Cardano Volume Jump Highlights Growing Investor Optimism

In just 24 hours, Cardano’s trading volume shot up by an amazing 69%, reaching $2.12 billion across all exchanges around the world. This rise in activity shows that investors are feeling good about the market, which is a sign of both institutional interest and the belief that future rallies will keep going up.

Higher trading volumes usually mean more liquidity and easier access to the market, which makes it easier for investors to buy or sell with confidence. ADA’s increased activity shows that participants are becoming more confident. This suggests that bullish trends may continue as more institutions adopt the currency. There is a lot of momentum behind Cardano.

Institutional Moves Support Cardano Bullish Narrative

Grayscale said it plans to stake all ADA in its ETF, which could directly increase returns for institutional investors if it gets the go-ahead. This move shows that institutions trust Cardano’s proof-of-stake ecosystem and see the bigger picture for staking in regulated investment vehicles.

Analysts also say that Cardano has a 90% chance of getting a spot ETF by October 23, 2025. If regulators approve it, ADA would become a mainstream asset that is easy to get, which would boost bullish momentum. These changes make Cardano a much stronger investment choice in light of favorable U.S. policy conditions.

Cardano Overtakes Tron in Market Ranking Battle

With a market cap of $33.7 billion, Cardano passed TRX by a small margin to take back ninth place in the cryptocurrency rankings. This success shows that investors are moving their money into ADA because they prefer its research-driven, sustainability-focused development model over other options.

TRX, on the other hand, keeps showing strength, with small increases in both price and transaction volume while dominating stablecoin transfers by a large margin. Even though ADA won, the competition is still close, and the two assets often switch places in 2025. Competition keeps ecosystems moving forward.

Recommended Article: Cardano Price Retest Signals Renewed Bullish Momentum Building

Tron Stablecoin Dominance Remains a Strong Advantage

In August, Tron handled $687 billion in USDT transfers, which gave it 57.7% of the world’s stablecoin transfer volume. This kind of performance shows how strong Tron is at making its network work well, which means it will stay a strong competitor in blockchain financial transactions.

This dominance shows why ADA needs to keep coming up with new ideas to stay ahead, even though investors are excited about it. Capital flows are still fluid, changing based on market cycles, adoption metrics, and technical strengths. Cardano is always under pressure to deliver.

Analysts Eye $2 Price Target for ADA

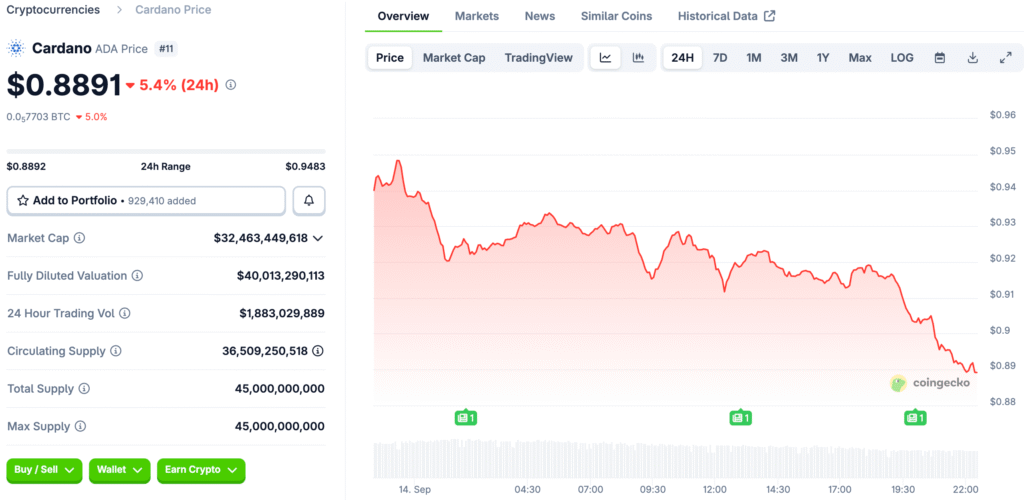

Technical indicators show that ADA has broken above its descending channel and closed near $0.926, which could mean that it is ready to break out to the upside. If ADA breaks through the $1 resistance level, analysts say it will quickly move toward $1.50 and maybe even $2 if the bullish momentum stays strong.

Such gains would mean more than 100% growth from where they are now, which would make investors even more excited. But there are still problems to deal with, like sellers who don’t want to sell and the possibility of prices dropping below moving averages. For bullish validation, sustained volume and accumulation are very important.

Historical Context Highlights Cardano’s Upside Potential

Cardano hit an all-time high of $3.10 in September 2021, so a $2 target is very possible if things go well. Market watchers say that renewed momentum could bring back excitement, especially if whales keep buying ADA at a fast pace.

Analysts are still split, with bullish scenarios pointing to technical breakouts and cautious voices warning that volatility risks could stop long-term growth. Even though there is hope, the crypto markets are still hard to predict, so be careful. Still, ADA’s path is still in line with the larger bullish cycles that are happening.

Cardano’s Path to $2 Awaits a Bullish Breakout

Cardano’s 69% increase in volume shows that more people are interested in the market, which puts ADA back in ninth place and gives bullish stories a big boost. Institutional involvement and possible ETF approvals are strong reasons to be optimistic about Cardano’s price in the medium term.

Even though Tron is still a strong competitor, ADA’s strong fundamentals and community support make it likely to grow over time. A $2 target is still possible if conditions are right and adoption continues. Cardano is a good example of how cryptocurrency markets can be unstable but also have a lot of potential.