Solana Maintains Reputation Among Leading Blockchains

Solana, a renowned blockchain ecosystem, is gaining popularity due to its speed, scalability, and business use. Despite recent rallies, momentum has slowed down, and prices have held steady at around $219.

Analysts predict that the market will continue to consolidate unless a bullish breakthrough of resistance and higher targets occurs. Institutional inflows may help maintain stability, but there is a possibility of retracements. New projects like Mutuum Finance are attracting more attention for big returns.

Price Outlook Suggests Gradual Gains for Solana

Unless Solana breaks through the resistance between $245 and $250, technical indicators say that consolidation will continue. If SOL breaks out for real, it could go up to $300, but market conditions and institutional flows are still very important. Without catalysts, Solana could stay stuck in its current range.

Analysts say that there is support near $210, which could act as a floor for retracements if bearish sentiment grows stronger. So, Solana has steady performance, but it doesn’t have the huge upside potential that it did in earlier growth phases. Even though there aren’t many short-term growth opportunities, investors who want long-term reliability may still prefer Solana.

Mutuum Finance Presale Attracts Significant Momentum

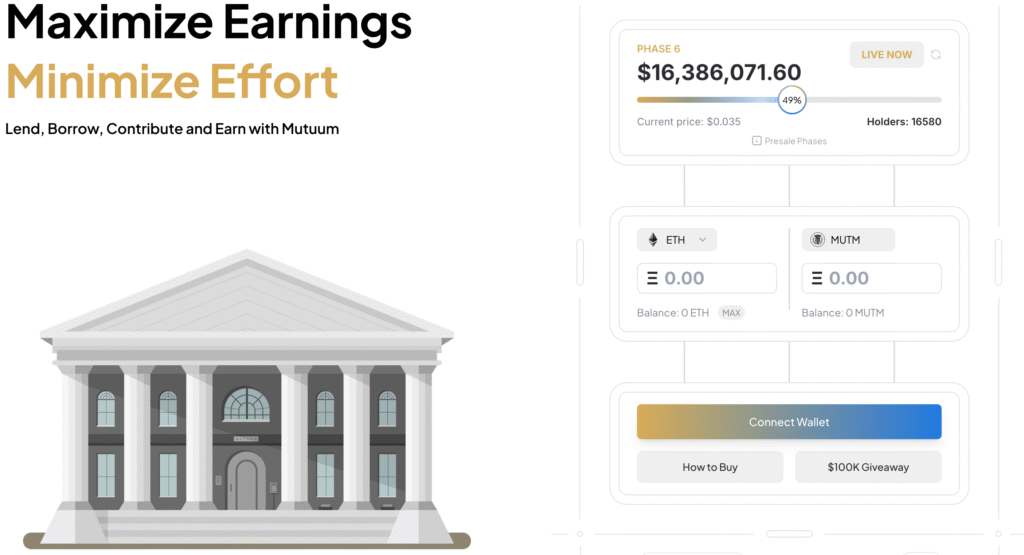

Mutuum Finance’s Stage 6 presale has begun, raising $16.3 million with tokens costing $0.035. Over 16,570 investors participated, indicating growing confidence in the protocol’s lending and borrowing methods.

MUTM is a closely watched presale in decentralized finance due to its adoption wave. The protocol offers advanced features for managing collateral and risk, ensuring user safety and efficiency in unstable market conditions. This presale interest indicates a strong chance of growth once the product is released.

Recommended Article: Warren vs Binance: Mutuum Finance Gains Investor Confidence

Innovative Risk Management Strengthens Protocol Appeal

To keep prices accurate in a volatile market, Mutuum Finance uses liquidity hedging, stablecoin strategies, and Chainlink oracles. Its system is reliable because it uses fallback oracle modes, composite data feeds, and decentralized exchange time-weighted averages. These protections make the system more stable and lower the risk for everyone involved.

Stable assets back LTV ratios, and reserve factors spread out risk. This makes sure that lending practices are sustainable and that the risks of liquidation are as low as possible in unstable situations. MUTM appeals to cautious investors who are new to decentralized finance by focusing on security and innovation.

Community Incentives Drive Early Adoption Success

Mutuum Finance is giving away $100,000 to ten early participants, each of whom will get $10,000. This will increase presale engagement and investor interest. This marketing campaign shows that the project puts the community first by giving early supporters real benefits. These kinds of incentives get people from all over the world to take part in the presale stages.

MUTM is more than just promotions; it also focuses on long-term lending structures that find a balance between managing risk and making the most of capital. Reserve multipliers and protective buffers make sure that participants get the best returns without too much risk. These features work together to build trust and speed up the rate of adoption.

Long-Term Protocol Development Enhances MUTM Potential

The roadmap includes algorithms that make stability and interest rates better, which makes capital more efficient in both lending and borrowing markets. These tools make things more sustainable in the long term, making sure they work well even when things are volatile. These kinds of designs make investors feel more sure.

In the competitive DeFi space, Mutuum Finance’s protocol development stands out because it focuses on resilience and growth. MUTM wants to build long-term adoption beyond speculative presale demand by putting user safety and efficiency first. Its new design makes it easy for people to use.

Comparative Advantage of MUTM Over Solana

Solana is a stable and growing investment option for cautious investors seeking reliable long-term performance. However, MUTM Finance has significant upside potential and high presale prices, making it more trustworthy than speculative presales.

MUTM’s integration with Chainlink oracles and advanced collateral systems makes it more trustworthy. Investors see Stage 6 tokens as a way to participate in the blockchain market, making MUTM a promising growth opportunity compared to well-known blockchain leaders like Solana.

Mutuum Finance Set Up for Huge Growth

MUTM is worth $0.035, which is a lot more than Solana’s $219, so even small investments can grow a lot. If certain goals are met, analysts say that a $300 investment could grow to $15,000, which shows how big the opportunity is. This potential is bigger than Solana’s steady outlook.

Mutuum Finance seems ready to take on established players because it has a lot of interest in its presale, new features, and community incentives. Solana is still a good investment, but MUTM has a lot more growth potential for investors who are willing to take risks. Together, they give you a way to balance stability with big gains.