XRP’s Price Rejection Puts It in a Descending Triangle

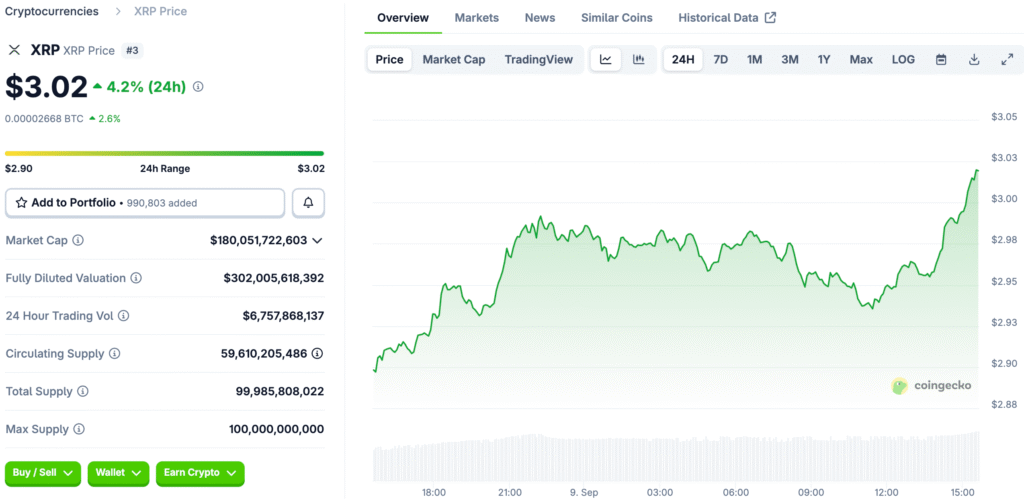

XRP shot up to $2.88, briefly testing $2.92 before being turned down again and again, which stopped the upward trend even though there were a lot of trades. Bulls defended the $2.86 support level, which helped keep things stable in the short term.

This consolidation shows the descending triangle pattern that XRP’s price structure is now following. Traders keep a close eye on the narrowing range to see which way the breakout will go.

Market Catalysts Affect Price Changes

Expectations of a Fed rate cut are driving macro flows, and there is almost no doubt that the rate will be cut by 25 basis points at the meeting on September 17. A more relaxed policy could give crypto assets more liquidity.

Trade problems between the U.S. and China also make things more unstable. XRP is still getting support from institutional inflows, even in these broader conditions.

Technical Setup Points to a Breakout

As the price stays below $2.92, the descending triangle structure gets smaller. This makes the upcoming close even more important. If prices stay above resistance, they could go up to $3.30.

If the price doesn’t stay above $2.86, it could invite more selling, which would show weakness. Indicators like RSI and MACD show that bulls are gaining momentum.

Recommended Article: XRP Price Prediction Whale Moves May Drive Ripple Past $3

Institutional Accumulation Strengthens Outlook

Reports say that whales have added more than 340 million XRP in the last few weeks, showing that there is strong support from large investors. These kinds of inflows give prices a strong base to stay strong.

Institutional behavior indicates that conviction endures despite challenges to resistance. This accumulation makes the bigger bullish thesis seem more likely.

Fed Meeting Looms Large for XRP

The Federal Reserve meeting on September 17 is likely to lead to policy changes that will have a big effect on liquidity. A confirmed rate cut would be good for risky assets like XRP.

Any difference from what people expect could have a big effect on crypto sentiment. Traders are getting ready for volatility during this time.

ETF Rulings Could Transform Market

The SEC’s October decisions on spot XRP ETF applications are still a big reason for the rise. Approval could open the door for structural inflows from traditional investment vehicles.

Delays or rejections could make people less hopeful, which would keep resistance levels near $3. Traders keep an eye on these decisions as possible turning points.

XRP Awaits Breakout as Speculation Heats Up

Retail traders are back as speculation picks up, which makes alt season cycles more likely. XRP is still a key asset in these changes.

Consolidation that lasts near support creates a base for bullish growth. Breakouts above $3 would confirm the next step up.