Sharps Technology Strengthens Its Solana Strategy with Bonk

Sharps Technology, a Nasdaq-listed company, has partnered with memecoin Bonk to stake part of its Solana reserves in BonkSOL, a liquid staking token that provides both yield and liquidity. This move aligns with Sharps’ goal of generating long-term returns for shareholders and strengthening its Solana network position.

Bonk has become a cultural force for Solana, blending meme appeal with real-world decentralized finance innovation. Sharps aims to maintain competitiveness by using Solana-based staking options to make money off its Solana treasury holdings.

BonkSOL Offers New Ways to Stake

BonkSOL lets Solana holders stake their tokens and get liquid staking assets that can be used in decentralized apps. This dual benefit gives you both passive income and more involvement in the ecosystem, all without losing liquidity on DeFi platforms. Sharps thought this chance was very important for getting the most out of its growing treasury holdings.

The deal shows that more and more Solana-based treasuries are using memecoin partnerships to diversify their staking methods. Bonk, which already has almost 200,000 SOL in staked value, is still growing through partnerships with big companies. Sharps’ investment should help both its own bottom line and Bonk’s ability to be used by more people.

Sharps Technology Makes One of the Biggest Solana Treasuries

Last month, Sharps Technology said it had raised more than $400 million to greatly increase its Solana reserves. The effort put Sharps in the top tier of digital asset treasuries based on Solana holdings in the wider market. The company currently has more than two million SOL, which puts it in the same league as the best Solana-focused companies.

DeFi Development Corp., Upexi, and other companies also own about two million Solana each. Forward Industries recently joined the movement and bought more than 6.8 million Solana for almost $1.6 billion. Forward said that all of the Solana tokens it bought have already been staked to get the most out of them.

Recommended Article: Bonk Price Forecast Points To Breakout As Bulls Regain Control

Institutional Support Makes Solana’s Growth Story Stronger

Cantor Fitzgerald, ParaFi Capital, and Pantera Capital helped Sharps raise money in a private equity deal. The deal shows that institutions have a lot of faith in Solana’s long-term potential in the markets for decentralized finance and blockchain infrastructure. Sharps wants to use this support to become even more involved in cutting-edge staking solutions like BonkSOL.

Institutional involvement has become a key part of Solana’s plan to grow in markets around the world. With strong support from established funds, Solana is becoming more and more popular as a core blockchain network. Sharps’ partnership with Bonk shows how traditional banks are now using memecoins to make money from staking.

Bonk Emerges as a Solana Ecosystem Powerhouse

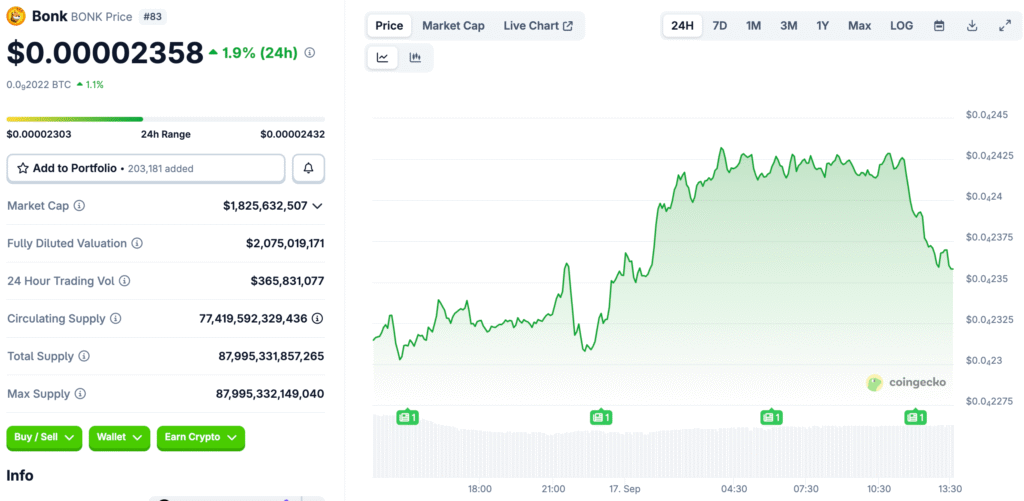

Bonk, a memecoin on the Solana blockchain, has gained popularity due to its utility-driven platforms and cultural significance in the Solana community. Currently worth $1.8 billion, Bonk fits well into decentralized finance systems and maintains high liquidity.

Despite trading 60% below its all-time high, investors continue to buy and sell at around $0.000023. BonkSOL attracts more retail and institutional stakers who want to make money without doing anything, demonstrating its strong fit in decentralized finance systems.

The Growing Importance of Memecoins in DeFi

Memecoins like Bonk and Dogwifhat are revolutionizing decentralized finance by combining cultural branding with staking mechanics. DeFi Development collaborated with Dogwifhat to create a validator and reward communities for staking.

This demonstrates the deep connection between meme-inspired tokens and blockchain financial systems. BonkSOL, a prime example, generates money and aids liquidity, making it attractive to treasury partners like Sharps. This demonstrates how memecoins are transforming treasuries in decentralized blockchain economies.

Sharps Balances Shareholder Growth and Ecosystem Participation

James Zhang, Sharps’ strategic advisor, said that the partnership is good for both the company’s bottom line and the ecosystem as a whole. He said that Bonk has always helped Solana’s cultural growth and technological progress in decentralized finance. Sharps hopes to add value for shareholders while also helping the network grow.

Sharps reduces risk and makes its portfolio more efficient by using a variety of staking strategies. Its choice shows how treasuries can make money while also getting involved in the blockchain community. BonkSOL is the way to reach these goals and make Solana’s market ecosystem even better.

Sharps’ Investment in BonkSOL Signals a Major Trend

Sharps’ investment in BonkSOL is part of a larger trend of institutions using the Solana ecosystem. Treasuries and companies are more and more looking for ways to earn interest by staking with both DeFi platforms and memecoins. This means that Solana is still gaining ground as it becomes more important in the global economy.

The fact that more treasury managers are getting involved with Bonk suggests that memecoins could become permanent parts of institutional blockchain portfolios. Other companies may follow Sharps’ lead and use similar methods to manage their digital assets. Solana’s strong community and scalable infrastructure make it look like its DeFi ecosystem is ready for more institutional involvement.