The Launch of YZY on Solana

Ye, the artist formerly known as Kanye West, has launched a new meme-based cryptocurrency, Yeezy Money (YZY), on the Solana blockchain. Announced via his X account, the project is marketed as part of a “new economy built on-chain.” Despite his previous public stance against crypto projects, Ye has integrated the YZY token into the Yeezy Money ecosystem and his online store.

The token’s debut was explosive, with its market cap surging to $3 billion within the first 40 minutes. However, this massive initial surge was followed by a sharp decline, with the value dropping to approximately $1.05 billion by the time of reporting. This rapid rise and fall is a hallmark of many celebrity-backed crypto projects that rely heavily on social media hype rather than a strong economic model.

Insider Concerns and Supply Control

The launch of YZY has raised significant concerns about transparency and market manipulation. On-chain data revealed that a staggering 94% of the token supply was initially held by insiders. One multisig wallet alone controlled 87% of the total supply before distribution, raising questions about potential unfair advantages for a select few.

Critics, including Coinbase director Conor Grogan, have highlighted the outsized influence of insiders in the token’s early distribution. This type of initial token allocation can lead to rapid price swings and make it difficult for retail investors to participate on a level playing field.

High-Profile Engagement and Volatile Trades

Despite the concerns over insider dominance, the project has drawn attention from high-profile figures in the crypto space. BitMEX co-founder Arthur Hayes and prominent whale trader James Wynn have both engaged with the token. The speculative nature of the launch led to some highly volatile and, in some cases, lucrative trades.

One single user reportedly profited $3.4 million in one trade, while another user accidentally lost $710,000 but later recovered the funds. This illustrates the high-risk, high-reward environment surrounding projects of this nature, where a few individuals can secure massive financial gains at the expense of others.

The Role of Gas Fees in the Launch

The YZY launch also highlighted the dynamics of the Solana network itself. The user who profited $3.4 million did so after spending a hefty $24,000 in Solana gas fees to prioritize their transaction. This maneuver showcases the competitive nature of the network for high-value transactions, as traders are willing to pay significant amounts to get ahead of others.

While this demonstrates the speed and efficiency of the Solana blockchain, it also brings up questions about fair access and the potential for a “pay-to-play” environment, where only those with deep pockets can truly capitalize on a token’s initial surge.

Read More: 1inch Launches Solana-EVM Cross-Chain Swaps Without Bridges

A Comparison to Other Celebrity Coins

The volatility and speculative nature of YZY have drawn comparisons to other celebrity-backed projects, such as Donald Trump’s TRUMP coin, which also saw a volatile, short-term surge. Many of these tokens lack a clear, long-term utility, relying instead on the brand power and social media influence of their creators.

While this can lead to massive initial gains, it often results in the project fading away as quickly as it appeared. The project’s initial launch mechanism, which used 25 different contract addresses to mitigate front-running, still faced criticism for the rapid liquidation of insider holdings and the token’s overall lack of real-world use.

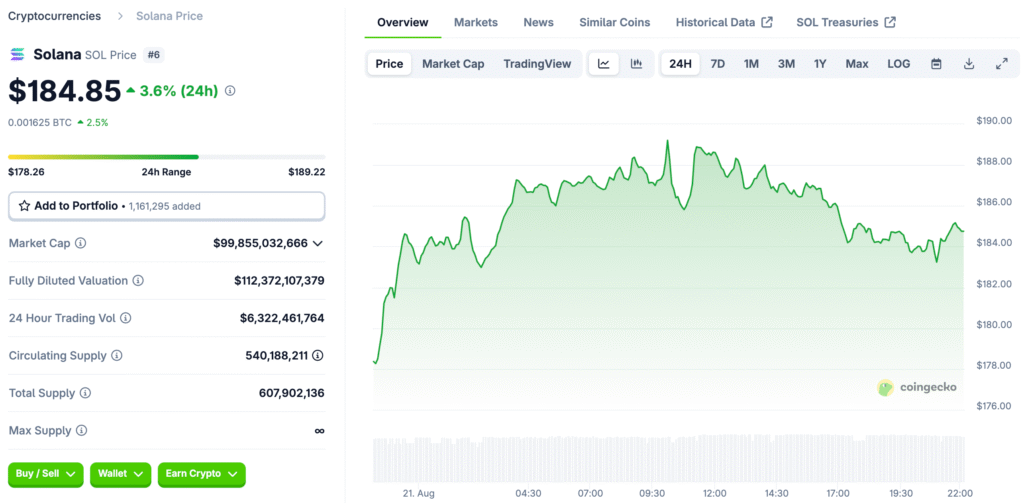

Impact on the Solana Ecosystem

The YZY launch, while volatile, also highlights the capabilities of the Solana blockchain. The network’s speed and low transaction fees (relative to networks like Ethereum) make it a popular choice for new meme coin launches. While the launch brought a wave of attention and trading volume to Solana, it also brought a degree of reputational risk, as the project’s insider-heavy allocation and lack of utility may be seen as a negative reflection on the ecosystem.

As Solana continues to grow, it will be interesting to see how the network balances its role as a fast and efficient platform with the need for fair and transparent token launches.

Celebrity Crypto: A Case Study in Hype

The case of Yeezy Money (YZY) provides a crucial case study for the future of celebrity-driven crypto projects. While they have proven to be effective at generating massive initial hype and market cap, their long-term viability remains a significant question. The lack of robust economic models, coupled with concerns over insider dominance and transparency, makes them a high-risk, high-reward investment.

As the crypto market matures, investors are increasingly looking for projects with real utility and a strong community, rather than those built on hype alone. It remains to be seen whether YZY can defy the odds and evolve into a sustainable project or if it will simply serve as a cautionary tale about the pitfalls of celebrity-backed crypto ventures.