Sora Ventures Targets Bitcoin Treasury Growth

Sora Ventures has said that they want to raise $1 billion for a Bitcoin treasury fund in Asia. The project shows that more and more institutions in the area want Bitcoin.

Partners put in $200 million to start the fund, and they plan to put in another $800 million in the next six months. This money will be used to build up large treasury holdings.

A First for Asia in Bitcoin Treasuries

Sora says that this is the first time Asia has promised a billion dollars to Bitcoin treasuries. The company thinks this fund is a big step toward more institutions using it.

Luke Liu, a partner at Sora, stressed that this effort will create a network of Bitcoin treasury companies. He also said that Asia is now ready to compete with Western markets.

How to Stand Out from Other Bitcoin Companies

The fund will be different from other companies, like Metaplanet, which already has more than $2.2 billion in Bitcoin. Sora’s fund will centralize institutional capital, which is different from firms with only one balance sheet.

This pooled money will help existing treasury firms and encourage the growth of new ones all over the world. The goal is to get more people around the world to use Bitcoin, not just in Asia.

Recommended Article: Bitcoin Market Cools Key Price Level To Watch

Institutional Interest Expands in Asia

Jason Fang, the founder of Sora, said that more and more people around the world are interested in Bitcoin treasuries. He did say, though, that Asian efforts have not been as coordinated as those in the U.S. and Europe.

He said that this new fund brings together money from different regions into a single global effort. This shows that people are becoming more confident in Bitcoin as a strategic reserve asset.

Global Market Comparisons Highlight Gap

More and more institutions in the US and EU are using Bitcoin for treasury purposes. More than 3.7 million BTC are now held by more than 300 people.

Even though Asia has been a leader in blockchain technology, it has fallen behind. Sora Ventures thinks that its new fund can help close this gap and make Asia more important in the crypto economy.

Possible Effects on Bitcoin Price and Use

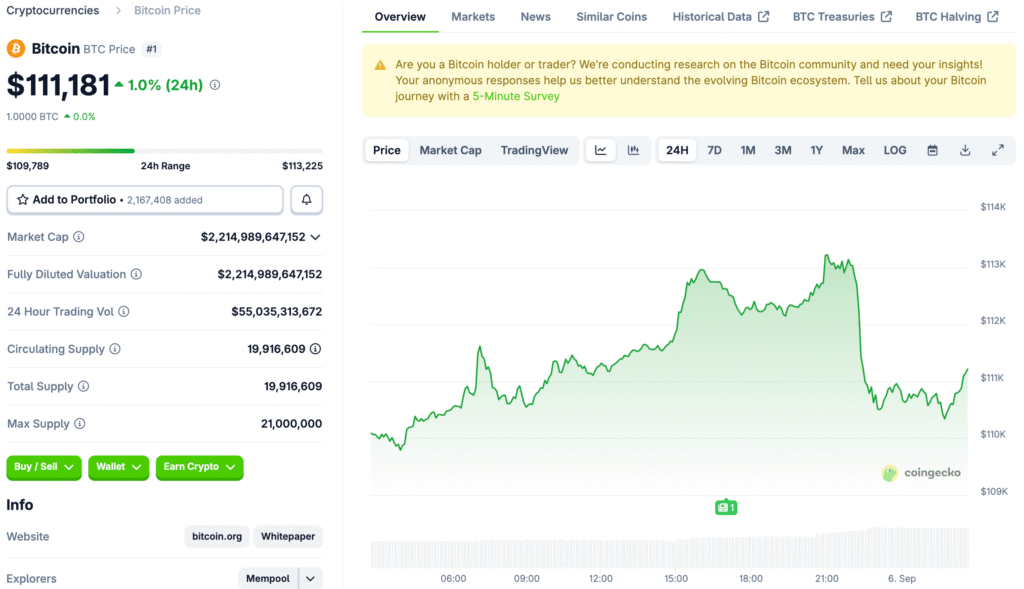

The news comes out when Bitcoin is trading above $110,000, which shows that the market is moving quickly. Investments in the Treasury could help keep demand for Bitcoin steady.

Big commitments like this can make supply tighter and maybe even raise prices. Analysts think that institutional capital flows will affect the next stage of Bitcoin’s growth.

Asia’s Part in the Future of Bitcoin Treasuries

Sora’s billion-dollar plan makes Asia a major player in the future of Bitcoin in institutions. If the region’s efforts were brought together, it could compete with the West in adoption.

If it works, the project could get more businesses and governments to think about Bitcoin. This could be the start of a new global treasury standard.