XRP Price Struggles Below $3 Support

The price of XRP has recently dropped below the important $3 mark, which has people worried about possible downward pressure. Analysts say that the inability to keep up the momentum shows that bullish sentiment is fading in the short term.

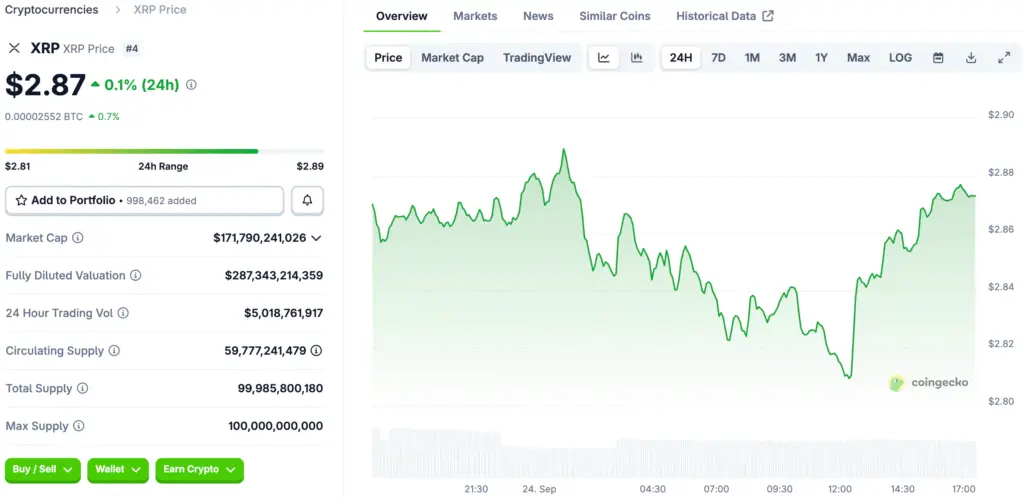

XRP is currently trading at about $2.87, which is a 5% drop in the last 24 hours. This means that there is more selling pressure. Some people in the market are still worried about a deeper correction, while others see chances to build up their positions over the long term.

Bearish Descending Triangle Formation Emerges

Technical analysts have historically seen a descending triangle pattern on the daily XRP chart as a bearish continuation setup. This structure has both downward-sloping resistance and flat horizontal support, which could mean that it will break down.

If the descending triangle closes below $2.75 every day, projections say that the price will go back down to around $2.07. In this case, there would be a downside risk of about 26% from the current trading price levels.

Technical Indicators Reinforce Bearish Bias

XRP is trading below its 50-day and 100-day simple moving averages, which adds to the bearish market conditions in the short term. Traders looking for confirmation of momentum in volatile crypto markets often use these levels as guides.

The relative strength index has dropped from 50 to 39, which means that bearish sentiment is growing and momentum is slowing down. Traders see this RSI going down as a sign that the price may keep going down unless buying pressure rises a lot.

Recommended Article: XRP Market Awaits ETF Decisions Amid Price Struggles

XRP NUPL Ratio Signals Local Price Tops as Profit-Taking Accelerates

XRP’s Net Unrealized Profit/Loss ratio has moved into the 0.5–0.6 range, which is usually where local price tops happen. These levels show that investors are taking more profits, which makes the risk of more price drops even higher.

Analysts think that sell-side pressure will continue to be a major short-term factor because more than 94% of the supply is currently profitable. Similar NUPL signals have happened before, like in 2017 and 2021, and they led to quick and big drops in price.

Analysts Keep Making Long-Term Bullish Predictions

Even though XRP has bearish patterns right now, analysts say it still has strong bullish potential on longer-term charts. Weekly charts show that the bull flag pattern is still forming, which usually means that prices will keep going up after they have stabilized.

Crypto experts say that XRP could go up more than $5 in October if the momentum comes back strongly. Long-term forecasts even go into double-digit price territory, thanks to macro bullish structures and comparisons to past cycles.

Macro Trends Point Toward Larger Gains

Analyst Egrag Crypto stressed how important it is to look at longer time frames to keep your confidence even when the market is volatile in the short term. He thinks that XRP makes an ascending triangle on the monthly chart, which means that it could break out in a big way.

Elliott Wave models show that XRP investors can still reach a cycle peak above $20. These positive long-term predictions show that more and more people believe that XRP’s overall trend is still positive, even though there are some bearish signals right now.

XRP Faces Short-Term Weakness as Indicators Suggest Corrections Ahead

Technical indicators show that XRP traders are more uncertain because they predict short-term weakness and possible corrections toward $2.07. Market conditions call for immediate caution, especially for leveraged traders who are exposed to volatile downside risks.

Still, analysts say that XRP’s overall trend is still intact, which means that it could break out and reach $15 to $27 in the next few years. When investors are thinking about risk management strategies, they need to be able to tell the difference between short-term corrections and longer-term bullish structural signals.