The Core Contradiction of ‘Mining’ XRP

A new international project, RichMiner, has entered the digital asset space, advocating for a “green cloud mining” system that they claim utilizes renewable energy sources such as wind and solar power to reduce carbon emissions. However, this assertion is met with a major red flag that casts serious doubt on the platform’s legitimacy. The central claim is that the ability to mine XRP is a fundamental technical impossibility.

Unlike cryptocurrencies like Bitcoin that rely on a proof-of-work (PoW) mining consensus, which involves computers competing to solve complex mathematical problems to validate transactions and earn rewards, the Ripple blockchain, which governs XRP, operates on a unique and distinct consensus system. All 100 billion XRP tokens were pre-minted and released at the time of its creation, meaning they were never designed to be mined. This core contradiction directly undermines the platform’s foundational technical claims and serves as the most significant warning sign for potential investors.

Unrealistic Financial Promises and Red Flags

Beyond the technical impossibility of its claims, RichMiner also makes highly dubious financial promises that are a hallmark of fraudulent schemes. The company reports offering staggering returns of nearly 47% monthly, which would translate to $4,680 on a $10,000 investment in just 30 days. Analysts and industry experts are quick to caution that such propositions are extremely likely to be indicative of a Ponzi scheme.

In this type of fraudulent operation, early investors are paid with funds collected from new investors, creating a deceptive facade of profitability that is entirely unsustainable. The scheme’s survival depends on a constant influx of new capital, and it is destined to collapse, leaving the majority of investors with a complete loss. The combination of scientifically questionable claims about mining and these unrealistic financial returns presents a clear and present danger to anyone considering investing in the platform.

Misleading Pitch on ESG and Regulation

RichMiner attempts to present itself as a legitimate and forward-thinking enterprise by strategically aligning its marketing with current industry trends. The company pitches its model as one that is compliant with the European Union’s Markets in Crypto-Assets (MiCA) regulation. This regulation is particularly relevant as it requires sustainability disclosures and aims to phase out energy-intensive crypto mining.

By promoting a “green cloud mining” model that supposedly uses renewable energy, RichMiner is cleverly trying to capitalize on the growing demand for environmentally friendly investment options. This strategic use of ESG (Environmental, Social, and Governance) trends appears to be a calculated diversion, attempting to create an illusion of compliance and ethical operation to mask the underlying technical falsehoods and financial risks of their business model.

The RichMiner Deception and ESG

RichMiner’s appeal to ESG principles is particularly potent because it taps into a very real and growing global concern about the environmental impact of the cryptocurrency industry. Public awareness has been increasing, placing significant pressure on the industry to adopt more sustainable practices. For example, a 2024 study by the University of Cambridge estimated that Bitcoin mining used more power than the entire nation of the Philippines.

Furthermore, by 2025, crypto energy consumption accounted for 0.5% of the global total. In this context, any project that claims to offer a solution to this problem, even one as technically flawed as RichMiner’s, can attract a naive and well-meaning investor base. The company exploits the genuine desire for sustainable crypto solutions to make its fraudulent pitch more compelling and believable to those who may not be technically proficient in blockchain protocols.

Capitalizing on the Demand for Sustainable Crypto

The market for sustainable crypto investments is not just a passing fad; it’s a significant financial megatrend. According to a report from BlackRock, sustainable investments in XRP and other cryptocurrencies rose by 15% in the year 2024. This trend signals that a substantial segment of investors is actively seeking opportunities that align with their ethical values, even in the crypto space.

RichMiner is actively trying to exploit this market demand by falsely claiming it offers a sustainable way to invest in XRP. By targeting a growing demographic of eco-conscious investors, the company’s misleading marketing campaign becomes highly effective. It creates a sense of trust and perceived legitimacy that can lead people to overlook the basic technical facts about XRP and its consensus mechanism.

The Unsupportable Claims of RichMiner

A defining characteristic of this project, and a primary indicator of its fraudulent nature, is a complete lack of transparency. Without a clear and verifiable explanation of how a non-minable asset like XRP is being “mined” and how such extraordinary returns are being generated, the platform’s core claims are unsupportable. The absence of publicly available information regarding the company’s team, its financial backers, or its operational history raises further serious questions.

A legitimate financial project would provide a clear paper, a public team, and a track record of operations. RichMiner provides none of these. This deliberate opacity is a major danger to investors, as it prevents them from conducting proper due diligence and understanding the true risks involved.

RichMiner: A Cautionary Tale for Investors

The controversy surrounding RichMiner serves as a powerful cautionary tale for both new and experienced crypto investors. It highlights the importance of rigorous technical due diligence, independent verification of claims, and a healthy dose of skepticism when faced with promises of outsized returns. The project combines multiple red flags, from technical impossibilities to unrealistic yields and a lack of transparency, into a single fraudulent scheme.

It also demonstrates how bad actors can leverage broader trends, like the move toward ESG principles, to create a convincing and profitable deception. In the volatile and often unregulated world of cryptocurrency, the responsibility falls on the individual investor to be vigilant and informed to avoid falling victim to such elaborate scams.

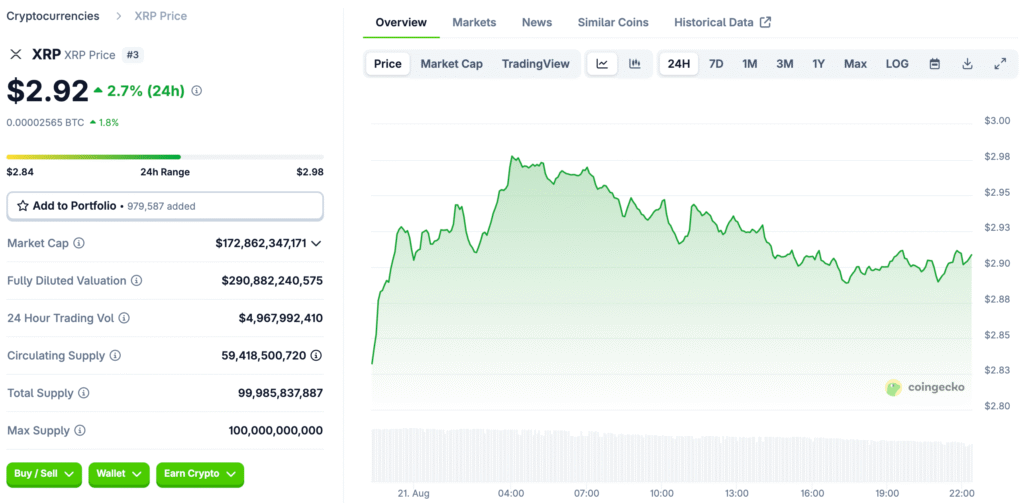

Read More: XRP Price Prediction: SEC ETF Delay Sends XRP Below $3 as Investors Brace for Volatility