it is very important for figuring out where the token is going next.

Ali Martinez, an analyst, stressed how important $1.15 is as a make-or-break point and said that Cardano would continue to rise if it closes above. A breakout like this would show that the market is confident and could start a chain reaction that sends ADA toward the much-anticipated $1.25 target.

A Confluence of Bullish Signals for Cardano

Martinez said that Cardano recently got over a number of short-term obstacles, which shows that it is getting stronger and ready to try again at a higher level of resistance. If the price closes above $1.15 cleanly on a weekly basis, it could start a bullish surge that takes prices up to the $1.25 and $1.50 levels.

Some other technical analysts say that Fibonacci extension targets are between $1.15 and $1.78. This means that there is potential for the market to move up over a longer period of time if conditions are right. The fact that these indicators are all pointing in the same direction makes bullish sentiment even stronger. However, analysts say that volume, sentiment, and overall macroeconomic strength should be confirmed first.

The Cardano Rally Is Driven by Whales

Recent blockchain metrics show that whales are getting bigger and bigger as big addresses keep buying ADA during consolidation phases. This makes bullish conviction much stronger. This accumulation makes exchanges less liquid, which could make breakouts more important when prices cross important levels.

The accumulation trend shows that institutional and high-net-worth investors are becoming more confident in Cardano’s long-term adoption potential and the strengthening fundamentals of its ecosystem. Whales can increase upward pressure by buying a lot, which can start rallies that smaller investors often follow, giving the whole market a lot of momentum.

Recommended Article: Cardano Volume Surge Sparks $2 Price Target Speculation

Navigating ADA’s Outlook Amid Market Uncertainty

Cardano’s technical patterns are bullish, but the overall mood in the crypto market is still cautious because of macro risks and the possibility of Bitcoin’s price changing quickly. Technical services say that short-term momentum is neutral to bullish right now, but analysts say that false breakouts are still possible without confirmation from the broader market.

Cautious sentiment shows how delicate the balance is between bullish optimism and macro-driven fears, which can change how investors act in unexpected ways. Traders need to keep a close eye on what’s happening and quickly change their strategies to protect themselves from losses or take advantage of gains.

Bullish Scenario Projects Breakout Beyond $1.15 Toward $1.25

If things go well for ADA, it will break through resistance at $1.15, which will be supported by higher trading volumes. This will confirm momentum and push the price up to $1.25. If people keep buying, targets could go up to the $1.50–$1.80 range, thanks to technical clusters and analyst projections that say prices will keep going up.

For this positive scenario to happen, Bitcoin needs to stay stable, and demand for altcoins needs to keep going up, which will give the market the momentum it needs. If the right conditions are met, ADA’s upward trend could speed up a lot, making it one of the top altcoins that are likely to keep growing.

Bearish Scenario Highlights Risks Of Rejection And Retracement

Analysts say that if ADA doesn’t break through resistance at $1.15, a sharp rejection could cause it to fall back to strong support near $0.80. In the past, mid-cycle rejections at resistance have led to quick pullbacks, which have frustrated traders who were hoping for breakouts and made the market more cautious.

A failed attempt could quickly change people’s minds, which would hurt bullish setups and make it harder for traders who don’t know how to manage risk. This shows how important it is to have stop-loss protection and balanced exposure when trading assets that can change quickly, like Cardano, when the market is uncertain.

Cardano Nears a Critical Price Junction

Ali Martinez’s bullish roadmap has set $1.15 and $1.25 as key levels that will determine the next market phase for ADA trading in September. A clean breakout could confirm bullish momentum, but a rejection would remind traders that there is still a lot of resistance to overcome.

Experts stress the importance of disciplined risk management, no matter what happens, because the crypto markets are still unpredictable and things can change very quickly. Investors in Cardano need to be careful with their optimism and realize that the current technical patterns have both bullish and bearish potential.