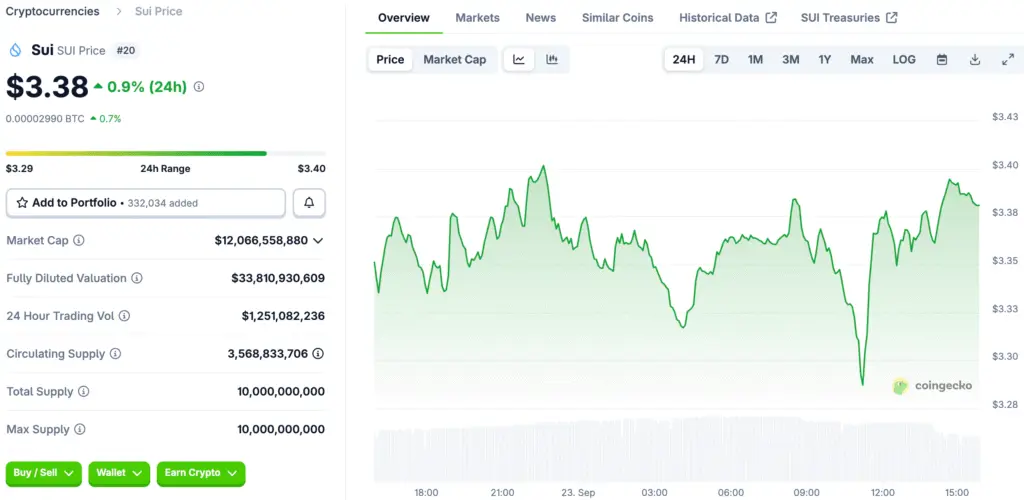

Sui Holds Important Support Level at $3.20

Sui has stayed above the $3.20 level, which makes bullish traders more sure of themselves. This level has drawn buyers many times, which shows that the market is very strong. Technical indicators show that momentum is building toward higher levels. If volume rises significantly near support zones, traders expect more buying pressure. This makes it more likely that bullish sentiment will last across exchanges.

Traders say that this defense is key to keeping the upside potential alive. If the price drops below $3.00, it could change the bullish mood. For now, people in the market are still focused on consolidation, staying steady. Analysts say that if support isn’t maintained, it could lead to a chain reaction of liquidations that puts pressure on price and pushes it into a broader bearish phase across multiple timeframes.

Ascending Triangle Signals Bullish Setup

There is an ascending triangle pattern forming on the daily chart. Higher lows mean that buyers are consistently active, but resistance stops progress near $3.90–$4.50. This technical structure often comes before the price goes up again.

Market experts say that a confirmed breakout above resistance could speed up the move toward $4.50. The pattern shows accumulation phases, when demand is greater than selling pressure, which causes prices to rise over time.

Risk Management Centers on the $3.00 Level

Analysts stress how important it is to control risk when the market is unstable. If it breaks below $3.00, it could change people’s minds from bullish to neutral or bearish. Traders are told to use stop-loss protections.

Defending $3.20 keeps buyers going. Every time this level has been tested, confidence has grown. Analysts say that disciplined strategies will help lower risk when things are unstable.

Recommended Article: Sui Price Holds Strong as $10 Breakout Rally Comes Into View

Trading Plan for Short-Term Moves

Traders think that $3.20 to $3.30 is the best place to enter. This area is a good place to be near important support. The setup gives active participants good chances to make money with low risk.

Resistance levels are $4.00 and $4.50, which are in line with previous levels where traders took profits. Analysts stress the importance of sticking to strict exit plans. These strategies protect capital while maximizing potential returns.

Sui Traders Eye Volumes and China’s Stablecoin for Next Big Move

People in the market are still cautiously optimistic about Sui. Daily trading volumes show that people are very interested in all exchanges. Analysts say that bullish setups often come with more people getting involved.

Momentum may be affected by changes in the broader market, such as China’s new stablecoin developments. Cross-border flows could make people more positive about altcoins, which would help Sui even more. Traders are still keeping an eye on global events.

Analysts Think There Is a Chance of a Breakout

If bullish conditions hold, analysts say there could be a breakout. Targets go beyond $4.50, depending on how the market feels and how stable it is. This outlook depends on keeping the ascending triangle shape going.

Similar events in the past show that patterns like these often lead to long rallies. If volume surges confirm it, Sui could reach new highs. Given how the market is right now, investors think this could happen.

Sui’s Future Hinges on $3.20 Support and $4.50 Resistance Levels

Sui’s future depends on holding on to $3.20 support and breaking through $4.50 resistance. These zones set the token’s short-term outlook. Traders are still keeping a close eye on things to see if there is a breakout.

Analysts stress the importance of finding a balance between being hopeful and being careful. There is a chance for upside, but there are still risks of volatility. People who work in the market are told to put discipline first when they set themselves up for possible gains.