SUI Holds Key $3.30 Support for Potential Rally

Sui has held strong support around $3.30, which shows that traders and investors are very interested in buying. In the past, this level has been a springboard for bullish price movements, which gives the current technical structure more confidence.

Analysts say that the fact that this support zone has been tested many times shows that buyers are building up. A strong base around $3.30 often makes it easier for prices to go up, especially when there is steady trading volume and a good mood in the market.

Ascending Triangle Pattern Points to Breakout

An ascending triangle is forming, with resistance between $3.90 and $4.50, according to technical analysis. Rising lows show that buyers are slowly coming in, which is building pressure for a big breakout.

This pattern has happened before big price increases, especially in assets with strong fundamentals like Sui. For short-term traders, this formation is very important because it makes it more likely that a breakout will happen.

Target Levels: $4.00 and $4.50 Resistance Zones

If support holds, traders are keeping an eye on $4.00 as the first breakout point and $4.50 as the second resistance point. These goals are in line with the upper limits of the ascending triangle pattern, which shows that the market is clearly bullish.

Historical patterns show that setups like this often lead to big price rises. A confirmed breakout above resistance levels can start moves based on momentum, which could make the token more appealing to both institutional and retail investors.

Recommended Article: SUI Price Forecast Strengthens After Key Support Test

ETF Filings Could Amplify Sui’s Upside

Several ETF filings, such as those from Canary Capital and 21Shares, could make Sui more appealing to institutions. Approval would give investors regulated access, which could speed up price growth toward double digits in the next year.

Sui’s technical advantages, like fast throughput and gasless transactions, make its ETF story stronger. If Sui gets listed, it could follow the same path as other altcoins that have been adopted by institutions, which would strengthen its position as a top blockchain platform.

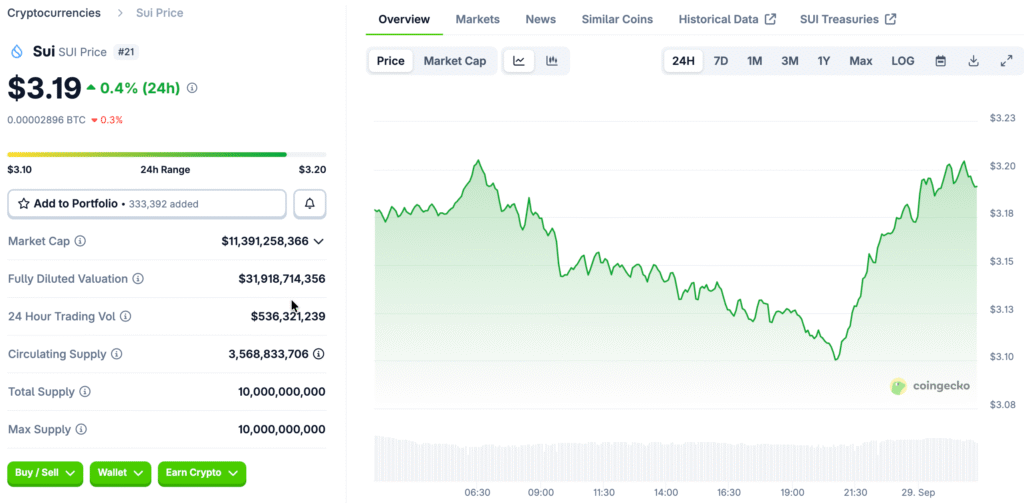

Sui Price Risks Drop to $2.80 If $3.29 Support Level Fails to Hold Firm

Even though there are signs that the stock will go up, Sui is under pressure to short-sell, which amounts to about $31 million. This cautious approach is a result of the uncertainty in the broader market, which could affect short-term price behavior even though the technical fundamentals are strong.

If the price drops below $3.29, it could drop even further to $2.80, which would be a risk for the downside. However, if the overall mood gets better, strong support zones and bullish structures may stop these kinds of moves.

Macro Market Context Shapes Price Action

Sui’s path is affected by changes in the larger crypto market. Bitcoin and Ethereum corrections have caused some short-term problems, but Sui’s network growth shows that the fundamentals are strong enough to fight against bearish macro trends.

Key performance indicators, like 1,632 TPS and $143 billion in DEX volume, show that the network is very strong. These kinds of numbers support long-term bullish projections, even when the market is volatile in the short term.

SUI Reaches Critical Juncture as Technical and Fundamental Factors Align

Sui is at a very important point where technical, fundamental, and regulatory factors all come together. The $3.30 support level will tell us if the bullish momentum can keep going toward the $4.50 breakout target.

Traders and investors should keep an eye on changes in ETFs, volume trends, and the overall economy. A breakout could mean the start of a new bullish leg, while a failure at support could start bigger corrections.