Falling Stablecoin Share Flags Risk‑On Rotation

USDT’s dominance slipped from 4.74% to 4.37% over seven days, an 8.4% decline. Historically, falling stablecoin share indicates capital rotating into higher‑beta crypto assets seeking greater upside.

This shift coincided with broad market rallies, reinforcing the risk‑on signal. Traders often treat USDT dominance as a barometer for appetite to move from defensive positioning into active exposure.

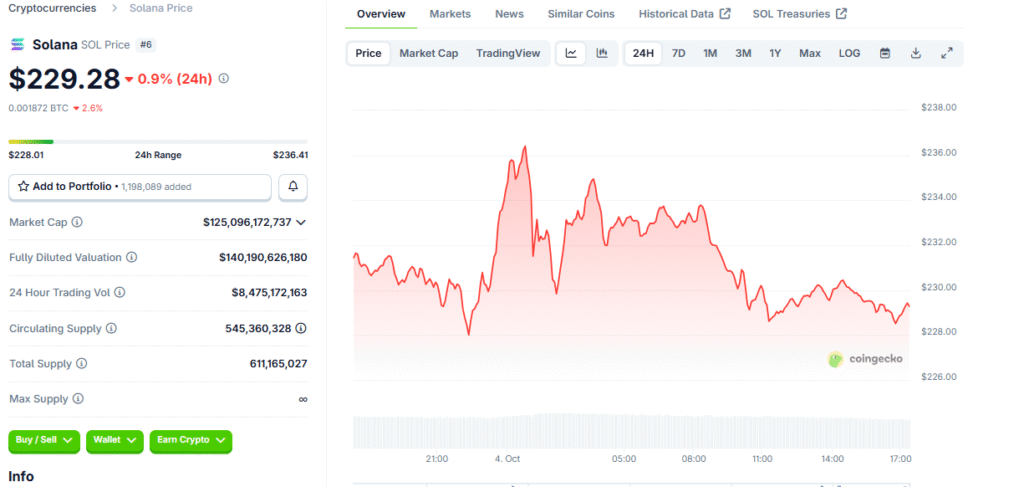

Solana Extends Run Toward $225 On Strong Bids

Solana advanced to $225 as buyers redirected capital from stablecoins into momentum leaders. Liquidity pockets above prior ranges attracted follow‑through, while dips were aggressively absorbed.

Performance leadership among large‑cap alts typically draws incremental flows. That reflexive behavior can extend trends when broader market breadth is improving.

Rotation Beneficiaries Emerge Beyond SOL

Several altcoins rallied alongside Solana as capital dispersed across narratives. Layer‑one, DeFi, and infrastructure names saw renewed interest amid the improving tape.

Early strength often concentrates in high‑liquidity assets, then filters down the risk curve. If dominance continues lower, secondary alts may capture outsized percentage moves.

Recommended Article: Solana Price Rebounds Strongly After Shutdown Fears Spark Selloff

Why USDT Dominance Matters For Timing

When investors exit stablecoins, it suggests confidence in directional exposure. Sustained declines in dominance frequently precede multi‑week advances across crypto benchmarks.

Conversely, rising dominance can foreshadow de‑risking and consolidation. Monitoring the trend helps contextualize rallies and identify when to fade or follow strength.

Confirming Signals To Validate Risk Appetite

Look for expanding spot volumes, improving market breadth, and positive funding that remains balanced. Rising open interest should trail price responsibly, avoiding overheated leverage.

Bitcoin leadership typically anchors rotations; a constructive BTC backdrop lowers tail risk for alts. Together these signals can authenticate the shift implied by dominance data.

Risks That Could Stall Rotation

Macro headlines, regulatory setbacks, or abrupt ETF flow reversals could spark a return to stablecoins. Excessive leverage buildup could also invert momentum via liquidation cascades.

Risk management remains critical during transitions, as profit‑taking can be sharp. Staggered entries and disciplined targets help navigate volatility while trends establish.

Bottom Line: Early But Encouraging Signals

The drop in USDT dominance, paired with Solana’s strength, suggests risk appetite is rebuilding. If conditions hold, altcoin breadth could expand as capital ventures further down the curve.

Traders should verify with volume, breadth, and derivatives hygiene. When aligned, rotations often carry further than consensus expects, rewarding patient participation.