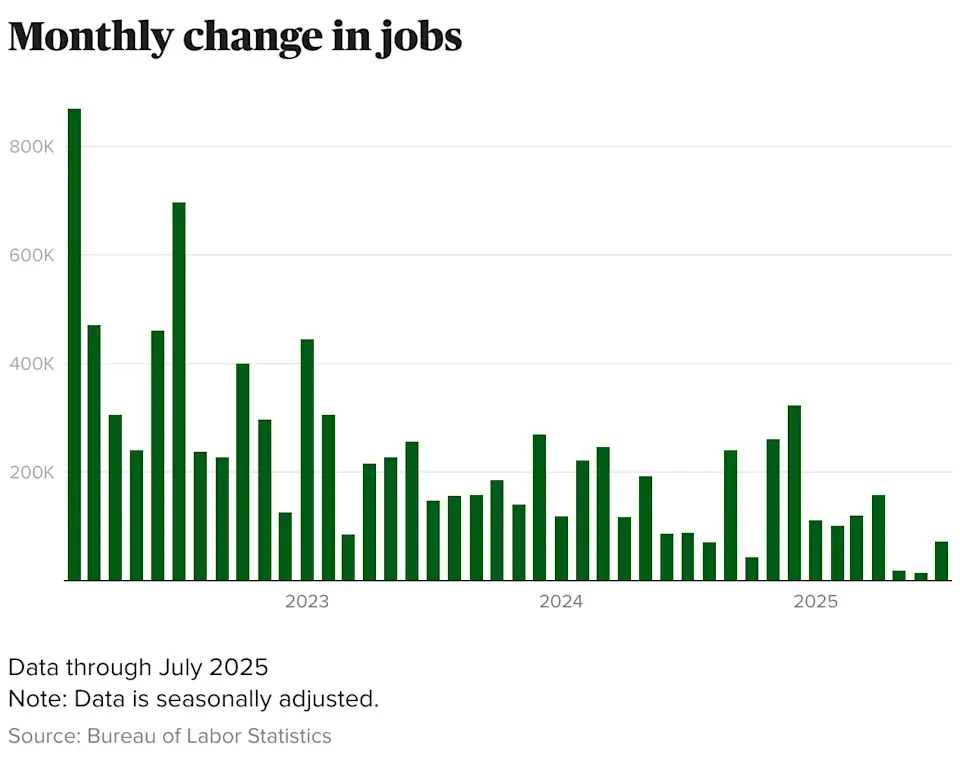

December Job Gains Signal Stability Amid Slowing Employment Growth

In December, US employers added about 50,000 jobs, which is a sign of stability after a year of slow hiring. The number was a little lower than what economists had hoped for, but it still showed that the job market was strong. December marked the end of the worst annual job growth since the pandemic recovery period began.

Even though the economy was growing more slowly, economists said that hiring didn’t stop because of political or economic instability. The data showed that the job market was balancing caution with a strong demand for workers. Analysts said that things were steady but not too busy as 2026 began.

Source: Yahoo

Revised Data Underscores Softness In Late 2025 Hiring Trends

Changes to the payroll data for October and November showed that hiring was even weaker than what federal statisticians had thought before. The combined changes took away about 76,000 jobs from earlier counts. The long government shutdown in October made it very hard to measure the job market.

These downward changes made people even more worried that things slowed down more quickly in the last three months of 2025. Economists stressed that problems with collecting data made it harder to understand what the real job market was like. But the overall trend still pointed to a drop in demand for workers.

Unemployment Rate Eases As Participation Remains Cautious

In December, the national unemployment rate dropped to 4.4%, down from a four-year high. This drop meant that there were fewer layoffs, not that there were more jobs being created. People were still careful about joining the labor force because the economy was uncertain.

Analysts called the situation “no hire, no fire,” which means that there wasn’t much hiring or firing going on. Employers seemed hesitant to hire a lot of new workers while also avoiding making big cuts to their current staff. This balance helped the economy stabilize slowly instead of quickly.

Recommended Article: BOJ Holds Steady Economic Outlook Across Japan’s Regions

Trump Administration Highlights Growth Amid Labor Market Slowdown

Since taking office again, President Donald Trump has talked a lot about how the economy is growing, using strong third quarter growth numbers as an example. However, data from the labor market showed that job growth was much slower than in previous years. The number of people hired in 2025 was much lower than in 2024.

Critics said that the administration’s story about growth didn’t match up with slow job growth and rising living costs. Supporters said that stable jobs were more important than quick growth. The difference sparked political debate about how to manage the economy as we head into 2026.

White House Faces Scrutiny Over Early Jobs Data Disclosure

The White House got a lot of bad press when the president shared job data before it was officially released. People who saw the move said it was an unusual break from long-standing rules for handling economic data. Later, officials admitted that they had accidentally made public information that had already been released.

The administration said it was looking into the rules that govern sensitive economic data. Lawmakers were worried about how this would affect openness and fairness in the market. The event made an already closely watched employment report even more politically charged.

Federal Reserve Weighs Policy Amid Mixed Labor Signals

At their next policy meeting, officials from the Federal Reserve are likely to look at employment data from December. Interest rates are still between 3.5% and 3.75% right now. It seems that policymakers don’t all agree on whether more cuts are needed.

Some officials want to keep rates the same because inflation risks are still high and job growth is slow. Some people say that easing could help keep the job market going into 2026. Minutes from recent meetings showed that there was a lot of disagreement within the organization about the best way to move forward.

Outlook For 2026 Hinges On Confidence And Policy Alignment

Economists think that how the job market will change in 2026 will depend a lot on how confident people are and how well policies work together. If inflation stays stable, cautious rate cuts could help employment by making it easier to find work. But easing too soon could cause prices to rise again in all consumer markets.

In the end, the report from December showed that the economy was strong but not growing, with no signs of a crisis or a boom. Businesses, workers, and lawmakers will have to find a way to balance a lot of things in the future. In the coming year, success may be more about long-term stability than quick growth.