PENGU Confirms Breakout of Falling Wedge

After weeks of falling, PENGU made a strong comeback. The daily chart shows that the price broke out of a falling wedge that had been going on for seven weeks. This bullish continuation pattern often comes before big price jumps. Traders see the move as a big change in direction.

The wedge is also part of a cup and handle shape. This structure points to a better chance of going up in the future. Technical traders keep a close eye on this. The setup makes people more hopeful that the recovery will last.

Cup and Handle Structure Signals Upside

Since early 2025, the cup and handle have been forming. The cup phase ended with a rounded bottom. The falling wedge acted as the handle. Breaking out usually means that a new bullish wave is coming.

If this pattern is confirmed, it supports higher price targets. Traders think the price will go up to $0.045 and higher. A breakout above $0.047 confirms the whole structure. These kinds of moves often make investors feel more confident.

Technical Indicators Go Up

The MACD lines crossed in a bullish way not long ago. Green histograms show that buying is picking up speed. The RSI rose above 59, which means that demand is getting stronger. All of the indicators show that buyers are putting more pressure on prices.

Momentum and price structure signals are in sync. This convergence makes people want to buy. Traders see these signals as proof. As indicators point to an upward bias, confidence grows.

Recommended Article: PENGU ETF Launch Date Sparks $5 Billion Market Cap Hopes

PENGU’s Growth Signals Strong Capital Inflows

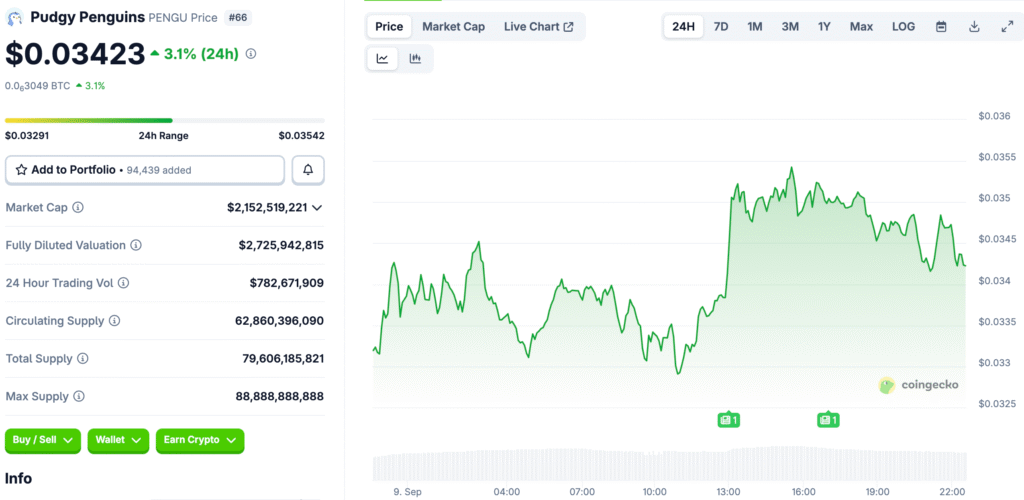

The daily trading volume for PENGU went up to $951 million, which is three times what it was before. The market cap went over $2.2 billion. This helped PENGU get ahead of projects like Kaspa and Cosmos Hub. These changes show that there are strong capital inflows.

More activity helps keep prices high. More liquidity lowers the risks of volatility. Investors see a growing market cap as proof. More people are joining in, which shows that more people are paying attention.

Bullish Catalysts Keep Things Going

Excitement in the community makes bullish views stronger. The SEC’s review of the Canary Spot PENGU ETF adds fuel. Traders see this as a step toward more institutional use. As excitement grows, more people are interested.

Accumulation is still going on across exchanges. On-chain data backs up buying trends. Engagement metrics show that there is room for growth. Together, catalysts make the conditions for a rally very strong.

Risks That Could Make Setup Invalid

The bullish setup for PENGU is still good as long as it stays above $0.027. If it drops below this support, confidence will go down. Traders keep a close eye on this level. Volatility is still a natural risk in meme assets.

After big rallies, corrections may happen. Taking profits can make prices go down for a short time. Experts say you shouldn’t ignore the risks of losing money. It’s important to find a balance between being hopeful and being careful.

PENGU Targets Its July Highs With Bullish Momentum

PENGU is now aiming for its July high of $0.045. This move is likely to happen because there is strong support and bullish signals. If the price breaks above $0.047, it could go up even more. Traders are still hopeful about short-term gains.

People are still getting more involved in their communities. Technical strength lines up with market drivers. Investors expect things to be unstable, but they want more growth. In the next few weeks, PENGU’s path may become clear.