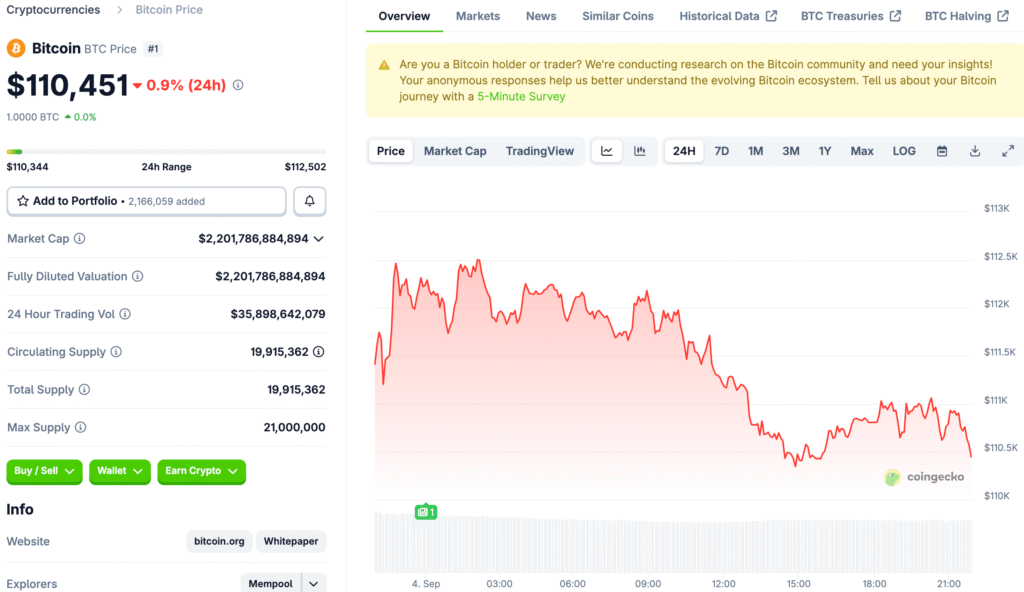

Bitcoin Price Drop Recently

The price of Bitcoin has gone down recently. It dropped 14% from its highest point ever. The price is now at its lowest point in seven weeks. This means that the market is getting tired.

The rally to new highs made all of the supply profitable. This is very hard to keep up for a long time. It needs a lot of money coming in. This demand eventually started to run out of steam.

A Market Shift: Bitcoin’s Euphoric Phase Ends

The Bitcoin supply is making money, according to the data. At its highest point, it reached 100%. This is a rare and hard state to keep. It needs new buyers all the time.

The supply that makes money has now dropped to 90%. This means that the euphoric phase has ended. The market is now in a distribution phase. Some investors sell out of fear because of this.

The Corridor of Consolidation

The price range right now is $104,100 to $114,300. This is called a consolidation corridor. It has always come after euphoric peaks. It often makes the market choppy.

If it drops below this zone, it would mean more tiredness. A recovery above it would show that people want it. The market is now looking for a clear path. This is a very important time.

Recommended Article: Bitcoin’s Volatility Decline Attracts Wall Street Investment

Behavior of Short-Term Holders

It’s important to know how much short-term holders have. There was a big drop in the percentage of profit. It went down from 90% to only 42%. This is a classic sign that things are cooling off.

This change often makes people sell out of fear. It can then make the seller tired. More than 60% of the short-term supply is now making money again. This recovery is still very weak.

Overcoming the Main Resistance

The relief rally for Bitcoin stopped at $112,000. This shows that bears are protecting this level. This area is a strong point of resistance. It has important moving averages.

Bulls need to make this area a new support. This would prove that the correction is over. If this doesn’t happen, there could be more bad news. The price movement is a big sign.

A Critical Price Point Bitcoin Must Hold to End Correction

One analyst points out the consolidation. Bitcoin has not been able to get back to its old range. It would be good if it went back above $112,000. It has to stay above that price.

This would be a very good sign. It would mean the end of the correction. Then it would be possible to test the old highs again. This move is what the market is waiting for.

Bitcoin Bulls Target Key EMA to End Correction Phase

The price needs to go above $112,438. The 20-day exponential moving average is this. To confirm higher lows, this move is necessary. It would mean that the correction phase is over.

Bulls would win big if this happened. It would show that the momentum has changed. There could be a rally that takes prices to all-time highs. Investors would be happy with this change.