The Crypto Market Is Shifting

This year, investors in the cryptocurrency market are acting very differently. While investors are now moving away from traditional stories and toward DeFi projects that are very useful. This is a clear sign that the market is shifting. These big companies are putting new ideas ahead of old stories.

This strong difference shows a new trend in the market. Decentralized innovation and institutional-grade security can now work together. This is a big change for the whole ecosystem. This change is a big step forward for the future.

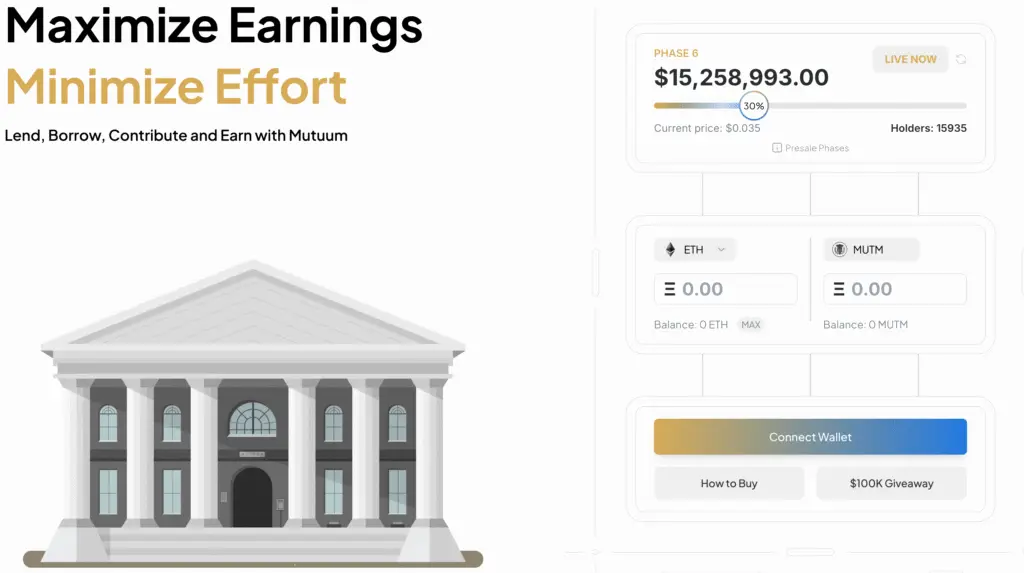

Mutuum Finance’s Presale Success

In its presale, Mutuum Finance has already raised more than $15.15 million. This is a clear sign that it is doing very well in the market. The project has also gotten more than 15,800 investors. This momentum is very impressive and shows that there is a lot of demand.

There is a clear plan for the project, and the price will go up in the next phase. This gives a lot of people a very strong reason to do something. One of the main reasons it works so well is the dual-lending framework. It brings together two very different models. This fills in a big gap between traditional finance and DeFi.

The SEC’s Decision and XRP’s New Status

The SEC’s decision to change the classification of XRP has helped it a lot. This has brought in a lot of new money and big companies into the ecosystem. The token’s technical benefits also make it a new option for sending money. This is a great way to use the token.

But its potential for ROI is still limited by its status as a new utility token. The price targets are a lot lower than those of some other projects. A lot of investors don’t like this about it. There are limits to how appealing the institution is.

Recommended Article: XRP Rallies as Mutuum Finance Gains Momentum

The Strategic DeFi Security of Mutuum Finance

One of the main reasons people like MUTM is that it has institutional-grade security. CertiK gives the project a very high trust score. A lot of people trust this blockchain auditor because it is one of the best. The project also started a new program to reward people who find bugs.

These safety steps are in line with a new poll. A lot of DeFi users care more about security than yield, according to this survey. The new stablecoin that is pegged to the US dollar also makes it more appealing. This is a big reason why it did well at first.

Looking at Deflationary Tokenomics and Supply

One of the main reasons people like Mutuum Finance is because of its deflationary model. There are a lot of new buybacks and burns in the project. This makes things scarce and puts a lot of new upward pressure on the price. This is not at all like the old model.

There will always be 100 billion XRP tokens. For a lot of people, this doesn’t have any built-in way to lower prices. This is a big difference between the two projects’ tokenomics. Investors like the deflationary model a lot more.

The Multi-Chain Benefit for Mutuum Finance

Another big advantage for Mutuum Finance is its plan to expand to multiple chains. The project wants to start on a number of different blockchains. This will help it reach a lot more people. This is a very smart and well-thought-out move.

This is very different from XRP’s focus on a single chain. This makes it less flexible in a DeFi landscape that is broken up. The multi-chain method is much more adaptable and can grow much more. This is a big plus for the project.

Whales Are Choosing Mutuum Finance

More and more whale investors are choosing Mutuum Finance (MUTM) over XRP. This is a very strong sign that the DeFi disruption is the new normal. The old model is falling behind the new hybrid lending models and deflationary design. This is a big change in the market.

Projects that mix new ideas with ways to lower risk are likely to do better than old stories. Mutuum Finance is a great example of this new trend. DeFi has a very bright future.