Solana Treasury Debuts Amid Market Volatility

DeFi Development Corp. and Fragmetric Labs have opened the first Solana Digital Asset Treasury in South Korea. The move is similar to earlier treasury strategies used with Bitcoin and Ethereum, which gives Solana more reasons to be adopted. Traders are now guessing that this move could push Solana back above $250, even though it has been going down lately.

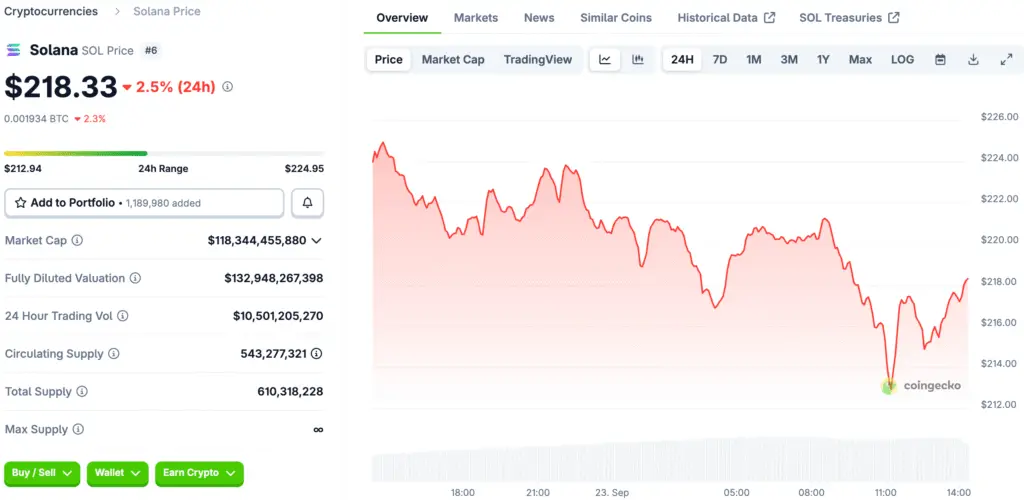

Solana was trading for about $221 at the time of writing, after a market-wide sell-off. Even though it has lost value, the token is still up more than 50% this year. Analysts say that treasury initiatives provide long-term support by making exposure more common and increasing demand in markets around the world.

South Korea Chosen for Strategic Expansion

Solana’s treasury debut is centered on South Korea because of its lively crypto ecosystem. The country’s clear rules and high level of retail participation make it a good place for institutional projects. Some analysts think that demand in Asia could make Solana’s global liquidity profile even better.

DFDV and Fragmetric will buy a local public company and give it a new name so they can manage Solana’s assets. Fragmetric will be in charge of the management structure, and DFDV will get equity stakes. This partnership could help more people use Solana and make it more well-known in Asia’s rapidly changing digital asset markets.

DeFi Development Corp Strengthens Position

DeFi Development Corp. already has more than 2 million SOL, which makes it one of the biggest public Solana treasuries. Its holdings have had a big effect on its Nasdaq-listed share price, which went up when Solana’s prices went up. The company combines Solana staking yields with money from real estate to make its growth model more diverse.

Shareholders have praised the treasury’s plan to grow as a step in the right direction. DFDV strengthens its balance sheet and boosts confidence in Solana’s long-term growth by using its treasury reserves. Market participants think that its treasury playbook will lead to more institutions using it.

Recommended Article: Solana Co-Founder Warns Bitcoin Must Upgrade for Quantum Risk

Fragmetric Labs Innovates With Liquid Staking

Fragmetric Labs is bringing its knowledge of liquidity restaking to the treasury project. The company has created tools to make yield distribution more efficient, and it manages more than $96 million in assets. This knowledge will help the new treasury get the most out of its investments while keeping demand for Solana high.

The partnership shows how asset management and blockchain infrastructure are coming together. Solana’s ecosystem gets a powerful new driver when Fragmetric’s restaking innovation is combined with DFDV’s public market reach. Analysts think that this synergy will help long-term strategies for collecting tokens.

Traders Monitor Technical Resistance at $250

Traders in the market are still paying attention to Solana’s technical resistance level of around $250. A close above this level is seen as very important for bullish momentum. If it breaks through resistance, it could go up to $300 in the next three months.

Sentiment on perpetual exchanges is still positive, and Binance’s long-to-short ratio is in favor of buyers. Spot market inflows also point to accumulation at lower prices. Traders say that these signals show that people are becoming more sure, even though prices are going up and down in the short term.

Broader Market Influences Remain Key

Solana’s future is still being shaped by things outside of its control, like how well Bitcoin is doing. Analysts say that a Bitcoin recovery above $115,000 could give the market the boost it needs. For Solana to keep going up, the rest of the market needs to stay stable.

Still, Solana has strong fundamental support from South Korea’s treasury initiative. This new institutional foothold adds to the technical optimism, making a case for higher valuations that is more than one layer. Long-term investors see this as a big step forward for Solana adoption.

Solana’s Path to Higher Prices

The opening of South Korea’s first Solana treasury shows that more and more businesses trust the ecosystem. Solana’s bullish story is supported by strategic partnerships, treasury reserves, and excitement from retail investors. Market watchers think these things could help Solana get ready for its next big rally.

Even though things are still volatile, the path to $300 is still possible as long as there is enough demand. If whales and institutions support treasury accumulation, the price of Solana could go even higher. Some people even think that $500 is possible if support levels stay strong until the end of the year.