Pepe Coin Enters a New Trading Cycle

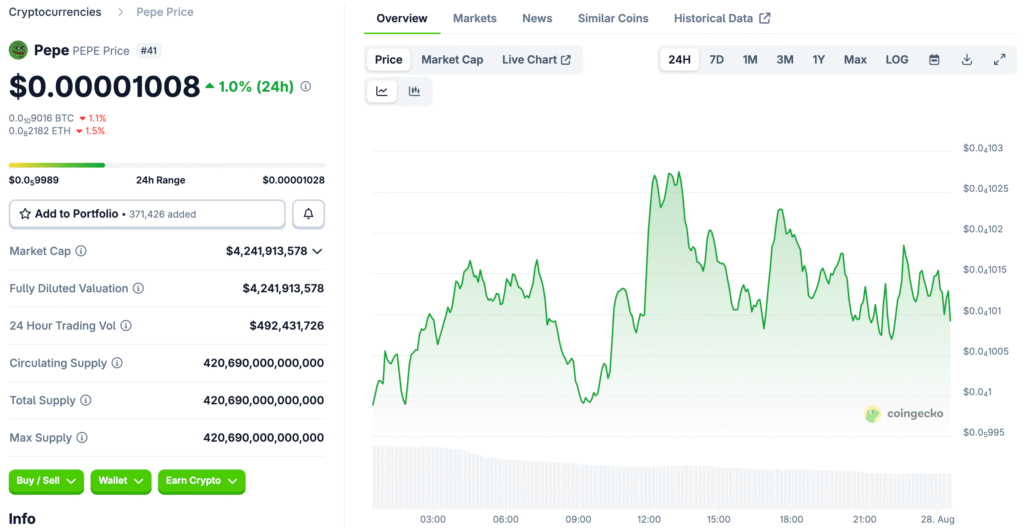

Pepe Coin has captured the attention of traders and analysts alike following a recent price dip to a low of $0.00001156. This drop has sparked intense debate within the crypto community, with many now projecting a potential 40x surge to a target price of $0.000399702. The coin’s price action appears to be forming a classic accumulation pattern within a defined parallel price channel.

The price has tested the lower boundary of its trading range, which has created a potential support zone that analysts are closely monitoring. If the current bottom holds, it could trigger a breakout similar to previous recoveries, where the price rebounded from comparable support levels. This technical setup is a key reason for the renewed optimism surrounding Pepe Coin.

The Technical Indicators Driving the Forecast

The analysis of Pepe’s price action highlights key Fibonacci retracement levels at 23.6%, 61.8%, and 100%, which serve as critical technical indicators for potential price reactions. These levels are used by traders to identify key support and resistance zones. The chart indicates that if the current bottom holds, it could trigger a major rebound.

The prominent crypto analyst CryptoELlTES shared a chart on August 25 outlining this potential opportunity, describing it as a “huge buying opportunity” for risk-tolerant traders. The tweet has gained significant traction, reflecting the growing interest in this technical setup. The comments section, however, reveals a divided sentiment, with some users expressing optimism about the projected 40x move, while others are warning of the risks of entering the market at this stage.

The Bullish Case for Pepe Coin

Historical price patterns for Pepe Coin show a strong precedent for a significant rebound from a low. The current setup is the third such instance in the token’s charted history. This historical behavior gives many analysts confidence that the coin could repeat its past performance.

If the current bottom triggers a similar response, the price could climb toward the $0.000399702 level, which would represent one of the most substantial moves in the token’s history. The projection, based on measured prior movements within the defined channels, suggests that Pepe could follow a similar trajectory. This historical context is a crucial factor in the bullish case for Pepe Coin.

Read More: PEPE’s Strategic Accumulation Phase Signals Breakout

Market Sentiment and Confirmation Signals

While the 40x growth projection is highly appealing, it is important to note that this is based on technical analysis and is not a guaranteed outcome. The crypto market is volatile, and sentiment can shift quickly. For traders, the key focus is on whether the price can break out of its current range. Immediate resistance is expected at the upper channel boundary, while the Fibonacci levels will be watched closely to determine potential turning points.

Confirmation of a breakout will require strong volume spikes, sustained candles above the midpoint of the channel, and consistent price behavior around key trend lines. Until these signals are confirmed, market participants will remain cautious, questioning whether the current setup will hold or if Pepe’s momentum has already faded. The debate underscores the highly speculative nature of momentum-driven assets.

The Role of Technical Analysis in Crypto

Technical analysis is a crucial tool for traders in the crypto market. It involves studying charts and patterns to predict future price movements. The analysis of Pepe Coin’s price action is a perfect example of this. By identifying the classic accumulation pattern and using Fibonacci retracement levels, analysts can make informed predictions about potential future price targets. However, technical analysis is not a perfect science.

It is a probabilistic tool that provides a framework for understanding market behavior. The outcome of any trade depends on a variety of factors, including market sentiment, news events, and overall market conditions. The high-risk nature of crypto trading means that even the most compelling technical setups can fail to materialize.

The Debate: A Risky Bet with High Rewards

The intense debate surrounding Pepe Coin highlights the dual nature of crypto investing. For risk-tolerant traders, the potential for a 40x surge represents an incredible opportunity. The possibility of such a massive return is what draws many people to the crypto market. However, for more cautious investors, the risks of late entry and the speculative nature of the asset are significant concerns.

The market’s divided sentiment reflects this fundamental tension. While the technical analysis is compelling, the potential for failure is real. This is why it is crucial for investors to do their own research and understand their risk tolerance before entering a trade.

Pepe’s Future Awaiting Confirmation

Pepe Coin has drawn significant attention following a price dip that has led to projections of a 40x surge. The technical analysis, which highlights an accumulation pattern and historical rebounds from similar lows, provides a strong bullish case. However, the outcome remains uncertain and depends on key confirmation signals like a sustained increase in trading volume and a breakout from the current range.

While the potential rewards are significant, the high-risk nature of the asset means that traders will be closely monitoring the situation. The debate surrounding Pepe’s future underscores the speculative nature of the crypto market and the importance of due diligence.