Early Momentum Echoes Historical Litecoin Trends

Remittix’s recent price action is attracting serious attention from seasoned traders and analysts. The project’s chart displays consolidation patterns nearly identical to Litecoin’s early breakout stages. These formations often precede explosive rallies in high-potential crypto assets. Investors are increasingly interpreting these signals as precursors to significant upside moves.

Litecoin’s historical trajectory offers a useful blueprint for understanding Remittix’s current behavior. Before Litecoin’s legendary surge, it experienced months of tight trading ranges. These accumulation phases were marked by increasing on-chain activity and social chatter. Remittix now seems to mirror these crucial stages closely.

Market Rotation Boosts Legacy And Emerging Projects

Legacy altcoins like Litecoin are benefiting from renewed market rotation trends. ETF delays, shifting liquidity, and speculative narratives are drawing attention back to older, reliable networks. Simultaneously, newer projects such as Remittix are leveraging these shifts to gain traction quickly. Investors are diversifying between proven names and early-stage growth plays.

The combination of institutional speculation and retail momentum can be powerful. Litecoin’s ETF news triggered massive short liquidations, boosting overall market sentiment. Similar structural catalysts may develop for Remittix as listings and integrations accelerate. Strategic entry during consolidation periods often yields outsized returns when breakouts occur.

Technical Indicators Highlight Strategic Entry Points

Technical analysis reveals bullish momentum building steadily within Remittix’s structure. Moving averages indicate a strong upward bias while oscillators suggest temporary overbought zones. Experienced traders see this as a healthy reset within a broader accumulation phase. Proper timing could allow participants to maximize entry positions before large rallies commence.

Price targets between breakout resistance and near-term Fibonacci extensions provide clarity. A decisive move beyond critical resistance zones may unlock rapid price appreciation. Traders carefully monitor order book dynamics for signs of incoming liquidity waves. Breakout confirmation remains a key trigger for institutional inflows.

Adoption Metrics Strengthen Bullish Narrative

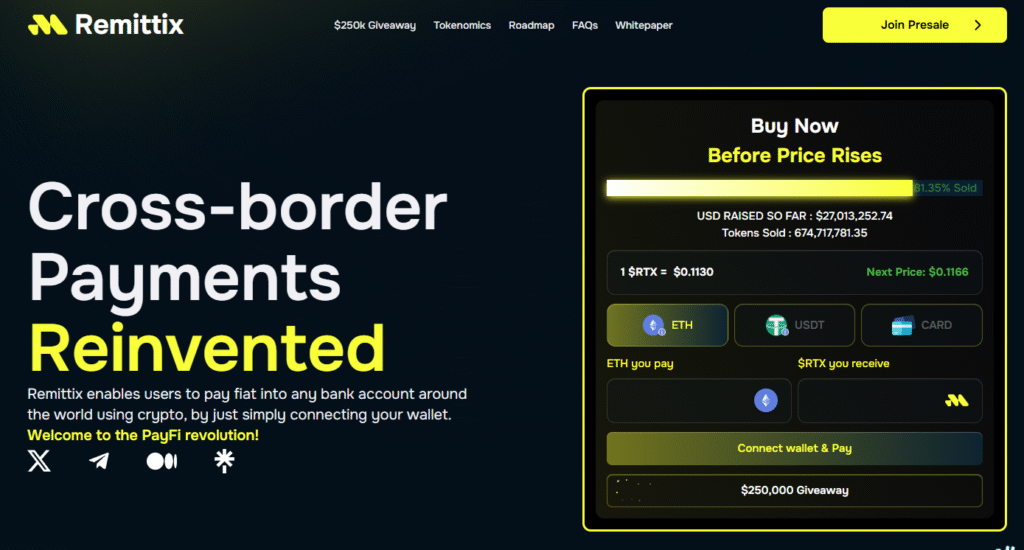

Remittix isn’t merely relying on technical hype to fuel its momentum. The project has raised over $27 million, secured 40,000 holders, and generated substantial community engagement. Its deflationary model and staking mechanisms are designed for long-term value creation. These fundamentals give Remittix durability compared to speculative-only tokens.

Strong referral programs and wallet beta launches further expand its reach. The $250,000 giveaway program encourages viral participation across social platforms. Remittix blends payment utility, DeFi innovation, and community incentives effectively. These adoption metrics underpin the growing bullish outlook among analysts.

Exchange Listings And Verification Build Credibility

BitMart and LBank have already confirmed upcoming Remittix listings. Such listings often act as liquidity catalysts, increasing trading volume dramatically. CertiK verification provides additional confidence by ensuring security and transparency. These factors contribute to positioning Remittix as more than a passing speculative trend.

Exchange accessibility remains a crucial factor for early adoption acceleration. Verified listings attract both retail traders and institutional observers. This combination frequently drives sudden liquidity inflows following official announcements. Remittix appears well-positioned to capitalize on these moments strategically.

Community Expansion Fuels Network Effects

Remittix’s community growth trajectory is exceptional for a project at this stage. Over 350,000 giveaway entries and strong social media traction demonstrate expanding awareness. Platforms like Telegram, TikTok, and X have become major engagement hubs. This surge in grassroots participation often precedes viral breakout moments for crypto assets.

Network effects are essential for sustaining growth beyond initial hype cycles. As communities expand, organic marketing and liquidity depth naturally improve. These self-reinforcing dynamics have historically propelled tokens toward exponential growth phases. Remittix’s expanding community provides the fuel for such movements.

Strategic Outlook For Long-Term Investors

Analysts emphasize Remittix’s unique combination of technical setups and adoption drivers. It mirrors early Litecoin behavior while simultaneously building real-world utility foundations. This dual narrative strengthens its positioning within a crowded payments-focused crypto segment. Long-term participants could benefit from accumulation before broader awareness peaks.

Investors are encouraged to monitor both fundamental milestones and market structure developments closely. Early strategic positioning often provides significant upside during parabolic cycles. Remittix’s blend of deflationary economics, referral incentives, and listings creates compelling upside potential. Execution and sustained community engagement remain decisive factors for success.