PENGU Price Holds Support Amid Market Volatility

PENGU is maintaining support zones despite market volatility, causing traders to remain cautiously optimistic. Buyers consistently buy dips near demand, indicating interest in the market and supporting its positive short-term trend. High trading activity suggests that current consolidation is not a sign of tired bulls but preparation.

The market’s structure remains consistent, with higher lows occurring, suggesting the market will continue to rise once resistance levels break down. Participants monitor liquidity clusters around support to predict market bounceback and plan staggered entries with controlled risk.

Short-Term Correction Before Potential Breakout

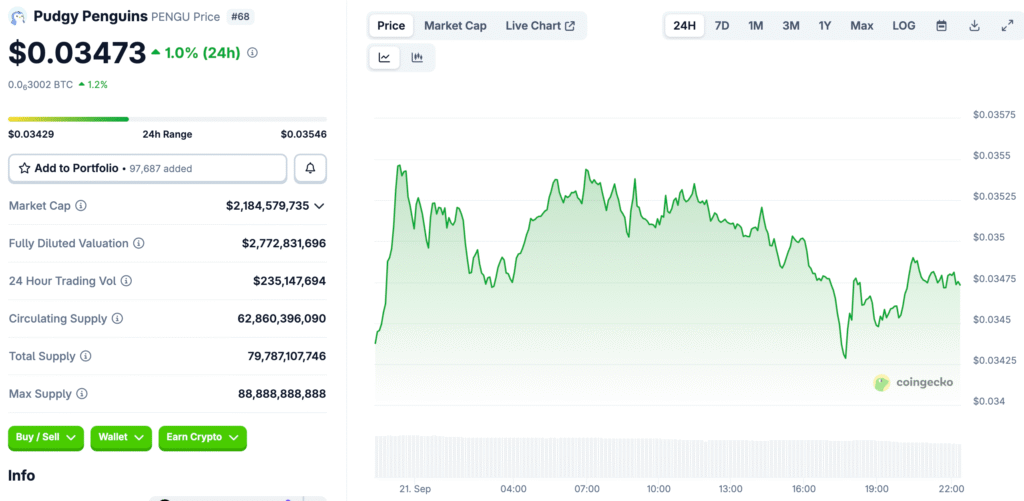

PENGU trades near $0.035, despite a 7% drop, with over 300.15 million volumes, indicating active trading despite fluctuating prices. This indicates healthy consolidation phases before new breakout campaigns. Momentum oscillators are neutral, suggesting growth potential if bids strengthen and contested supply zones are taken back.

High demand near intraday supports will force sellers to sell more, supporting the bullish market thesis. If the market doesn’t stabilize, it could go down further, but strength on longer time frames still favors an upward trend.

Bullish Pennant Pattern Shows Momentum

Charts show a bullish pennant with prices testing lower limits before breaking out to the upside. This could speed up the resumption of the trend, bringing attention back to overhead supply and previous rejection zones. Increased volume should also increase, making confirmation stronger, reducing false breaks, and encouraging new participants.

Analysts suggest spreading momentum over different time frames to prevent divergence and maintaining structure above pennant support for good probability distributions for upside targets and measured moves. Invalidation occurs below pattern lows, leading to liquidity hunts and larger corrective sequences.

Recommended Article: Pudgy Penguins Price Builds Momentum With Breakout Retest

Fundamentals Add Confidence to Technical Setup

Speculation about ETF allocations and OpenSea integrations is increasing trust among retail and institutional investors, enhancing the platform’s technical strength and support scenarios. Partnership stories keep attention, increasing liquidity and attracting long-term capital from institutions. As utility grows, people believe PENGU goes beyond speculative cycles, supporting its value through real progress in the ecosystem.

Delivering on roadmaps can turn narrative momentum into fundamentals, boosting confidence during market downturns. When the story and execution align, it often leads to long-lasting improvements that last longer than short-term hype-driven spikes.

Social Sentiment Strengthens Bullish Outlook

Community trust has risen over 95%, resulting in a rebound in prices to $0.0379. Increased social media engagement can speed up momentum recovery. Sentiment often leads to rallies beyond initial targets. Traders monitor sentiment changes, technical triggers, and on-chain activity trends.

A positive market can encourage incremental bidding, keeping lows higher while supply distribution thins. Sharp reversals can occur, but strict risk parameters can help manage swings without giving up on the main idea.

PENGU’s Technical Levels to Watch

The market is currently focused on demand between $0.033 and $0.034, which has been a favorable spot for absorption during high volatility. If this band is breached, the price could return to $0.038, confirming the bullish market structure. If lost, deeper tests could occur, potentially reaching a target of $0.030, posing questions about the broader trend’s integrity.

Liquidity pools below recent lows could temporarily lower prices before responsive buying drives them back up. Traders plan to enter the market in stages, with increasing exposure as confirmations come in.

What PENGU Investors Should Know

PENGU is at a pivotal point where short-term volatility meets long-term bullish structures. Despite a break for market adjustments, community excitement and good technicals keep things moving. A break above $0.038 with volume could make the continuation official, bringing in sidelined capital and making the market more liquid.

However, not defending demand could lead to a downward expansion of the range, requiring strict risk controls and adaptable strategies. Both resolutions allow traders to quickly adjust their positions, protecting their capital and preparing for long-term opportunities.