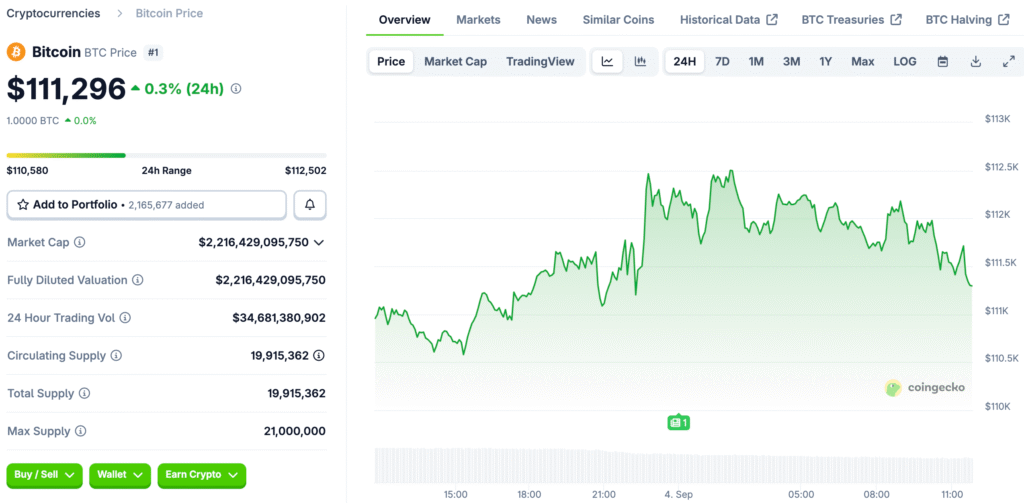

Bitcoin Breaks Out of Its Downtrend

Bitcoin has been able to close outside of a key trend line every day. This is the first time this has happened since the middle of August. A new signal could end a two-week downtrend. This is a very good sign.

Now, the whole drop from August’s highs is being questioned. The daily candle tried to break through resistance that was going down. It finally worked, which is a big deal.

Technical Confirmation and Bullish Signals

This rebound has been followed by a bullish divergence on the RSI. This is a very strong and good sign for traders. There is now a rebound from lows that lasted for weeks. This means that there is a new upward trend.

A daily close above the downtrend would show that the breakout was real. This would be a big win for the bulls in terms of technology. The price is now trying to break its downtrend. This is a very important time for the token.

Bitcoin’s Bull Market: A Mix of Bullish and Bearish Outlooks

People still have different ideas about what will happen to the Bitcoin bull market. Some traders still think that the price will go back down to $100,000 or less. They still think the token’s future is very bad. This is making things very unclear.

A lot of people cared about a certain price level. They think of it as a resistance flip target. A lot of people think this level is very important. There are a lot of different opinions in the market.

Recommended Article: Bitcoin’s Volatility Decline Attracts Wall Street Investment

Looking for a Break Above Key Resistance

Traders are now waiting for a break above an important resistance level. The area is the same as a patch of ask liquidity on exchange order books. This means that there is a lot of selling pressure. A break would be a great sign.

A close above this level could cause a lot of new short positions to be closed. This would raise the price a lot. This is a very important level to keep an eye on. Here, a big move is needed.

What Macroeconomic Data Does

The price is going around a key level before new US economic data comes out. These data prints could change the price a lot. They could cause a lot of changes. The market is very touchy right now.

The Fed’s monetary policy and trade news are two big things that matter. They could send a lot of new money back into risky assets. This is a very important part of the market. This data will affect the token’s future.

Market Pressure and Levels of Liquidation

There are a lot of new liquidations piling up above a key level. A lot of traders think this is a very important sign. A lot of people are interested in this area. If the price goes past this level, it could start a very quick rally.

Around a new resistance is another important area to keep an eye on. This is also for the same reason. The liquidation levels show where the most stress is. The token has to get past these levels.

What the Future Holds for the Bitcoin Market

Bitcoin has a new signal that could stop its two-week losing streak. The daily close outside of the downward trend is a very good sign. The market is still very uncertain, though. There are a few things that will affect the outcome.

For a new rally to happen, a key resistance level must be broken. If it doesn’t work, it might go back to the old lows. Bitcoin’s future is now very uncertain.