Safety Shot Inc. Partners with BONK: A Full-Scale Entry into DeFi

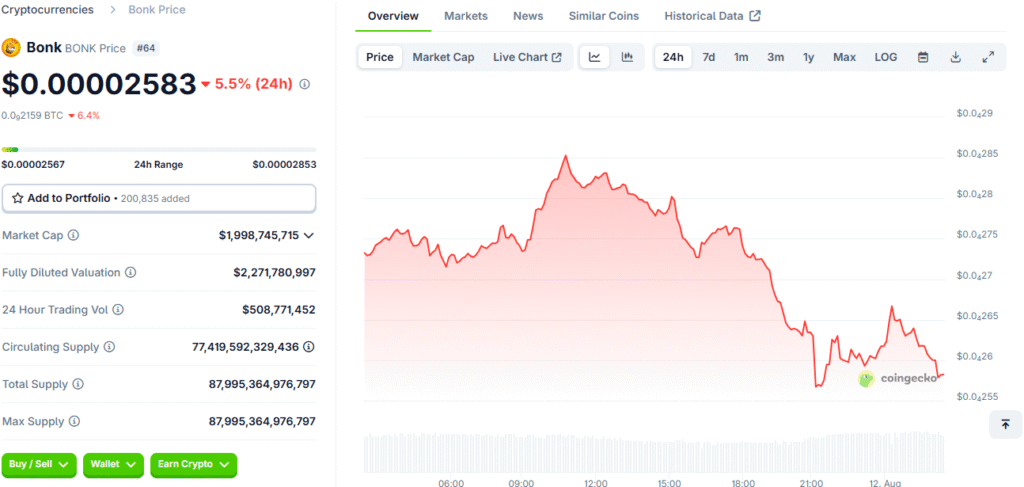

In a bold move that has captured the attention of both traditional finance and the decentralised finance (DeFi) community, Safety Shot Inc., a publicly traded NASDAQ company, has announced a significant strategic alliance. The company has formally partnered with the founding contributors of BONK, a prominent Solana-based token with a market cap exceeding $2 billion. This alliance is not a passive investment but a full-scale entry into the DeFi sector.

The core of the deal involves Safety Shot exchanging $35 million in convertible preferred shares for a $25 million stake in BONK tokens. This transaction not only marks Safety Shot’s official foray into the digital asset world but also positions it as a key player at the intersection of traditional corporate strategy and blockchain innovation. The decision is especially noteworthy given the company’s strong financial footing, which includes a healthy $15 million in cash reserves and a complete absence of debt, providing a stable foundation for this ambitious new venture.

The Strategic Rationale Behind the BONK Alliance

Safety Shot has partnered with BONK to diversify its corporate treasury and capitalize on the growing acceptance of digital assets as potential hedges and long-term value creators. The alliance aims to leverage the unique properties of the BONK token and the underlying Solana network, demonstrating the growing acceptance of digital assets as legitimate tools for corporate treasury management. By integrating BONK into Safety Shot’s balance sheet, the company aims to create new avenues for shareholder value and establish a presence in a rapidly evolving financial landscape.

Leveraging Solana’s Speed and BONK’s Deflationary Model

The choice of BONK as a partner was a deliberate and calculated one. According to Safety Shot, the primary appeal of the token lies in its technical foundation and economic model. BONK operates on the Solana network, which is renowned for its exceptional transaction speeds and low costs. This technical efficiency is a crucial factor for any institutional entity looking to engage with digital assets. Furthermore, BONK’s deflationary tokenomics model was a major draw.

A deflationary model, where tokens are systematically burnt or removed from circulation, can create scarcity and, theoretically, increase the long-term value of the asset. Safety Shot views this as a protective measure for its treasury, a hedge against the erosive effects of inflation. With nearly a million active users, BONK also offers the benefit of high liquidity and widespread adoption, making it a robust and reliable asset for institutional engagement within the DeFi ecosystem.

Direct Partnership Over Exchange Trading

One of the most telling aspects of this deal is Safety Shot’s decision to partner directly with BONK’s founding contributors rather than simply buying tokens on a public exchange. This approach highlights a sophisticated and long-term perspective. By engaging directly with the creators, Safety Shot gains a level of strategic insight and governance control that would be impossible to achieve through an indirect investment.

This direct collaboration allows the company to align its interests with the core vision and development roadmap of the BONK project. It stands in stark contrast to other corporate strategies that might rely on third-party investment channels or custodial services. This method underscores a commitment to deep integration and active participation in the Web3 space, rather than a passive, hands-off approach. It is a clear signal that Safety Shot intends to be a proactive force in the token’s development and success.

A New Blueprint for Corporate Treasury Management

Safety Shot’s strategic pivot is not an isolated event; it aligns with a broader industry trend of traditional firms exploring blockchain-based assets for treasury management. This shift reflects a growing institutional acceptance of tokenised assets as viable tools for diversification and shareholder value creation. The move serves as a potential blueprint for other publicly traded companies considering a similar path. While the company has not provided specific financial projections or timelines for its treasury strategy, choosing to emphasise long-term value over short-term gains, its approach is being watched closely. The integration of digital assets into corporate balance sheets is a nascent but rapidly developing field, and Safety Shot’s willingness to lead the charge could pave the way for a new standard in corporate financial management, where digital assets are considered as seriously as traditional stocks and bonds.

Safety Shot and BONK A Strategic Alliance for Long-Term Value

Safety Shot, a company with immense strategic potential, is navigating the volatility of the digital asset market by leveraging the long-term value of blockchain technology while managing risk. The partnership with BONK’s founders allows for a more informed and controlled entry into the space. The company plans to explore value-enhancing activities like token buybacks and staking, but specific plans remain undisclosed.

This deliberate pace and focus on long-term value creation for shareholders positions the company as a thoughtful pioneer, rather than a reckless speculator. The success of this venture could serve as a case study for established companies integrating blockchain assets into their operations.

The Synergy of TradFi and Web3 Safety Shot and BONK

This alliance represents more than just a financial transaction; it embodies the growing synergy between traditional corporate entities and the decentralised, innovative world of Web3. It highlights a future where publicly listed companies are not just observers but active participants in the token economy. Safety Shot’s partnership with BONK demonstrates that blockchain technology is no longer a niche interest but a powerful tool with practical applications for treasury management and corporate growth.

By aligning with the foundational contributors of a widely adopted token, Safety Shot has solidified its position at the vanguard of this new institutional adoption curve. The company’s trajectory will be a fascinating one to watch as it navigates the opportunities and challenges of this exciting intersection, potentially setting a new precedent for corporate innovation in the digital age.

Read More: BONK Price Analysis A Battle at Key Resistance Levels