XRP and Dogecoin Get Historic ETF Listings

XRP and Dogecoin will become the only US cryptocurrencies to receive spot ETF approvals, joining Bitcoin and Ethereum. Trading will begin on September 18, a day later than originally planned. This move signifies the increasing popularity of altcoins in regulated financial markets.

ETF analysts Eric Balchunas and James Seyffart confirmed the final approval, with the REX-Osprey XRP ETF trading under the ticker XRPR and the Dogecoin ETF under the symbol DOJE. Both funds were included in a joint prospectus filed with regulators.

Why These Spot ETFs Are Unique for Investors

XRP and Dogecoin ETFs, unlike Bitcoin and Ethereum spot ETFs, took less time to review due to the simpler 1940 Act framework. This legal path, designed for investment companies, provides investors with more protection, including stronger governance structures, stricter custody rules, and more open asset management.

This streamlined route made it easier to obtain approvals, avoiding issues faced by other cryptocurrency fund applicants. This framework may encourage future issuers to consider similar structures for other cryptocurrencies still awaiting regulatory approval.

Institutional Backing Drives Mainstream Accessibility

REX Shares and Osprey Funds have partnered to create ETFs, demonstrating the increasing acceptance of cryptocurrency-based investment vehicles by traditional banks. The partnership demonstrates the growing compatibility between digital assets and traditional financial institutions.

ETFs can be traded on major U.S. exchanges like the New York Stock Exchange and Nasdaq, eliminating the need for crypto wallets or exchange accounts, making it easier for investors hesitant to engage with cryptocurrency infrastructure.

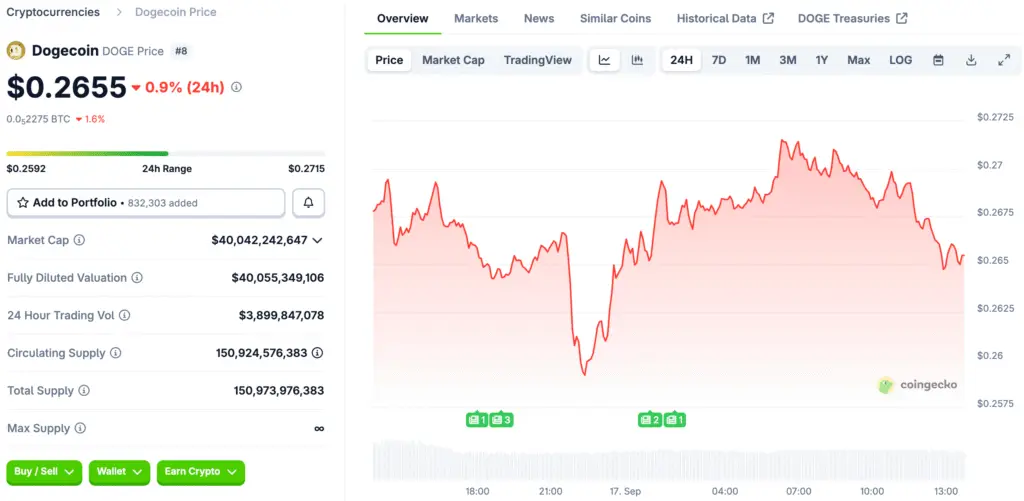

Recommended Article: Dogecoin Price Targets $0.31 as Analysts Spot Bullish Breakout

Direct Altcoin Exposure for Retail and Institutions

The XRP ETF and Dogecoin ETF will hold tokens directly, allowing investors to monitor the cryptocurrency’s market movements. They will use subsidiaries in the Cayman Islands to manage up to 25% of their assets, ensuring rules are followed. Derivatives can be used for tracking and tax treatment compliance with U.S. standards.

These regulated fund structures ensure investors can benefit from cryptocurrency price changes without impacting the performance of XRP and Dogecoin. This could encourage institutional investors to invest in altcoins.

SEC Opens Doors Beyond Bitcoin and Ethereum

The SEC’s decision to allow XRP and Dogecoin ETFs into the market indicates that Bitcoin and Ethereum are no longer the only important coins. This shift indicates regulators are becoming more comfortable with cryptocurrencies with high trading activity and market liquidity.

The development demonstrates a closer relationship between crypto markets and traditional financial oversight. Over 90 other ETF filings, including altcoins like Avalanche and Litecoin, are being considered. Analysts predict approvals in October could make alternative cryptocurrencies more accessible for institutions.

Potential Market Impact and Capital Inflows

When trading starts later this week, the XRP and Dogecoin ETFs are expected to bring in a lot of money. Analysts say that billions of dollars could go into these funds, which would make altcoins more legitimate in mainstream portfolios. This inflow could help make the market more credible and stable in liquidity.

Institutional demand for a wide range of cryptocurrency exposure is still a big reason why these approvals are happening. Because ETFs are easy to get to, investors of all kinds, from individuals to pension funds, can spread out their holdings without having to worry about custodial risks. If this many people start using it, it could make prices more stable and the market deeper in altcoin ecosystems.

Broader Adoption and Investor Confidence Rising

The launch of XRP and Dogecoin ETFs is a big step forward for the cryptocurrency markets. It stands for a time when investors are more confident in regulated digital asset investment products. Altcoins are now ready to be seen as legitimate currencies along with Bitcoin and Ethereum.

If these ETFs do well, they could set the standard for other altcoin products in U.S. markets. This could speed up the approval process for more projects and lead to new ideas in how funds are structured. The rest of the market is ready to accept altcoin investments that are safer and more open.

ETF Approvals Pave the Way for Broader Crypto Adoption

Analysts think that more altcoin ETFs will get the go-ahead in the next few months, thanks to the success of XRP and Dogecoin. These kinds of approvals will probably make the market stronger by giving investors a wider range of blockchain projects to invest in. This diversification lowers the risk of having too much of one type of cryptocurrency in a portfolio.

The ETFs for XRP and Dogecoin might make regulators think about looking at more digital assets under simpler rules. This could make it easier for people to buy altcoins while also making sure that investors are protected and that financial rules are followed. The road ahead points to a wider use of cryptocurrencies in institutional-grade investment products.