Bitcoin’s Maturation and Low Volatility Spark New Investor Interest

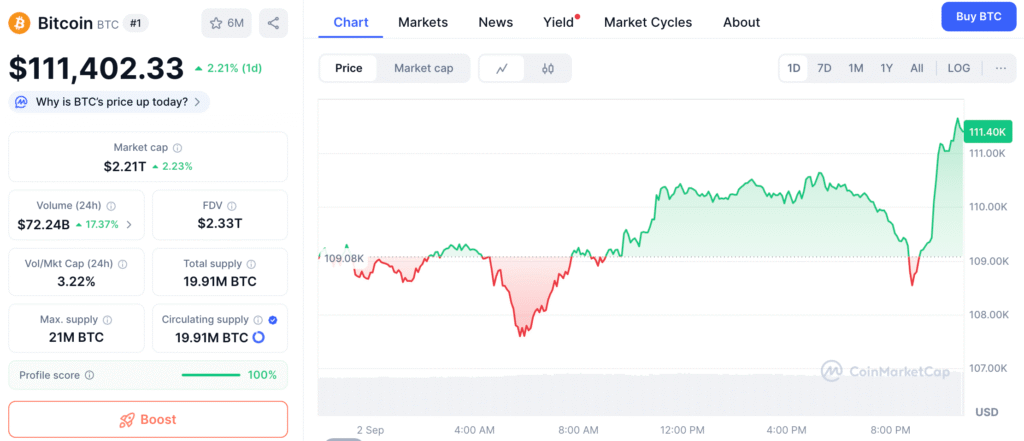

This year, Bitcoin’s prices have been much less volatile than in the past. Its three- and six-month volatility is at an all-time low. Even as Bitcoin hits new highs, this trend has stayed the same. This could be a big change.

According to JPMorgan strategists, this is because companies are stockpiling. Businesses are quickly buying the digital currency. Now, this makes the asset look more stable. This is making investors think differently about Bitcoin.

Corporate Treasuries Fuel Bitcoin’s Newfound Stability

More than 6% of Bitcoin’s total supply is now held by corporate treasuries. This is like quantitative easing for crypto in the private sector. This is a very strong force in the market. It shows that people are starting to trust the asset more.

Nikolaos Panigirtzoglou, JPMorgan’s global market strategist, wrote a note to a client. He thinks that the drop in volatility is because companies are buying. These new buyers are making a big difference. This is a big change in the market.

What Wall Street Thinks About Lowering Volatility

People have always thought of Bitcoin as a very unstable asset. Wall Street has had a hard time because of this volatility. But over time, the price swings have gotten smaller. This is a very good sign for the future.

This trend has been helped by the introduction of new financial products. New types of investors came in because of futures contracts and exchange-traded funds. These items give you a lot of new access. They are making Bitcoin more popular.

Recommended Article: Bitcoin & Macroeconomics: How Global Factors Drive Crypto Volatility

The Trump Administration’s Good Crypto Policies

There have been some big wins in the crypto world this year. In August, President Trump signed an executive order. This order makes it easier for alternative assets to be regulated. It also lets you put crypto in your 401(k) retirement plan.

Trump signed a bill weeks ago. This law will let US banks make stablecoins. This is a great step forward for the whole industry. It shows that more and more people are okay with crypto.

Michael Saylor’s Legacy: Sparking a New Corporate Trend

Michael Saylor was the first person to suggest putting Bitcoin on a balance sheet. Strategy, his company, started buying the asset in 2020. Now they are a huge Bitcoin company. Saylor is a strong supporter of businesses using technology.

Since then, a lot of businesses have copied this playbook. They have bought billions of dollars’ worth of Bitcoin. This is a strong new trend. This plan has been shown to work.

Bitcoin’s Possible Role as a Rival to Gold

Bitcoin might be more appealing if it were less volatile. It might become a better option than gold. This is a big and important change in the market. This makes the asset worth more to investors.

This trend has a lot of effects on the market. A lot of new buyers might be interested in it. The drop in Bitcoin’s volatility could be a new story. It might help Bitcoin become a real store of value.

Bitcoin’s Maturation: A New Era of Growth and Legitimacy

The combination of things is very strong. Less volatile markets, corporate treasuries, and good policies. All of these things are changing the market in different ways. A lot of new legitimacy is coming to the crypto world.

This is a new stage of growth. More and more people are using Bitcoin. It is becoming more popular. This could lead to new opportunities for the whole ecosystem. The future looks very good.