XRP Reclaims Position Among Global Top 100 Assets

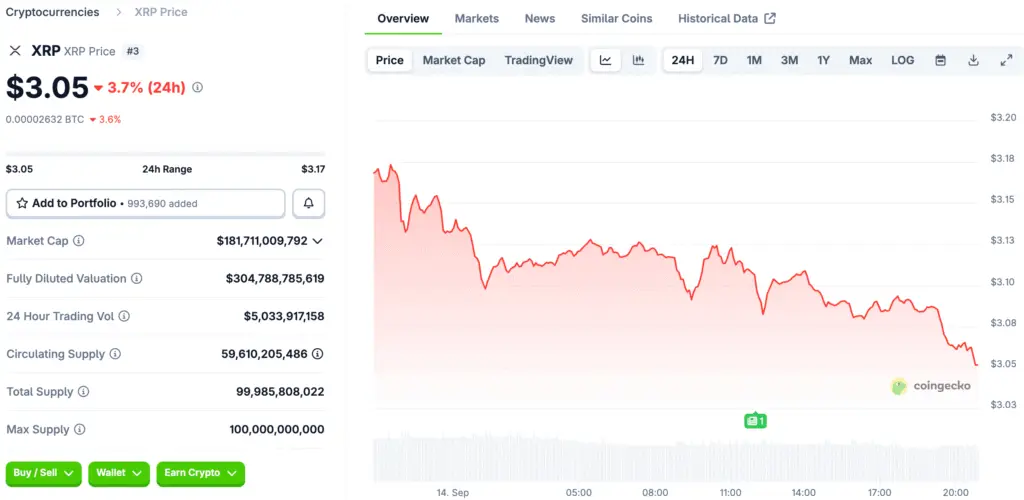

Ripple’s XRP has regained its position in the top 100 global assets after its market cap rose to $185 billion. This marks a significant recovery in the crypto market, following a brief drop to $2.70.

XRP’s strong performance, which saw it beat out major companies like Citigroup and Xiaomi, demonstrates its strength and its ability to compete with global giants. This move reflects the growing importance of cryptocurrency in mainstream finance and the broader recovery of the crypto market.

Market Recovery Boosts Ripple’s Standing Globally

The crypto markets as a whole bounced back, and XRP’s 10% weekly rise made it the 94th largest asset in the world. This rise shows that investors are still hopeful even when things are volatile, and it shows how quickly fortunes can change in the competitive world of cryptocurrency.

XRP’s rise allowed it to pass companies like Airbus, and it is now looking forward to competing with Verizon, Shopify, and Uber in the future. Every time XRP moves up in the global rankings, it becomes more relevant and trustworthy as an asset that can compete with traditional companies. Ripple’s usefulness for cross-border payments is still growing, which supports its long-term adoption story.

Bitcoin Faces Ongoing Battle Against Silver’s Strength

Bitcoin, with a market cap of $2.3 trillion, is one of the most valuable assets globally, while silver is worth $2.4 trillion. BTC has been outperforming silver and Amazon but has lost ground as precious metals recover.

This suggests investors prefer real safe-haven assets during uncertain times, contradicting Bitcoin’s claim of being digital gold. Despite dropping relative rankings, BTC remains a strong competitor among traditional assets, highlighting the impact of macroeconomic factors on institutional capital flow between digital and physical stores of value.

Recommended Article: SEC Extends Franklin XRP ETF Review As Optimism Builds In Markets

Gold Still Holds the Top Spot

Gold is still the most valuable asset in the world, with a market capitalization of almost $25 trillion. This shows that it is still the best way to keep your wealth safe. Recent price increases strengthened gold’s position, which was driven by demand during times of economic uncertainty and record highs against major fiat currencies.

Its size makes it clear that there is a big difference between Bitcoin and other cryptocurrencies when it comes to being a store of value. Still, digital assets are closing the gaps between them, showing that there is room for long-term growth in changing financial systems. Gold will always be the most important metal, but the way people are using cryptocurrencies suggests that there may be problems in the future.

Ethereum Climbs Global Rankings With Meteoric Rise

Ethereum has risen to 22nd place globally, surpassing Mastercard, Netflix, Visa, and Tencent. This indicates increased demand for decentralized apps, institutional interest, and ecosystem growth across various financial sectors.

Ethereum is the best smart contract platform, connecting new technology with mainstream investor recognition. Its goal is to reach the top 20, driven by increased usage and significant technical development milestones. Ethereum’s progress demonstrates how cryptocurrencies, beyond Bitcoin, are changing company valuation and ranking globally.

Wider Effects on the Use of Cryptocurrencies

The rise of XRP and Ethereum shows that more people are willing to invest in cryptocurrencies, including institutional investors and global financial assets. These milestones show how people’s views are changing, as blockchain-based tokens are becoming more competitive with companies for value and investor interest.

Bitcoin’s ongoing battle with silver shows how cryptocurrencies can compete with long-established safe-haven assets. At the same time, XRP and ETH show how digital finance ecosystems can be different. The global ranking shows that cryptocurrencies are becoming more and more a part of everyday economic talk.

XRP’s Return, BTC’s Struggle, and ETH’s Rise

XRP’s return to the global top 100 shows that it is strong, and it shows that cryptocurrencies can regain their value even when the market is volatile. Bitcoin’s fight against silver shows how hard it is for digital assets to get the same level of recognition as traditional stores of wealth.

Ethereum’s quick rise shows how smart contract platforms are becoming more important, making them a permanent part of the global economy. These changes all show how blockchain technology is becoming more important in shaping capital markets and changing the way assets compete with each other. As cryptocurrencies grow, their places in global rankings will increasingly go against what people expect, which means big changes are coming.