A Whale Buy Positions Pepe for a Potential Surge

Recently, a whale wallet bought 1.52 trillion Pepe tokens from Kraken. This has led to speculation about possible institutional involvement and market growth. Auros Global was named as the buyer, putting in $16 million and making a big investment that got a lot of attention from investors.

The big acquisition boosted bullish sentiment, and traders said that large-scale accumulation could start another cycle toward possible all-time highs. People in the crypto markets who are closely watching meme coin volatility right now are very excited about the possibility of new price rises after these kinds of consolidation purchases.

Auros Global Moves Tokens Between Many Centralized Exchanges

After gathering a lot of Pepe, Auros Global sent it to exchanges like Binance and Kraken so they could make the market and manage liquidity on a larger scale. This movement of tokens could mean that the people behind it want to get people trading more, which could lead to a lot more volatility in the coming weeks.

Transfers also included deposits to SwissBorgand intermediary wallets, which raised questions about strategy even though the exchange had a history of being exploited. The analysis of Bubblemaps showed that Auros Global controls 0.78 percent of the supply, making it the nineteenth largest wallet. This shows how important it is in shaping markets.

Whale Trading Strategy Says There Will Be More Volatility in the Near Future

Because Auros Global is an algorithmic trading firm, it’s likely that its Pepe token transfers are directly related to advanced market-making strategies. This means that trading is likely to be more active on all exchanges, which supports predictions that volatility may rise in September as traders expect sudden changes.

Liquidity provisioning often involves moving a lot of tokens between exchanges. This helps keep spreads tight and encourages speculative trading. Traders see these signals as a sign that the trading season is about to start, making Pepe a key place to look for short-term opportunities.

Recommended Article: Pepe Coin Price Eyes Major Rebound Toward Forty Percent Upside

Pepe Market Has Mixed Feelings Even Though Prices Are Going Up

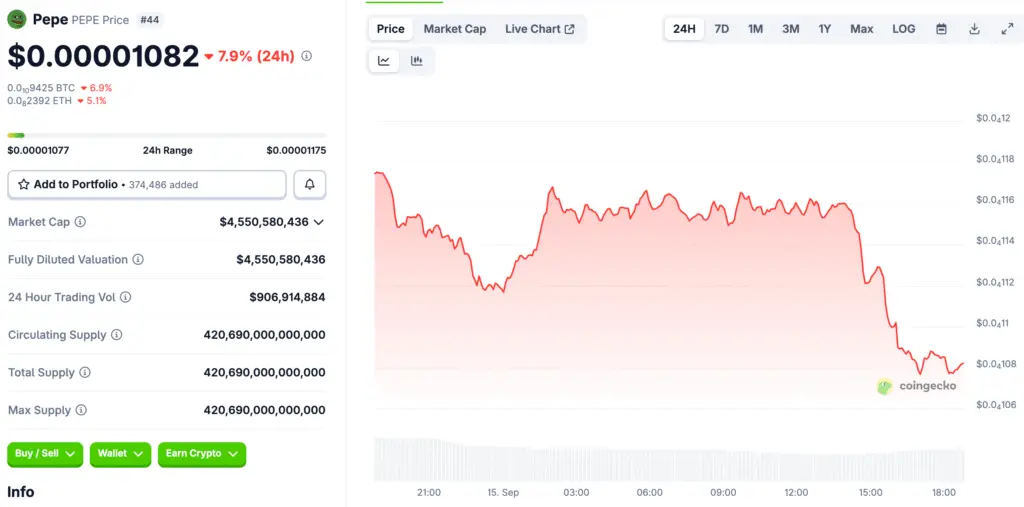

Pepe was worth $0.000011, which was a 16% increase over the previous week. However, short-term drops in value made investors less confident that the upward trend would continue strongly. Rallies in 2025 don’t last as long as they did in December 2024, which shows that there are still risks of volatility even though the long-term growth outlooks are positive.

Investors are still split, weighing their hopes for strong September sales against their worries about past dips and failed breakout attempts. Pepe is still undervalued compared to other assets, even though altcoin season is getting stronger. This means that it could suddenly go up in value if the right conditions are met.

A Tug of War in the Pepe Derivatives Market

Open interest in Pepe shot up to $105 million, the highest level seen since late December 2024. Most of this trading volume was on OKX, where whales keep their positions balanced between long and short.

Twenty big whales are actively trading kPepe derivatives, with half of them making bullish bets and half making bearish bets. This shows that institutional investors are unsure about what to do. The biggest long position was 16.8 million, which was a little bigger than the 15.6 million short position that was seen.

Bullish Momentum Returns to the Pepe Market

Pepe has done well in September in the past, with rallies that have gone over 100%, but the results depend a lot on the overall demand for altcoins. Analysts say that the combination of September momentum and whale trading could lead to breakout attempts, but there is still a high risk of sudden pullbacks.

The bull cycle of December 2024 is still going strong, which is a good reminder for investors that seasonal strength doesn’t always mean that things will go well again. Still, historical trends match up with what is happening now, which makes us cautiously hopeful that September could bring big gains again.

Whale Accumulation Signals a Coming Pepe Breakout

On decentralized exchanges, selling pressure is often stronger than buying interest because small rallies cause speculative holders to take profits. This situation has repeatedly stopped sustained breakout attempts, showing that investors would rather sell quickly than hold for a long time.

Whales are still quietly buying Pepe tokens, even though there are selling pressures. This suggests that they are expecting future demand to drive significant potential upside. Market watchers point out this difference, where smaller traders leave and larger players add to their positions, which could lead to unexpected breakouts.