Solana Price Rises Above Important Support

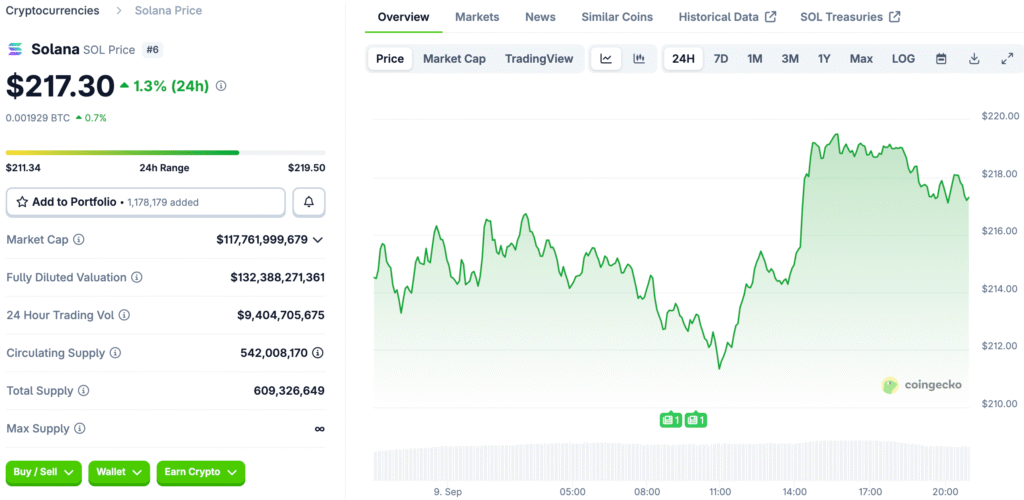

Solana keeps going strong, staying above the $210 support zone, which makes traders who expect the market to go up even more bullish. The breakout over $212 was a very important event. Analysts point to this level as proof that buying pressure is still strong and that people are still accumulating.

Market structure shows higher lows, which confirms momentum. If consolidation continues, technical indicators point to a possible rise. A lot of people in the market are getting more and more bullish. A push above the $218 resistance level could mean that the next leg up is coming. The price of Solana is still in a good place to keep going up into October.

Technical Indicators Support Bullish Continuation

The Relative Strength Index is above 60, which means that there is strong demand for Solana tokens. Traders see this reading as proof of strength. The MACD momentum is getting stronger, which could mean a golden cross. Analysts say that this kind of alignment usually means that the market will stay bullish for a long time.

Momentum backs breakout targets above the $232 resistance level. Analysts say that $244 and $250 are important short-term goals. Breaking higher could lead to big gains. Early estimates show a possible way to $300 highs. If the breakout is confirmed, it would strengthen Solana’s position as a leader in the current market cycle.

Solana Looks to Break Out Toward Big Levels

Traders see $232 as a key level of resistance. If it closes above, Solana could go up a lot, continuing its bullish trend with increasing speed. Targets higher than $250 start to look possible. Analysts point out a possible way to reach the $500 mark, and long-term estimates are even higher, close to $1,000.

The way Solana is going makes people feel good. Technical strength keeps demand strong among both institutional and retail investors. Breakouts make people think about big gains in the future. The upward momentum is still there. Investors think the market will get stronger again as catalysts come together. Solana is one of the best altcoins because it has a lot of room to grow.

Recommended Article: Solana Price Prediction Targets $320 After Nasdaq Approval

Integration with TradFi Drives Up Demand

People who work in traditional finance are starting to notice Solana. Companies use Solana in their treasuries, making it the foundation for digital asset infrastructure. Spot ETF decisions in October make people even more excited. Potential approval could be a game-changer that makes more investors around the world want to use it.

The CLARITY Act makes rules clearer, which makes people more hopeful. When compliance certainty goes up, institutional capital flows speed up. Broader integration shows that Solana is becoming more important around the world. Approval of an ETF could start a long-term rally. Involvement from TradFi adds credibility, which drives adoption cycles that strengthen Solana’s position as the market leader.

Regulatory Changes Coming Soon

The deadline for ETF approval in October is coming up fast. Traders are getting ready for a decision by taking strong positions, expecting prices to rise because of a possible catalyst. In the past, the success of ETFs has led to capital inflows. People in the market expect Solana to follow a similar path, which supports bullish expectations for its performance at the end of the year.

The U.S. CLARITY Act makes the ecosystem even more legitimate. Policy certainty lets sidelined capital come in. This growth gives long-term investors more faith in Solana. A strong mix comes from combining legislative support and ETF potential. Once the results become clearer in the regulatory landscape, investors expect a strong reaction.

Solana’s Price at a Critical Test of Key Support

Support around $212 is still very important. If this level is broken, Solana could retest $208 or lower, which would slow down momentum even though the fundamentals are still bullish. If the price drops below $204, it could go back to $200, which is a psychological support level. Analysts say that in unstable situations, it’s not a good idea to ignore the possibility of corrections.

Risk management is very important to traders. Even though things look good, there is still a chance that things could go wrong if the overall economy gets worse unexpectedly. Technical levels set the stage for short-term results. Holding support levels is important for keeping the bullish story going throughout the current cycle.

Parabolic Rally Looms for Solana as Investors Grow Hopeful

Investors are becoming more hopeful about Solana’s future. Analysts point out that a strong technical base, a strong ecosystem, and integration with TradFi are all driving momentum. Community stories stress the possibility of a parabolic rally. Traders are guessing about upside targets that are in line with ambitious forecasts of $500 and $1,000.

Adoption by institutions speeds up credibility. More support shows that Solana is a top digital asset with the potential to change markets around the world. People still feel good about it. Investors are excited about Solana’s story and expect it to grow a lot in the future as the right factors come together in the next few months.

Solana’s Bullish Path to $500 as Signals Align

The fact that Solana has stayed strong above $210 backs up the bullish story. Technical indicators and regulatory catalysts are in line, which makes people in the market more hopeful. The breakout levels at $218 and $232 are still very important. If these are cleared, the price could keep going up to $300, $500, and beyond.

Approval of ETFs and integration with TradFi could lead to a big rally. As we head into the end of the year, Solana looks like the best altcoin. Investors are cautiously hopeful. Support levels are still very important. Solana’s path suggests that the cryptocurrency market could change a lot in the next few months.