Divergence Between Gold and Bitcoin Performance

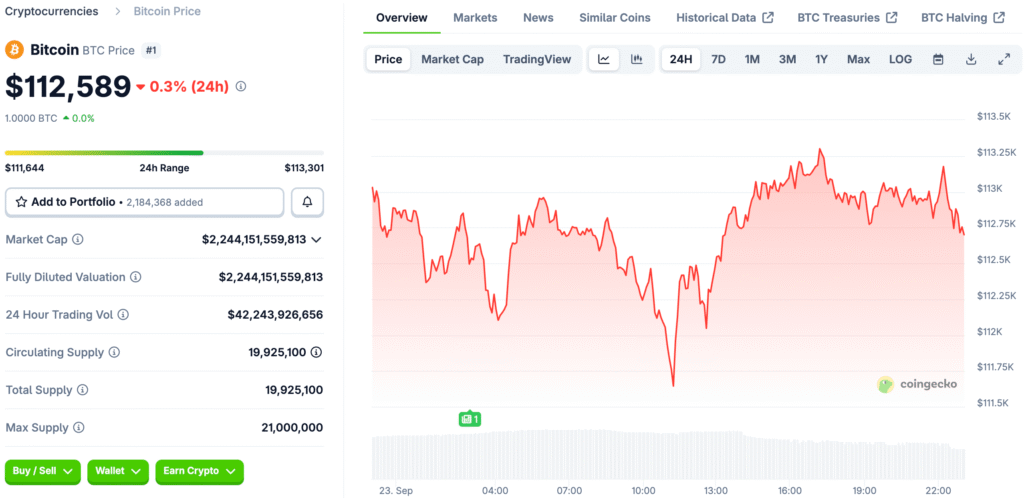

Gold prices hit all-time highs, but Bitcoin fell sharply below $111,000 after hitting $123,500 in August. The difference shows that gold is still a safe place to put your money when the economy is uncertain, while Bitcoin’s price keeps going up and down in unpredictable market conditions.

Analysts at Deutsche Bank say that these differences don’t stop both assets from doing well together in long-term monetary systems. They think that central banks might strategically diversify their holdings by balancing Bitcoin’s innovation with gold’s traditional stability for the future of global financial systems.

Deutsche Bank Forecast for Reserve Holdings

By 2030, analysts Marion Laboure and Camilla Siazon think that Bitcoin and gold will both be on central bank balance sheets. Their prediction is based on changing global reserve needs, changing macroeconomic conditions, and the dollar’s declining share of global trade.

This view sees Bitcoin as a complement to gold instead of a competitor, which could expand the range of reserve assets. Central banks will carefully consider both assets, comparing gold’s proven reliability to Bitcoin’s potential for innovation in a variety of portfolios.

Short-Term Drivers of Gold and Bitcoin

Traders are currently weighing geopolitical tensions, inflationary pressures, and changes in Federal Reserve policy that are driving up demand for gold. Gold’s performance shows that it is a stabilizing force when things get uncertain, keeping investors’ faith during times of economic turmoil and global instability.

Bitcoin, on the other hand, has had problems because of its volatility, even though it was widely used earlier in 2025. This shows how hard it is for short-term investors to trust it. Still, analysts say that Bitcoin’s progress shows that it has long-term potential that may be greater than the short-term problems and market corrections that will happen in the next few years.

Recommended Article: Bitcoin Market Rout Sends Shockwaves Through Crypto Sector

Global Gold Demand Remains Elevated

According to a 2025 World Gold Council survey, 43% of central banks plan to add to their gold reserves. Most people also think that global central banks will continue to buy more gold, which will strengthen gold’s position as the most important reserve asset around the world.

These numbers show how important gold is as central banks get ready for possible inflationary shocks and rising geopolitical instability in major economies. High demand shows that the asset is still important as central banks around the world build up their balance sheets with trusted reserve assets.

Bitcoin Demonstrates Growing Resilience

Bitcoin has shown that it can bounce back from recent drops, with historically low volatility and more and more global institutions using it. More than 180 businesses have added crypto to their balance sheets, often following Michael Saylor’s strategy model for corporate treasuries.

Eric Trump and other well-known supporters say that Bitcoin is an important way to protect against inflation and unstable financial markets. They stress its role as an asset that can help investors during times of economic instability and uncertainty about institutional policies.

Bitcoin as an Emerging Macro Hedge

Deutsche Bank sees Bitcoin as a new macro hedge that is slowly gaining acceptance alongside traditional assets like gold. They say that Bitcoin’s price could follow a “Tinkerbell effect,” where real demand and value stay high because people trust and use it.

The analysts say that regulations, institutional inflows, and changing investor views could make Bitcoin more important in sovereign portfolios. In this case, Bitcoin’s reputation as a diverse reserve asset grows. It offers new ideas along with tried-and-true options like gold.

Deutsche Bank Notes Bitcoin’s Role in Future Reserve Diversification

In 2000, the dollar made up 60% of global reserves. By 2024, that number had dropped to 43%. This drop makes central banks strategically diversify by looking at other stores of value that better reflect how things are in the financial world today.

Deutsche Bank says that Bitcoin could be included in new multi-asset structures that balance reliability with innovation. This way of doing things might help central banks deal with uncertainty better and take advantage of new chances that come up with digital assets like Bitcoin.