Whale Accumulation Signals Confidence in Pi’s Future

During the recent consolidation period, one whale has steadily built up a large number of Pi Network tokens by buying them almost every trading day. The most recent acquisition brought the total number of tokens to about three hundred seventy-three million, which is more than one point five million.

Whale is the biggest Pi Network participant, with holdings worth $128 million. People who watch the market see buying as a sign of confidence. Whale accumulation supports bullish speculation, which could push the market toward a breakout as supply becomes more concentrated under a single entity in the ecosystem.

Price Consolidation Indicates Accumulation Phase

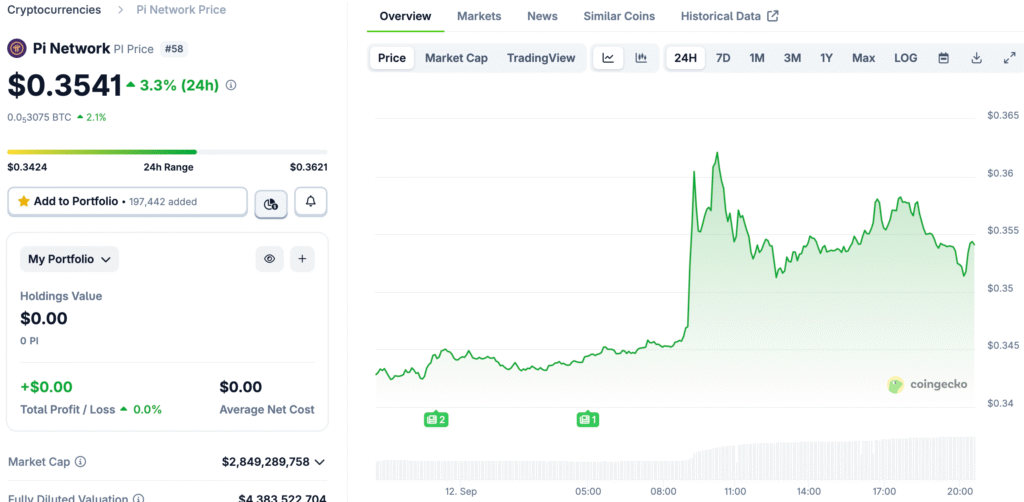

The price of Pi Network has stayed the same since August, hovering near its lows. Analysts see sideways trading as part of the accumulation phase of Wyckoff Theory. Historically, these kinds of phases happen before markup events, when prices go up a lot after consolidation.

Low volume and sideways movement are signs of accumulation. Investors point out that there are similarities with past examples, such as MYX Finance, where accumulation led to rallies. Consolidation makes it more likely that the Pi Network will break upward. People are keeping a close eye on the transition to markup, expecting whale behavior to speed up the bullish trend even more.

Technical Analysis Projects Breakout Potential

The technical structure shows both accumulation and the formation of a double bottom. These kinds of patterns usually happen after breakouts. If the price of Pi Network breaks out, analysts say it could hit the psychological resistance level of one dollar. There is still room for growth toward the neckline target of one point six six seven five.

Reaching the neckline target means a gain of almost 388%. Technical confirmations back up the bullish case. Investors see signals as strong proof that the asset may be about to enter a new cycle. The chances of a breakout are higher because whales are buying up a lot of stock, which makes market sentiment line up with an optimistic trajectory across the near-term horizons.

Recommended Article: Pi Network Upgrade Brings Hope for Price Recovery

Wyckoff Theory Bolsters Positive Story

The Wyckoff Theory talks about the phases of accumulation, markup, distribution, and markdown. Analysts say that Pi Network is currently in the accumulation phase. The fact that whales are buying strengthens the case that the accumulation is real. Transitioning to markup would cause prices to rise quickly, as has happened many times in the past in cryptocurrency markets.

Investors stress how important psychological resistance zones are. If you break through one dollar, you can make more money. As technical and behavioral signals line up with the Wyckoff framework, the narrative gets stronger. Speculation grows, making traders expect a big rise in prices. People who watch the market are still on the lookout for confirmations that will start the markup phase soon.

Whale Control Effects Market Mood

The market perceives the accumulation of the largest holder as insider confidence, boosting retail traders’ confidence. This concentration of ownership, while carrying risks, supports controlled supply. Whale dominance is seen as beneficial, strengthening investor confidence. As smaller players adopt the whale strategy, confidence grows, indicating hope for the long term.

This behavior often occurs before larger inflows, enhancing speculation excitement. Whale influence causes momentum shifts in the trading community, increasing the potential for price changes. Sentiment rises around narrative whale accumulation before significant price increases.

Investor Optimism Builds Amid Uncertainty

Even though it has dropped 90% from its all-time high, investors are still hopeful. Whale buying shows that people believe the market can recover. The consolidation base gives you stability. Traders carefully weigh the risks and rewards of a bullish outlook. Analysts say that there are still risks of volatility, but upside targets make speculators feel good about the market.

Pattern recognition is a way for investors to confirm their ideas. Technical confirmations give you peace of mind. As the ecosystem around the consolidation base gets stronger, hope grows. Traders plan for breakout scenarios and try to get in early. Confidence keeps growing, thanks to whale activity and theoretical frameworks that support bullish views well.

Pi Network’s Price Awaits a Breakout to $1 and Beyond

The outlook depends on a breakout above the consolidation. If things go well, the price could rise to one dollar, then one point six six seven five. Failure could make consolidation last longer and the bullish cycle start later. Investors keep an eye on whale accumulation and volume spikes as important signs that have a big impact on the direction of the market.

If the bullish case comes true, Pi Network could see a big increase in value. The case is stronger because the community is hopeful and the whales are sure. The change to the markup phase is a key moment. The market is getting ready for a big move. The future of Pi Network will depend on technical confirmations, whale persistence, and the general mood of investors around the world.