Solana’s Price Recovery Is Impressive

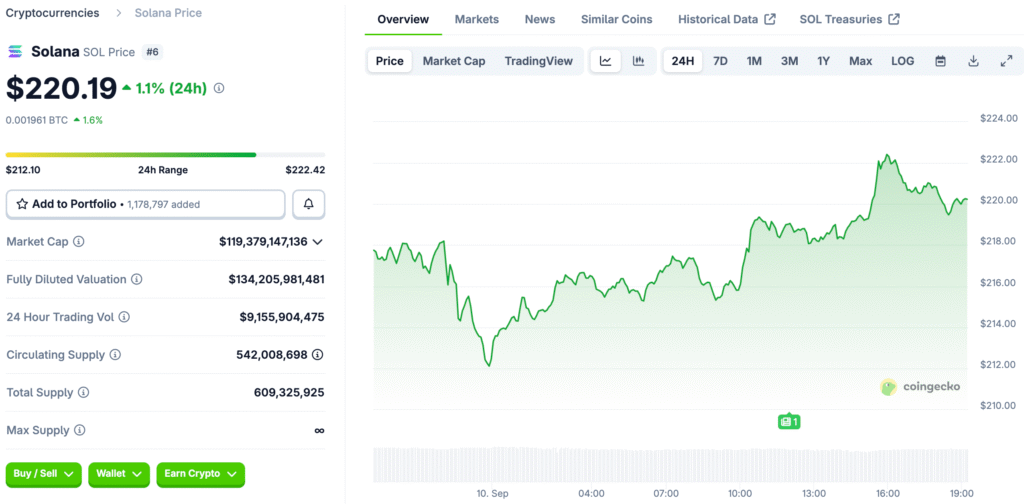

Solana rose 70% from June to August, showing that it is very strong and has a lot of bullish momentum in a tough altcoin market. Ethereum also went up. At first, Solana couldn’t break through the $220 resistance level, but it bounced back 12% after falling below $200 on September 1.

The recovery is part of a larger trend among the top cryptocurrencies, but Solana stands out because of the high level of network activity. Analysts say the fundamentals are strong. As demand grows and liquidity increases, Solana gets closer to breaking through higher resistance zones, which could lead to targets of $300.

Total Value Locked Hits New Highs

The total value locked in Solana went up by more than 57%, from $7.8 billion in June to $12.27 billion by the beginning of September. This growth is very big. TVL has gone up 31% in the last 30 days, which shows that people trust decentralized apps that run on Solana’s strong blockchain infrastructure.

Raydium, Jupiter DEX, Jito staking, and Sanctum protocol are all DeFi leaders that saw impressive growth each month. Raydium alone jumped 32%. More TVL makes things easier to use and increases liquidity, which makes developers and investors want to grow within Solana’s growing decentralized financial ecosystem.

Solana Outpaces Layer 2 Networks

Solana has a total value locked (TVL) of $12.2 billion, which is more than the total value of the Ethereum layer-2 ecosystem, which includes Base, Arbitrum, and Optimism. This makes Solana the better competitor. Ethereum is still the most popular chain, but Solana’s growth shows that the balance of power in the DeFi ecosystems is changing.

This trend shows that Solana can bring in money faster than Ethereum’s scaling solutions. More and more developers and traders are choosing Solana because it is efficient. Solana has become the second most important player in DeFi adoption after Ethereum by beating Ethereum L2s.

Recommended Article: Solana Gains Momentum With Support Strengthening Over $210

Solana Boosts the Memecoin Market

The Solana memecoin market grew by 70% overall, going from $7.3 billion in June to $12.4 billion in September. This is amazing. More people using decentralized exchanges made memecoins more popular, which drove daily trading volume up by 73% to $817.3 million.

Every week, Solana-based memecoins gain between 15% and 30% from local lows. The high demand for memecoins shows that they are being used more widely across the network. More investors are now using Solana for speculative purposes, which helps the platform stay stable in the long run by increasing liquidity and transaction volumes.

Technical Analysis Says a Rally Is Coming

Since January, Solana’s chart has been making a bullish V-shaped pattern, which means it could go back up to new price highs. After steep drops and quick recoveries, V-patterns show up. Once Solana breaks through neckline resistance, the pattern shows that there is more room for growth in a wide range of prices.

SOL is trading in a range between $200 and $240, which is an important supply-demand range. If it breaks above this zone, it will move toward $252. If the neckline is broken, analysts think Solana will try to break its all-time high of $295 and set new bullish goals.

Analysts’ Predictions Show Continued Bullishness

Experts in the market are still hopeful that Solana will soon test resistance and rise to levels close to $270 and higher. These signals from the market back up this view. Analyst Jussy said that if the $220 resistance level is broken, Solana could go up to $270, and prices could keep going up into 2025.

Another analyst, Kepin, says that the first breakout target will be $250, and then the price will rise to $290 to $300. This shows that more people agree. Their positive predictions are backed up by other technical evidence, which shows that Solana is ready to reach new highs in the next few months.

Solana’s Bullish Momentum Awaits a Breakout

SOL is now above $212 and stays above the 100-hourly simple moving average, which shows that bullish strength is still strong. The momentum indicators are still positive. A bullish trend line with support at $216 protects against price drops, lowering the risk of big short-term price corrections.

Near $220, there is some resistance, and at $228, there are stronger barriers. These are important short-term levels for investors to keep an eye on. A decisive breakout makes Solana’s bullish story even stronger. If it doesn’t work out, support around $216 will keep things stable until the next attempt to break out to higher levels.