SHIB History Echoes After Buterin Sells Meme Coins Causing Volatility

Traders were surprised again when Vitalik Buterin quickly sold off two meme coin positions, just like he did in the past when he made big moves in the market. His actions caused prices to change right away, reminding everyone how much his moves affect speculative assets.

The Ethereum co-founder’s wallet showed sales of Puppies and ERC20 tokens, which made meme coin markets more volatile. Analysts quickly drew parallels between these actions and past SHIB events, which led to a lot of talk and caution among traders.

Meme Token Sales Reignite Historical Comparisons

Onchain Lens confirmed that Buterin sold 150 billion Puppies tokens for 28.58 ETH and turned 1 billion ERC20 tokens into cash. Even though these sales were small compared to Ethereum’s size, they had a huge symbolic impact that made investors less sure of themselves.

After the trades, ERC20 prices fell by 70%, and Puppies came under fire from different trading groups. These strong reactions were similar to those seen in the past when Buterin was involved, which added to his reputation for causing volatility.

Traders Recall The Shiba Inu 2021 Donation Saga

People quickly compared the situation to Buterin’s famous Shiba Inu episode in 2021, when he got a lot of SHIB. He didn’t hold on to it; instead, he gave a large part of it to India’s COVID-19 relief, which had a huge effect on SHIB’s supply dynamics in a way that no one saw coming.

This donation shocked the crypto community and at the same time made SHIB more well-known, turning it into a meme token that people all over the world know about. Traders remember how that one move sent ripples through the market, changing SHIB’s famous bull run.

Recommended Article: Shiba Inu Poised for Rally Despite Shibarium Concerns

Symbolic Actions Create Outsized Market Impact

Even though these recent trades were for smaller amounts, they still had a big effect on traders’ minds. Buterin’s reputation means that every move he makes with his wallet has bigger effects on meme coin markets that are based on speculation.

People in the market often see his exits as hints about hype cycles or sustainability. This view leads to quick cascading sell-offs, showing how much more powerful symbolic actions are than just financial volume in meme token markets.

Short-Term Price Reactions Reflect Lingering Nervousness

The ERC20 token dropped 70% soon after the sales, and Puppies came under more scrutiny from traders. These reactions showed how meme markets are still very sensitive to the actions of important people, especially Ethereum’s well-known co-founder.

This nervousness is based on past events and the fact that meme coin ecosystems are not very stable. Traders know that what celebrities do can quickly change the way people speculate, which can cause prices to move in ways that are hard to predict and cause liquidity shocks.

SHIB Price Changes Are Like Past Changes

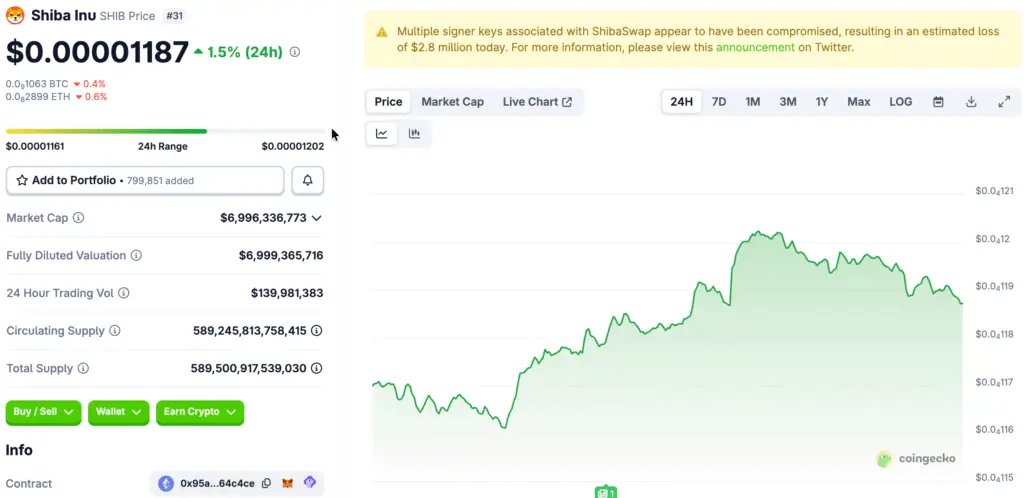

As these things happened, SHIB’s price went down a little bit, which shows that Buterin’s actions have effects on more than just the tokens he was targeting. SHIB was trading close to $0.00001174 at the time of writing, which is a 0.57% drop in the last 24 hours.

These kinds of reactions show that there are still psychological links between Buterin’s actions and SHIB’s past. Even sales that have nothing to do with him bring back memories, which makes people think he still has a big impact on meme-based cryptocurrencies around the world.

Buterin Wallet Transactions Act as Early Warnings for Meme Traders

People in the market are still on the lookout for future Buterin moves that could also shake up speculative ecosystems. His wallet transactions serve as early warning signs for traders who are able to navigate meme token markets that are very unstable.

Analysts stress being careful when famous people use meme coins. The market’s extreme sensitivity makes quick responses necessary, so participants who want to manage risk well during speculative cycles need to be well-informed.