Galaxy Digital Leads Massive Solana Purchase

Galaxy Digital has acquired over three million SOL, worth over $700 million, to fund Forward Industries, a Nasdaq-listed company, for Solana’s treasury strategy. The investment, linked to Binance and Coinbase platforms, demonstrates confidence in Solana’s potential.

Forward aims to create the world’s largest publicly traded Solana treasury. Galaxy is responsible for buying and managing transfers, while Jump Crypto and Multicoin Capital participated. This partnership signifies Solana’s growing legitimacy in the business world and emphasizes treasury diversification.

Forward Industries Grows Its Treasury Goals

Forward Industries has purchased Solana, a cryptocurrency, using funds from a recent raise to establish the world’s largest Solana treasury. Galaxy Digital will be responsible for purchasing Solana, aligning with institutional treasuries’ increasing use of altcoins.

The purchase demonstrates Solana’s potential as a treasury-grade asset, and Galaxy’s involvement makes it more legitimate. Analysts believe this move is a significant step towards more people using altcoins. The treasury expansion strategy aims to demonstrate Solana’s financial usefulness and potential future growth.

Novogratz Supports Solana’s Skills

Mike Novogratz, the CEO of Galaxy, said nice things about Solana in public. He talked about how blockchain can handle 14 billion transactions every day. Said that Solana was made for financial markets, focusing on scalability and efficiency. Comments put Solana in the lead for the next generation of on-chain capital markets platforms around the world.

Novogratz’s excitement came at the same time as SEC Chair Paul Atkins’ comments on the Project Crypto initiative. The agency wants to get more people to move their businesses to blockchain infrastructure. When the regulatory vision and Solana’s technology are in sync, the storylines come together. Analysts see synergy as a good thing for institutional confidence. Statements strongly support the idea that Solana is a one-of-a-kind asset.

Recommended Article: Bit Mining Expands Solana Holdings With 17K Token Purchase

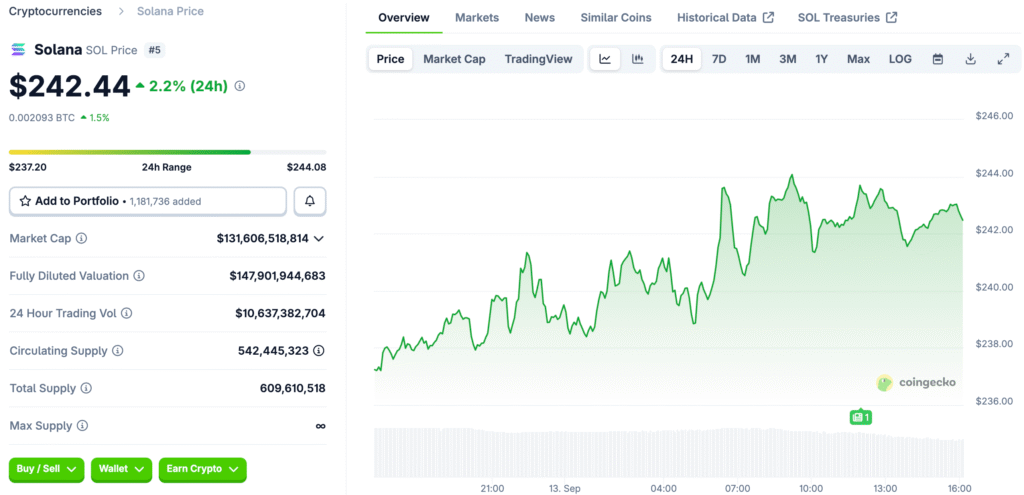

Solana Price Surges Past $240

After buying, Solana rose more than six percent every day and broke the $241 mark for the first time since January. The weekly performance showed a gain of almost 19%. Solana was the second-best cryptocurrency for weekly growth, behind only Dogecoin. The mood of the market changed to bullish.

Solana’s credibility grew when institutions backed it. The increase in trading volume showed that investors were excited. Analysts say that the upward trend is in line with whale accumulation and institutional flows. People who watch the market expect it to keep going. Price action is seen as proof that Solana is becoming a more important part of the digital asset landscape as a whole.

Institutional Endorsements Boost Confidence

Vidor Gencel, co-CEO of Solflare, said that Forward’s raise was three times the size of the largest Solana treasury that already exists. He said that transactions were a clear sign of institutional conviction. The statement made it clear that Solana had become a serious treasury asset, like Bitcoin and Ethereum in the past.

Satraj Bambra, the CEO of Rails, said the same thing, pointing to record activity across the Solana ecosystem. He said that buying things was a sign of faith in Solana’s future. Analysts say that Solana is the best institutional layer to use. Institutional validation changes how people see things, starting a cycle of adoption and investment flows that are very strong.

Upgrades and ETF Prospects Add Fuel

In addition to the treasury accumulation, Solana’s ecosystem developments give it more reasons to grow. The next Firedancer validator client is likely to make throughput much better. The Alpenglow upgrade is likely to make scalability and stability even better. Technological improvements make Solana a much stronger competitor in the blockchain space.

At the same time, the SEC is still reviewing applications for Solana ETFs. Analysts say that approval could lead to a lot of demand. ETFs would make it easier for both retail and institutional investors to get in. Approval is likely to boost the current bullish momentum. When combined with upgrades, ETFs are thought to be very important for speeding up the use of Solana in financial markets.

Solana’s Path to Becoming a Top 3 Digital Asset

Galaxy’s purchases could be a catalyst for Solana’s growth, with initial institutional buying attracting more interest. This positive feedback loop is expected, with institutional buying, ETF approval, and upgrades contributing to Solana’s growth. Analysts predict a long-term rally due to the convergence of factors.

In the near future, Solana’s price will follow ETF headlines and treasury flows, with a long-term focus on ecosystem adoption metrics. Analysts believe Solana will become one of the top three digital assets globally, with institutional trust and network upgrades being key building blocks for long-term growth.