SUI Price Drops Sharply Before Getting Important Technical Support

During the past week, SUI’s price dropped by a significant 17%, which worried traders who were closely watching important support levels. This drop put SUI in a downward channel, which is a sign of continued bearish pressure and profit-taking after earlier rallies throughout the year.

Interestingly, the token has hit a key support level, which has drawn a lot of interest from traders looking for possible rebound opportunities. People in the market are keeping a close eye on SUI to see if it can stabilize enough to bring back bullish sentiment in October.

Descending Channel Formation Suggests Market Correction Phase Ending

SUI’s recent drop fits with a descending channel pattern that analysts have carefully looked at on daily technical charts. In the past, these kinds of patterns have often come before stabilization phases or reversals, giving patient investors looking for good entry points a chance to make a strategic move.

The lower channel boundary hasn’t been broken yet, which could mean that committed buyers are willing to protect important price levels aggressively. This structure could mean that bearish momentum is running out, which could lead to rebounds and more accumulation activity.

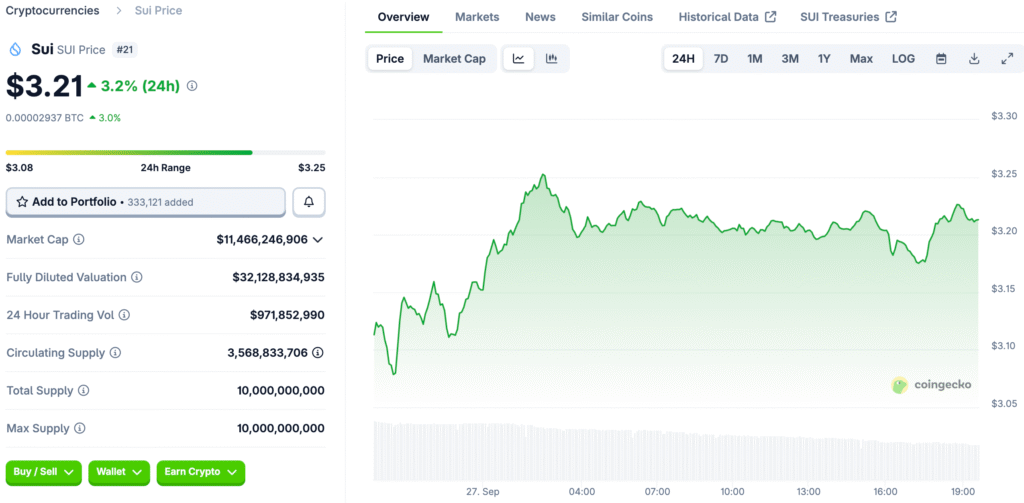

Double Bottom Formation Near $3.20 Strengthens Bullish Prospects

A double bottom has formed close to $3.20, which makes this technical support area much more important. In the past, double bottom patterns have shown that trends are about to change. This has led to strong recoveries in bullish markets that have been seen in the past in volatile cryptocurrency markets.

If SUI can stay at this level, it could quickly bounce back toward higher resistance zones, which would give traders a lot of confidence. If the support level holds, bullish traders may use this base to start more upward momentum in October.

Recommended Article: SUI Price Eyes Breakout Toward $4 After Falling Wedge Pattern

SUI RSI Drops Below 30 Signaling Oversold Conditions and Relief Rally

The Relative Strength Index for SUI has dropped below 30, which is a sign that the market is oversold and that a relief rally is likely to happen soon. Oversold signals often mean that traders are running out of things to sell, which makes them expect rebounds and get ready for possible upward movements.

If buyers act quickly, short-term bullish reversals could happen, which would push prices toward immediate resistance levels seen on intraday charts. Traders keep an eye out for confirmation signals because RSI reversals often happen with higher volume and a general sense of optimism in the market.

Seasonal October Trends Could Reinforce Recovery Momentum for SUI

In the past, October has been a good month for cryptocurrency rallies. This is because seasonal patterns and possible macroeconomic factors that could boost bullish sentiment strongly align. If the Federal Reserve cuts interest rates or Bitcoin does well, it could give the whole market a lot more confidence, which would help SUI’s recovery.

If these things come together in the right way, SUI could benefit from both technical and fundamental tailwinds that drive up its value significantly. Traders often take advantage of these seasonal trends by getting in early to get the most out of their investments when market conditions are usually better.

Key Resistance Levels Highlight Possible Upside Breakout Targets

If SUI bounces back from support, it will face immediate resistance at $3.44 and then at $3.83. If the price breaks out above these levels, it could go up to four dollars and forty-five cents, which would be a big gain for active traders right now.

Such movements would probably confirm bullish reversal patterns, which would get more sidelined investors to join in. When breakouts happen with higher volume, they usually make trends stronger, confirm changes in momentum, and boost overall confidence in the changing cryptocurrency markets around the world.

SUI Approaches Crucial Weeks as Traders Weigh Support and Breakout Odds

The next few weeks will be very important for SUI, as traders carefully consider how stable support is and how likely it is to break out. Price stabilization along with seasonal bullish trends could lead to a strong recovery, putting SUI in a good position going into the fourth quarter overall.

On the other hand, if support isn’t defended, the correction phase could last longer, which would eventually push prices down to lower retracement levels. People in the market are still paying attention because they know that what happens next will have a big impact on SUI’s path during this important time.