Institutional Investors Embrace Ethereum

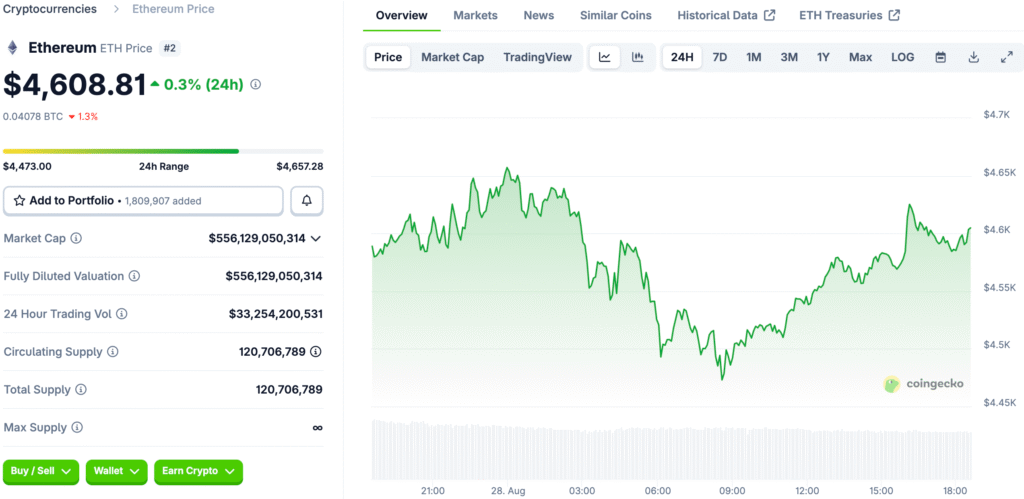

Institutional investors are buying Ethereum. They are doing this even though prices are falling. Ethereum slipped more than 8% recently. It dropped to around $4,420. But inflows into institutional funds remain strong.

Data shows that total assets under management have grown. This is true for Ethereum ETFs. These assets now total $28.8 billion. For many institutions, price dips are a major opportunity. They do not see them as warning signs.

BlackRock Leads the New Wave of Investment

BlackRock’s ETHA fund took the lead. It had a massive $323.1 million inflow. This sets the tone for the entire market. Other institutions also contributed to this trend. Fidelity’s FETH followed with a large investment. Grayscale’s spot ETH product also added funds.

Grayscale’s addition is notable. This is true despite challenges with its legacy trust. Together, these figures show a broad institutional shift. They are moving toward Ethereum as a serious asset. They are not just buying speculative crypto assets.

Why This Buying Trend Matters So Much

This is not BlackRock’s first large purchase. In July, ETHA bought 106,827 ETH. That was worth about $300 million in one day. That move pushed its AUM beyond $6 billion. More recently, ETHA bought another 65,900 ETH. These regular buys show a clear pattern.

BlackRock is not just experimenting. It is building a long-term position. The company is betting on Ethereum’s future role. This includes its use in DeFi and staking. These large purchases signal strong confidence.

Recommended Article: The Rise of Ethereum as a Corporate Asset

Ethereum vs. Bitcoin Inflow Trends

Ethereum inflows may be making headlines. But Bitcoin ETFs also attracted capital. On August 25, Bitcoin funds saw $219 million in inflows. Fidelity’s FBTC led the way with $65.5 million. BlackRock’s IBIT brought in $63.3 million.

However, the pace was slower than Ethereum’s. This shows a definite shift in market sentiment. Many investors are now looking beyond Bitcoin. They are seeing the value in other large-cap assets. Ethereum is leading this new trend.

The Long-Term Vision of Institutional Buyers

These inflows are changing how finance views Ethereum. It is no longer just a risky crypto bet. Clearer regulations are helping the process. Rising adoption by big companies is also a factor. Ethereum is moving more into the mainstream. It is being recognized as a foundational digital asset.

For investors, the message is clear. Ethereum is now seen as a serious institutional holding. It is being used for more than just speculation. It is becoming a core part of digital finance. This change is a huge step for the asset.

The Evolution of Ethereum’s Role

These large institutional investments are important. They are changing how people see Ethereum. It’s a foundational digital asset. This is a big step for the market. It’s no longer just a risky bet.

Institutions are now seeing the value. They see it for its future role. They see it in decentralized finance. They also see it in tokenized assets. They see it in staking. They are building long-term positions.

The Future Is Now for Ethereum

BlackRock’s recent purchase is a huge signal. It shows that major institutional players are loading up on Ethereum. This highlights growing confidence in the asset. It shows that they are looking past short-term price volatility.

Ethereum is evolving from a niche asset. It is now a mainstream player. It is being recognized for its real utility. These inflows are changing the way investors think. The future of Ethereum looks very bright.