Solana Trades at Key $200 Threshold Amid Rising Institutional Interest

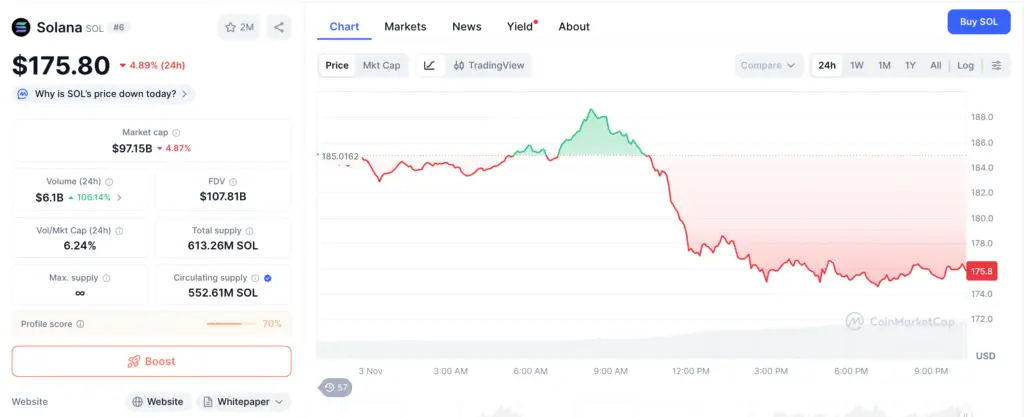

Solana (SOL) is trading near $175, placing focus on the psychologically and technically significant $200 level as institutional interest mounts. The recent launch of spot Solana ETFs and a surge in inflows highlight growing market confidence even as price momentum shows signs of strain.

Market analysts note that while SOL’s ecosystem remains robust—supported by high throughput and developer activity—the failing to firmly reclaim $200 could undermine near-term bullish sentiment. The accumulation phase now hinges on both institutional flows and price structure aligning.

ETF Inflows Bolster Solana’s Institutional Profile

The introduction of Solana-based ETFs has attracted major attention, marking a key shift in the asset’s adoption profile. OneSafe Editorial Team data shows over $199 million flowed into SOL ETFs in the week ending October 31, 2025, underlining growing investor commitment to Solana exposure.

Institutional entry often decreases spot supply and enhances market depth; however, it also ties asset performance to institutional sentiment and macro variables. SOL’s price action thus faces a dual driver: ecosystem fundamentals and fund-flow dynamics.

$200 Level Holds Both Psychological and Technical Weight

Zu0r’s chart analysis identifies the $200 price point as a strategic pivot for both retail and institutional traders. Historically, SOL has rallied above $200 but failed to hold sustained support, leading to recurrent pullbacks during consolidation phases. Achieving and maintaining this level could validate a breakout scenario and attract new layered entry points.

Technical indicators send mixed signals: while RSI and MACD suggest building strength, recent price draws show susceptibility to seller pressure in key resistance zones. Without a clear close above $200, traders warn of sideways or downward risk.

Recommended Article: Poain Expands Solana Integration as $200 Zone Draws Focus

Liquidity and Psychological Drivers Shape Market Behaviour

Trading psychology plays a key role at price thresholds such as $200—where traders often place large orders and hedge positions. Fear and greed converge, creating order-flow congestion that can delay breakout moves or cause sharp reversals. These dynamics are especially relevant in capital-intensive assets like Solana.

Liquidity depth, or the lack thereof near resistance zones, can amplify price swings. Analysts note that thinner books increase exposure to large trades and algorithm-driven shifts, making precise execution and risk management more critical for participants at this juncture.

Lessons for Startups and Ecosystem Developers

Blockchain entrepreneurs and fintech providers studying Solana’s price behavior can derive important signals about market maturation. Institutional influxes underscore the need for clear infrastructure, regulatory alignment, and ecosystem sustainability.

Startups should focus on scalability, cost-efficiency, and interoperability—the same traits that have helped Solana attract institutional flows. The SOL case illustrates how technical fundamentals, fund flows, and narrative cohesion combine to shape valuation potential.

Outlook: Breakout or Consolidation?

If Solana reclaims and closes above $200 with volume support, analysts estimate a path toward $260 and potentially higher, contingent on ecosystem catalysts. Conversely, failure to break above may result in sustained consolidation or even a retracement toward the $150-$170 band.

Investors are advised to monitor fund flows, on-chain activity, and price structure closely. As one strategist put it, “Solana’s trajectory will reflect not just technology adoption but how smoothly capital can transition into the network.”