The Rise of Remittix and Market Disruption

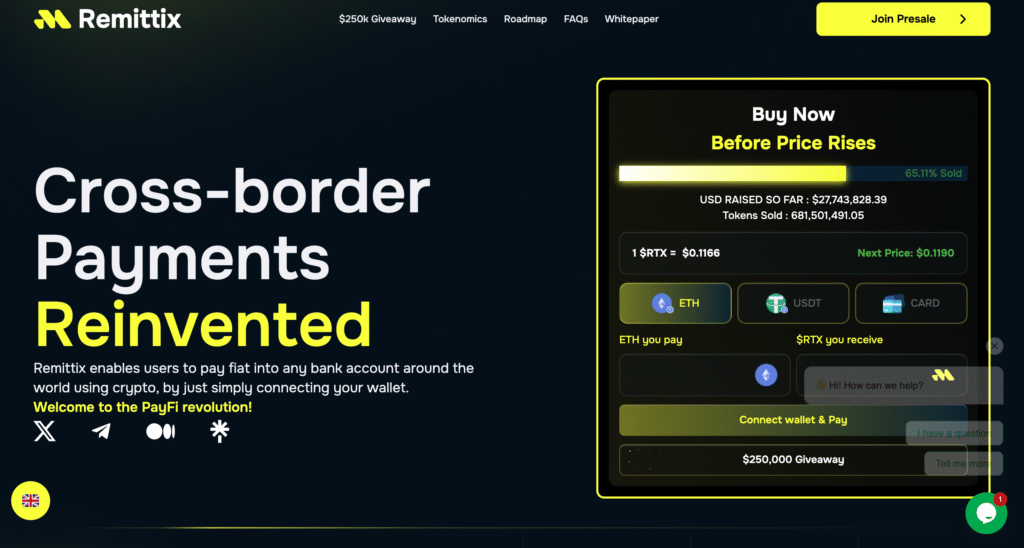

Remittix is reshaping crypto payments through fast, low-fee cross-border transfers across 30+ countries. Its beta wallet update positions it as a strong contender among payment tokens. Investor interest surged after $27 million was raised in its presale. RTX now competes directly with XRP for institutional payment rails.

XRP Momentum Fueled by Institutional Backing

Ripple’s XRP has regained traction after SEC clarity and growing institutional adoption. Trading volume spiked 25% as investors eye a breakout toward $5. The Evernorth SPAC deal added legitimacy and renewed exposure for XRP. Analysts say a clean breakout could target $10 if macro conditions align.

Cardano’s Decline and Investor Sentiment Shift

Cardano (ADA) faces waning activity and shrinking derivatives interest, signaling investor fatigue. Price stagnation near $0.67 underscores its struggle to maintain relevance. Analysts forecast limited upside without fresh ecosystem catalysts. Capital rotation is flowing toward newer, utility-based projects like Remittix.

Recommended Article: XRP Targets 20% Upside as Remittix Enters PayFi With Early Traction

Remittix’s Utility-Driven Advantage

Unlike speculative tokens, Remittix prioritizes practical use through real-world payment solutions. Users can transfer crypto directly into bank accounts, bridging DeFi and TradFi. Its CertiK audit and compliance focus strengthen trust among cautious investors. Early traction shows sustainable demand beyond short-term hype.

Core Features Fueling RTX Adoption

Remittix’s standout features include global reach, secure smart contracts, and deflationary tokenomics. Incentive programs, including a $250,000 giveaway, are boosting early engagement. Its real-time wallet provides seamless fiat conversions and user-friendly transfers. These elements combine to establish strong network effects and long-term value.

Market Dynamics and Future Positioning

Analysts project RTX could rival XRP’s market share if adoption maintains momentum. Cardano’s weakening position opens room for new entrants in the top 10. Institutional capital will flow toward compliant, high-utility projects in 2026–2027. Remittix’s hybrid payment model aligns with that evolving investor demand.

The PayFi Future and Investor Takeaway

Remittix exemplifies the shift from speculative DeFi toward functional PayFi ecosystems. Its blend of scalability, compliance, and accessibility positions it as a potential breakout star. As remittance markets digitize, RTX could become a flagship token for cross-border innovation. Investors eyeing the next payment revolution may find this cycle’s early opportunity in Remittix.