Russia Proposes a Crypto Bank to Fight Fraud and Support Miners

Russian officials are talking about setting up a crypto bank to better oversee the system, cut down on fraud, and find new ways for the federal government to make money. Evgeny Masharov said that a regulated bank could handle settlements related to people’s accounts, making things more open and stopping illegal activities to a large extent.

Belarus recently started a service like this, which has led Russia to look into setting up similar systems for using cryptocurrency. In spite of regional restrictions, this kind of institution could also give miners legal ways to cash out their earnings.

Legal Banking Support for Russia’s Crypto Miners

The proposal shows that Russia is trying to find a balance between regulation and encouraging growth by recognizing the benefits of using cryptocurrencies while also dealing with the risks. Legalized banking support could help the mining industry run more smoothly while still meeting the goals of the country’s financial policy.

Adding crypto banking services could cut down on shadow transactions, make things more clear, and boost trust in institutions. In the end, Russia’s exploration shows a larger trend around the world toward regulated cryptocurrency integration.

Mutuum Finance Presale Raises Over Fifteen Million in Phase Six

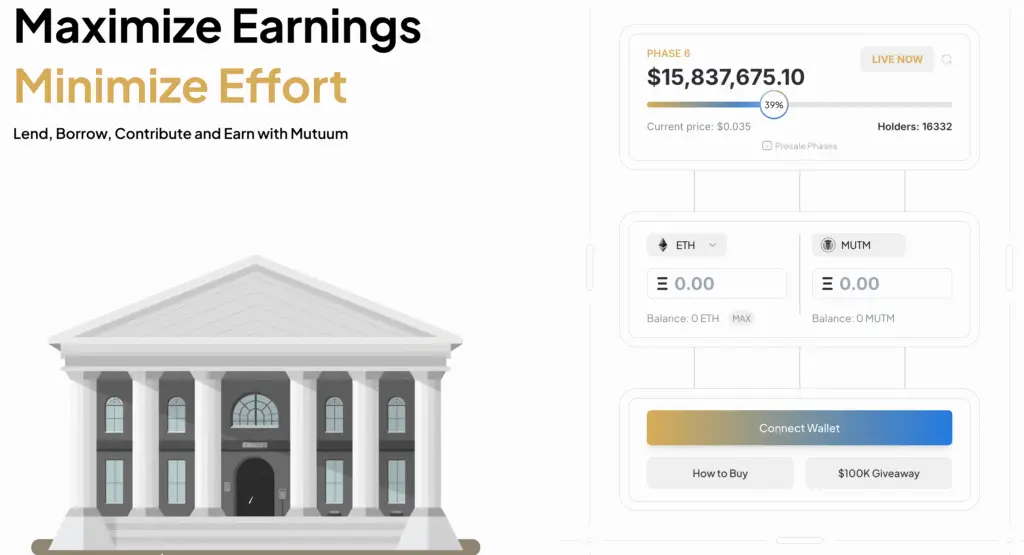

Mutuum Finance has raised $15.63 million, and more than 16,240 people have joined the presale. This shows that investors have a lot of faith in the project’s future. The price of phase six tokens, which is $0.035, is 250% higher than the initial offering price of $0.01, which shows that the momentum is strong.

The next phase will raise the price to $0.04, and the launch value is expected to be $0.06. Early buyers expect to make more than three hundred percent on their investments after the launch.

Recommended Article: Mutuum Finance Gains Ground As Cardano Stalls Below $1

CertiK Audit and Bug Bounty Reinforce Security Confidence for Mutuum Holders

Mutuum Finance just finished a CertiK audit that gave them a score of ninety-five. This showed that there were no weaknesses and that the contracts were clear across the ecosystem. A proactive bug bounty program worth $50,000 continues to improve security by encouraging researchers to take part at all levels of severity.

The program shows that Mutuum puts safety first, even when it comes to growth-focused development. Investors feel more secure knowing that protecting the ecosystem is part of the plan.

Lending Utilities Provide Flexible Yield Opportunities With Managed Risk

Mutuum offers two types of lending models: peer-to-contract and peer-to-peer. These models create a variety of safe ways to earn interest. P2C puts stablecoins into smart contracts that automatically change the yields based on how the market is doing.

P2P lets lenders and borrowers talk to each other directly, which increases the chance of getting a better return while also managing the risks that come with it. Both models need more collateral than the loan amount, which protects the loan from changes in the market.

Tokenomics Features Enhance Stability and Manage Volatility Exposure

The system sets limits on deposits and loans, which keeps exposure to very volatile assets in the lending ecosystem to a minimum. Liquidators buy collateral at a discount when thresholds are crossed, which keeps the ecosystem safe from losses due to defaults.

These mechanisms strike a balance between flexibility and controlled risk, which makes Mutuum’s design appealing to long-term investors. The protocol shows foresight by building in protections against instability.

How Mutuum Finance Is Building a Loyal Community

Community incentives include a leaderboard for the top fifty holders who get bonus tokens, which encourages investors to stay involved. Also, the $100,000 giveaway campaign gives ten winners $10,000 each, which helps more people buy during the presale.

These kinds of programs increase participation, strengthen community ties, and raise awareness of the presale even more. As protocol combines technology, tokenomics, and community rewards, investor interest keeps growing.