XRP Price Action Highlights Resistance Problems

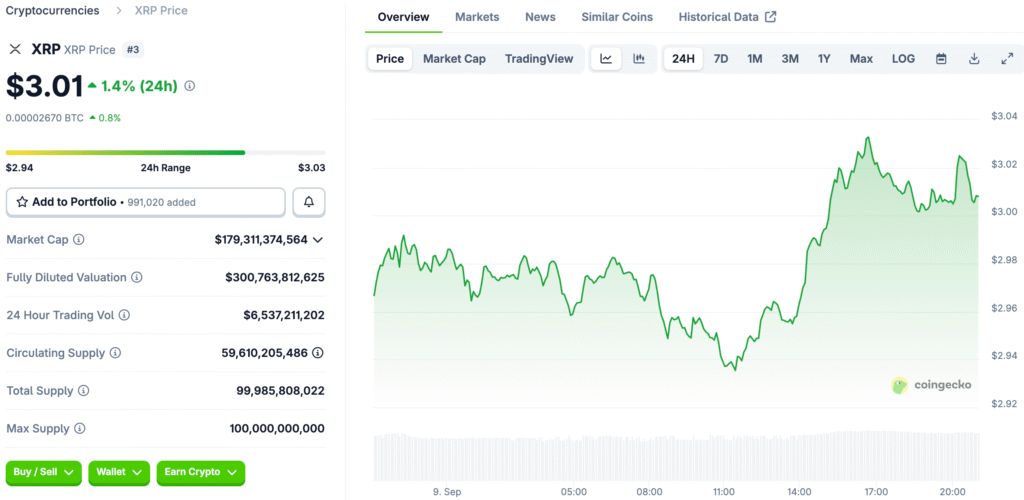

XRP is holding steady near $2.88, with a weak base above $2.84. Buyers keep defending the $2.77–$2.84 accumulation range with strength. Moving averages help. The 200-EMA near $2.82 supports the bullish structure and keeps the momentum going even though there is resistance at the $2.92–$2.93 convergence.

Patterns on charts show strength. Consolidation gives you a chance to get stronger again. Traders are keeping a close eye on breakout chances above the $2.93 resistance line. The support zone is still an important part of the foundation. If it falls below $2.84, it could lose momentum, which could lead to a bigger pullback in the current compression range.

Momentum Indicators Show Growing Bullish Strength

The Relative Strength Index goes above 59, which shows that more people are buying. This reading shows that things are getting better for a possible bullish expansion. The MACD is going up, but it is flattening out. Analysts see this as a shift from neutral to bullish, which means the market is getting ready to move.

Indicators point to a possible breakout. Technical alignment points to rising pressure on the upside. Traders are starting to expect stronger continuation above the current resistance zones. Confidence grows as momentum builds. The charts line up well. The market expects a possible shift from consolidation to breakout, with the goal of reaching higher resistance levels.

Resistance Levels Traders Closely Watching

Immediate resistance is between $2.92 and $2.93. The break above shows a bigger downtrend line near $3.10. Traders see $3.20 as an important goal. Breakouts need clear closes. Strength is confirmed by sustained momentum above resistance. If it fails, the consolidation could continue in a narrow trading range.

Traders think $3.20 is important. Clearing this up would make people more hopeful. Resistance levels show where the market might go in the near future. Market expectations are based on events that cause a clear breakout. Overcoming resistance is still the main idea behind figuring out where XRP will go next.

Recommended Article: XRP Price Consolidates Below $3 With Breakout in Sight

ETF Decision Looms Large for XRP

The decision about the ETF in October is a key factor. If approval happens, it could lead to institutional inflows, which would make prices go up a lot across all markets. Delays or rejections of ETFs could make people feel less positive. Traders think that clear rules are an important part of long-term adoption and legitimacy.

The appetite of institutions depends on how ETFs do. Traders who are hopeful think approval will happen, while traders who are doubtful stress the unknown. Both situations have a big effect on feelings. XRP’s future in the short term depends on this choice. Investors are careful but hopeful. Regulatory outcomes will affect the direction of the broader adoption story.

Market Structure Suggests Potential Compression Break

Chart patterns show where the compression zones are. Breakouts seem to be coming soon. The direction is still unclear, depending on the catalysts and the overall state of liquidity. Traders are paying close attention. Technical indicators point to a bullish bias, but we need to see decisive closes above major resistance levels soon to confirm it.

Before volatility spikes, there is often compression. Investors are careful but ready for either outcome. As the market gets closer to a key decision point, excitement grows. The chance of a breakout goes up over time. The market gets ready for an event that will cause volatility. Investors make plans that take into account both risk and possible rewards.

Institutional and Retail Investors Aligning Interests

Institutional investors keep a close eye on ETF approvals. Retail investors pay attention to chart patterns. Both groups expect big changes that will affect the future. Increased awareness leads to more people participating in the market. Consolidation draws in more participants who are looking forward to stronger price discovery phases.

Alignment makes bullish potential stronger. Unified participation often leads to big rallies. The convergence of institutional and retail trading raises the chances of breakout momentum. It matters that people believe in each other. As participants get on the same page, breakout scenarios become more likely. The whole XRP market ecosystem is becoming more optimistic.

XRP’s Calm Before the Storm: Awaiting a Major Catalyst

XRP is holding steady at around $2.88. Support is still there. The mood in the market is building up excitement for a big event in the next few weeks. The decision about the ETF in October is the main reason for the change. Results may lead to big changes, either up or down, depending on what happens.

Resistance around $3.10 is still a very important level. Getting through this could mean that the trend has changed. Traders look to the next few weeks for clear signals. Overall, there is a cautious sense of hope. The market is ready for ups and downs. Traders are still on the lookout for important events that will have a big impact on the price of XRP.